US Consumer Confidence Preview: Recession hints likely to keep the USD under pressure

- First-tier US figures scheduled throughout the week have more chances of affecting the Greenback.

- CB Consumer Confidence is foreseen steady in April, with a focus on Expectations.

- US Dollar bearish trend remains firmly in place, the report has no chance of affecting it.

The United States will publish the Conference Board Consumer Confidence Index, expected to remain steady in April, foreseen at 104.1 from 104.2 in March. As of late, attention has been on the sub-component Expectations Index, which ticked up in March to 73.0 from 70.4 in February, remaining below 80, the level which often signals a recession within the next year, according to the official report.

Concerns about a potential recession in the US had increased in the last two months as the banking crisis sped up the Federal Reserve's (Fed) decision to adopt a more dovish monetary policy approach. At the same time, this conservative approach diminishes the risk of a severe downturn.

Consumer confidence has suffered ever since the pandemic started and is slowly picking up pace. However, the report’s relevance this time could be overshadowed by the United States first-tier figures to be out later in the week. The country will publish the preliminary estimate of the Q1 Gross Domestic Product (GDP) and the Personal Consumption Expenditures Price Index for the same period, which will anticipate the March reading ahead of the official release on Friday.

USD possible scenarios

Furthermore, the report could offer a picture of how Americans feel these days, but it is worth remarking that it does not have the ability to affect the Fed’s current path. With that in mind, a downbeat outcome could exacerbate the current US Dollar's broad weakness, while a better-than-expected figure could hardly be expected to rescue the battered Greenback.

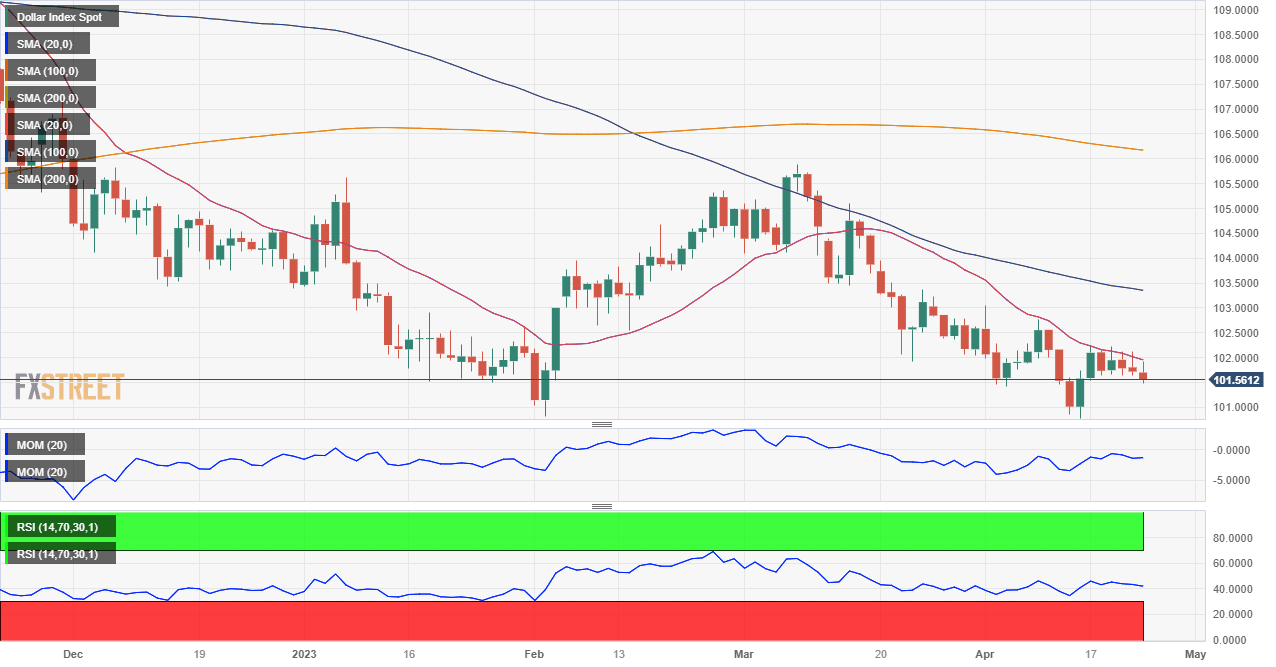

The US Dollar Index (DXY) is in a clear downtrend, and technical readings in the daily chart suggest it's ready to resume its decline after an upward correction that met sellers in the 102.20 area. It currently stands around 101.50 and posted a low of 100.78 in early April, just above the yearly low at 100.66.

The daily chart shows that a bearish 20 Simple Moving Average (SMA) leads the way lower, providing a strong relevant resistance level, currently at around 102.00. Additionally, the 20 SMA accelerated its decline below the longer ones, reflecting persistent selling interest. Finally, technical indicators are neutral-to-bearish within negative levels, supporting another leg south without confirming it at the time being.

A recovery beyond the 102.00 level could take off some of the current pressure on the Greenback but fell short of affecting the dominant downward trend. The recovery could extend towards the next psychological threshold at 103.00, where sellers should resume shorts. On the other hand, a break through the aforementioned yearly low should imply a test and a potential break of the 100.00 mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.