US CPI June Preview: Can the Fed evade a recession?

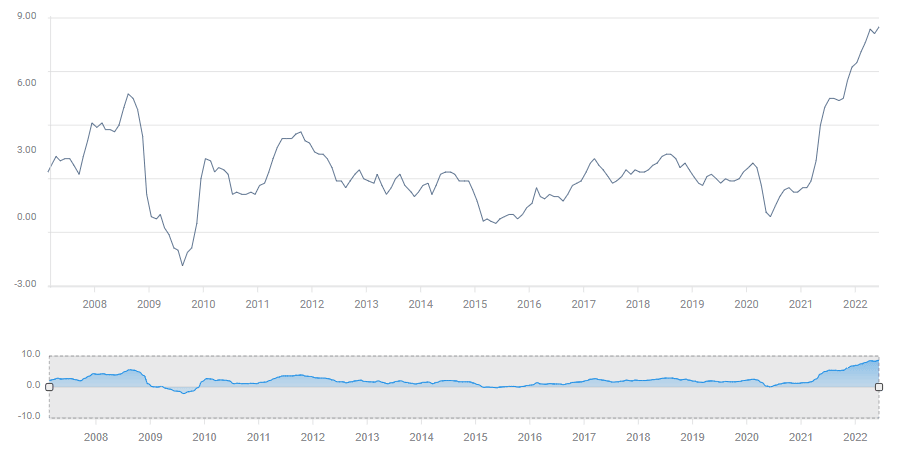

- Inflation forecast to set a new 40-year high at 8.8%.

- Dollar and equities could head in opposite directions on CPI.

- Federal Reserve policy will be unaffected with a 0.75% hike at month end.

Inflation is expected to provide fresh proof that US consumer prices have escaped the clutches of the Federal Reserve, as if any documentation is needed beyond the shrinking budgets of American families.

The Consumer Price Index (CPI) is forecast to rise to 8.8% annually in June, up from 8.6% in May and the highest three-month average since the last quarter of 1981. Core inflation, absent food and energy costs, should drop to 5.8% (YoY) from 6.0%.

CPI

Four decades ago inflation had already peaked and was rapidly falling from a high of 14.5% under the flail of the Fed’s 20% base rate. The price index would end 1982 at 3.8%.

The policies of the Paul Volker Fed are an uncomfortable comparison for Chair Jerome Powell. In 1980 the Fed found it necessary to raise interest rates almost 6% higher than peak CPI in order to defeat inflation.

PPI, Average Hourly Earnings

Prices paid by businesses for goods and services have been rising faster than general inflation for 17 months. The Producer Price Index (PPI) has been at 10% and more since January and the 10.7% average through to May is the highest on record.

Businesses tend to pass cost increases on to consumers gradually, aware that large individual price hikes can easily drive purchasers to competitors and permanently damage market share. A year-and-a-half of outsized input price gains have not been fully transferred to consumers, ensuring many months of retail increases ahead as businesses attempt to recoup their profitability and price structure.

PPI

Wage increases have been trailing CPI since early last year. The six-month average of annual Average Hourly Earnings (YoY) of 5.37% is more than 2% below the CPI average of 7.97%. That discrepancy, combined with the labor shortage represented by 11.2 million unfilled jobs in May, will keep worker demands for higher wages and employer willingness to meet them, at elevated levels for the rest of the year and perhaps beyond.

Companies are beset with rising prices for raw materials, energy and the largest component of business expenses, labor. Those costs and the generally permissive economic atmosphere for price increases, leave managers with little choice but to pass their problems on to consumers.

Federal Reserve policy

The Federal Reserve will continue to hike its base rate for the remainder of the year unless stopped by a recession.

Inflation at 8.6% in May has begun to affect consumer spending as families cut back on discretionary purchases to meet the ever-rising bills of food, gasoline and other necessities. Retail Sales were unexpectedly down 0.3% in May instead of climbing 0.2%.

Fed policy has targeted the core Personal Consumption Expenditures Price Index (PCE) with a 2% goal since the days of Ben Bernanke over a decade ago, claiming that it better represents long-term economic trends. Lately, however, Chair Jerome Powell has acknowledged that the headline rate-6.3% for PCE in May-may better represent the impact of rising prices on consumers and consumption. The European Central Bank targets the overall inflation rate for just that reason.

Fed policy and pronouncements have focused almost exclusively on inflation even as Powell and others have admitted that it will be difficult to manage a large reduction in inflation without incurring a slowdown in growth.

The US economy contracted 1.6% (annualized) in the first three months of the year and the Atlanta Fed GDPNow estimate for the second quarter is currently -1.2%. Second quarter GDP is reported on July 28, the day after the Federal Open Market Committee (FOMC) meeting.

Market responses

If the June CPI figures will not affect Fed policy, they have potential market results. Although the FOMC offically targets the core PCE rate, markets know, and the Fed has suggested that it understands as well, that consumers are beholden to the general rate of inflation. To understand the impact of inflation on the US economy, analysts look to the efffect on consumer spending, that is, to headline CPI.

Treasury yields have been sensitive to signs of an US economic slowdown, regardless of prospective Fed rate hikes.

If June inflation is less than the forecast 8.7%, expect a decline in bond yields commensurate with the size of the difference. Equities will also benefit from the prospect of lower market rates though the dollar may find its recent rally undermined by profit-taking.

If CPI is at or higher than the consensus forecast, Treasury rates will climb and equities fall. The dollar will benefit from the dual motivation of higher US returns and the safety-trade. Markets fear that inflation and its rate antidote will drive the US economy and then the global, into recession.

Conclusion

Will the Fed duplicate history and raise the fed funds rate over 10% to quell inflation?

Probably not. Inflation in the late 1970s and 80s was the product of more than 15 years of fiscal and monetary errors. Inflation and an inflationary psychology were deeply embedded in consumer and business attitudes and in the price structure of the whole economy. People routinely expected higher prices and behaved accordingly.

Current inflation is of a much shorter duration. If consumer price expectations are beginning to change, one of the Fed’s chief worries, there is a reasonably good chance that if inflation abates, especially for food and gasoline, people will moderate their anticipation in response. Nontheless, for markets, there is likley to be very little wholesome in June's CPI results.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.