US CPI February Preview: A perfect storm in the making?

- Low interest rates, stimulus spending, support US markets and growth.

- Strong consumer demand could repeat in February and March with government checks.

- Producer Price Index sharply higher in January, February gains expected.

- Lingering supply chain shortages could exacerbate price increases.

- Federal Reserve disavows inflation concerns, cites base effect, expects rise to be temporary.

- Climbing Treasury yields indicate growth and inflation ahead.

- Dollar surging on higher US growth prospects, interest rates.

Inflation hasn't had this much going for it in a decade.

Central bank liquidity, government deficits, stimulus checks and consumers liberated from their pandemic shackles may be stoking the strongest US price gains since the financial crisis of over a decade ago.

The Consumer Price Index (CPI) is expected to climb 0.4% in February from 0.3% and 1.7% annually from 1.4% in January. Core prices are forecast to rise 0.2% from flat and to be unchanged at 1.4%.

Producer Price Index

The recent sharp price increases in the production pipeline will be passed along to distributors and then to retailers. When these gains are combined with vaulting consumer demand it may give retailers something that have not had since before the 2008 recession--pricing power.

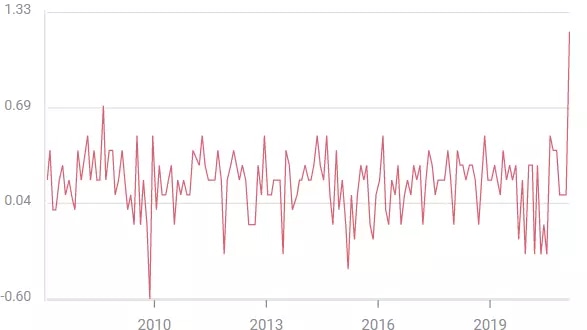

The Producer Price Index (PPI) jumped 1.3% in January, doubling the annual rate from 0.8% to 1.7%. The core rate rose 1.2% on the month from 0.1% in December driving the annual rate to 2% in January from 1.2%.

Core PPI (MoM)

February's PPI will be reported on Friday. Analysts in the Reuters poll anticipate the annual rate will reach 2.7% from 1.7% and a core rate at 2.6% from 2% in January.

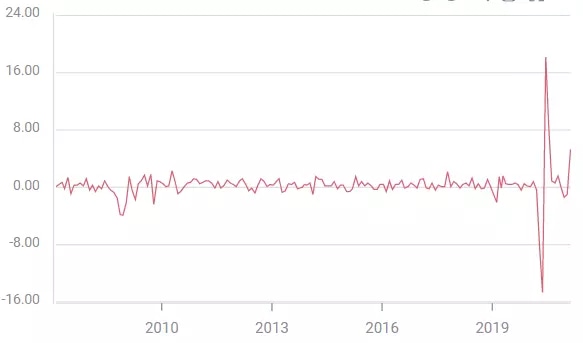

Stimulus and Retail Sales

Washington's second individual stimulus payment of $600 in late December translated into a 5.3% burst in Retail Sales in January.

Retail Sales

FXStreet

Congress is set to more than double that stipend in March with a $1400 payment.

Consumers have given notice that after a year of pandemic lockdowns, personal denial, controversy and COVID-19 fatigue they are ready to celebrate the end of the pandemic with a burst of spending.

The psychological relief from the resumption of normal life and the sudden access to cash should keep the consumption binge running at least through the end of the first quarter and likely into the second.

It is even possible that the sudden increase in demand for consumer products will produce shortages, letting retailers increase prices for desired items.

The pandemic lockdowns disrupted supply chains around the world and though most have reconstituted production, flexibility is down and alternative sources for materials and components may be limited or lacking.

Federal Reserve, Treasury yields and inflation averaging

The Fed is in the unusual positions of vowing to keep interest rates low until the economy is fully recovered while the credit market exacts rapid increases for intermediate and long term yields.

Two-year Treasury rates are but four basis points higher at 0.163% (March 8 close) from their New Year open in January.

2-year Treasury Yield

CNBC

The yield on the ten-year however has climbed 68 points to close at 1.594% on Monday and the long 30-year bond is 65 points higher at 2.30%.

Treasury yields are anticipating two economic changes . Much stronger economic growth in the first and second quarters, and higher inflation. As a corollary credit markets also expect the Fed to tolerate the rising rates in the middle and far reaches of the yield curve.

Fed Chairman Jerome Powell has played down the prospective increase in inflation. He said recently in Congressional testimony that any gains would be temporary and largely the product of the base effect from the collapse in prices early in the initial pandemic panic a year ago.

The adoption of inflation averaging as the Fed's official inflation policy, which permits extended periods of price gains above the 2% target, was designed to lessen the credit market's reflexive expectation that the Fed would hike the fed funds rate as inflation is assumed.

Practically, the Fed has used its $120 billion a month in bond purchases to keep short term rates nearly stationary while permitting the rest of the curve to seek market levels.

This dual policy has let the Fed support the economy and fulfill its mandate for employment, while letting rates normalize as growth increases. Higher rates will act as a deterrent to future price gains and inflationary expectations.

Conclusion and the dollar

The dollar's substantial gains this year against the euro, 3.0% , and 5.7% against the yen, are primarily a judgment on economic growth prospects backed by rising US rates.

The contrast to the sterling is instructive. The UK's pandemic response and growth potential from Brexit have the pound ahead by a modest 1.1% since December 31, though it has lost 2.2% from its high of 1.4137 just two weeks ago on February 24.

Inflation may indeed be slated for a revival in the first half, spurred by the combination of low interest rates, stimulus cash and consumer demand. Consider it a relief rally at the end of the pandemic. Welcome perhaps, at least by central banks, but temporary. The long term trend of globalization incurred lower prices has not run its course.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.