US core PCE is Friday’s data focus

This week finishes off with the Fed’s preferred measure of inflation in the shape of the USE PCE print. The PCE print refers to the measurement of personal consumption expenditures, which tracks the expenditure on goods and services by US citizens. Since around 2012, the PCE index has become the primary inflation index used by the Federal Reserve to guide its policy decisions.

The PCE price index comprises two sets of data. The first set includes all spending categories, while the second set excludes food and energy inputs. This second set is referred to as the ‘core PCE price index’ and is considered a more reliable indicator of inflation. This is because fluctuations in the food and energy markets can sometimes obscure true inflation trends. The key components of the report include:

Durable goods: This includes motor vehicles, recreational goods, durable goods, and furnishings.

Nondurable goods: This category encompasses items such as food and beverages, clothing, footwear, petrol, and other nondurable goods.

Services: It covers various services like healthcare, transportation, recreation, financial services, insurance, and other service sectors.

Friday’s PCE expectations

The last US PCE Index print came in at 4.2% y/y and it is expected to fall again this print down to 4.1%. The m/m reading is expected to rise to 0.2% from 0.1% prior. The core reading is expected to remain the same at 4.6% y/y, and the m/m reading is also expected to remain the same at 0.3%. See below for the expectations from Financial Source’s Economic data tracker.

The trade plan and outlook

Markets are laser-focused on inflation data and the Fed will determine their path of rates based on how inflation data is doing. If there is a big miss in the data then you would expect the USD to weaken on expectations that the Fed will need to be less aggressive in hiking rates. You would typically expect that to weaken US 10-year yields and strengthen gold.

If the data comes in high, and surprises markets, investors will know that keeps the pressure on the Fed to raise interest rates. Typically, if inflation comes in high, you would expect US 10-year yields to rise, gold to fall, the USD to rise and the S&P500 to fall.

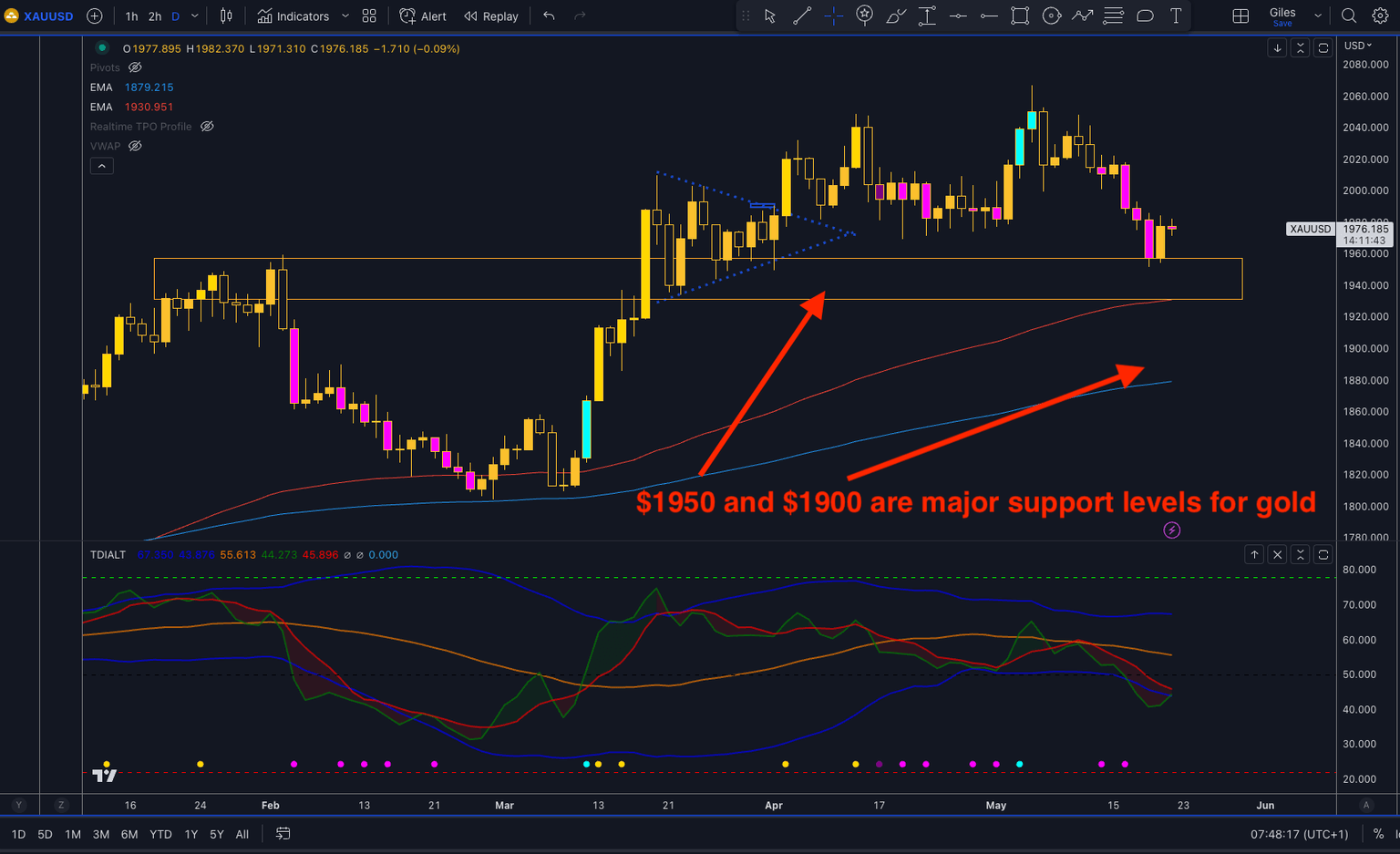

Be aware that with the US debt ceiling talks going on in the background, there may be other drivers on major instruments around the time of the PCE release and that can change the anticipated moves noted in the instruments mentioned above. Take a look at gold and the key support levels of note on the daily chart. A big miss in the Friday data and gold would be an obvious beneficiary notwithstanding the debt-ceiling talks which may or may not be resolved by Friday.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.