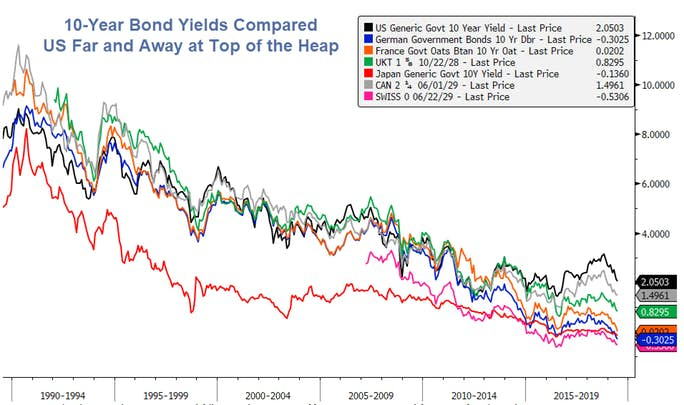

In a global comparison of 10-year government bonds, three countries have negative-yields and France is on the cusp.

The chart is courtesy of Chris Puplava at Financial Sense following an request by me. The data is from Bloomberg.

10-Year Yield Comparison

- US: 2.05%

- Canada: 1.50%

- UK: 0.83%

- France: 0.02%

- Japan: -0.14%

- Germany: -0.30%

- Switzerland: -0.53%

100-Year Bond Yield Madness

I failed to ask about Austria.

Please note a 100-Year Austrian Bond Yields 1.2%.

If you needed any more proof that the world of fixed income has gone mad in the rabid hunt for yield, look no further than the Republic of Austria. If you liked its 100-year debt issued two years ago with a 2.1% return, how about settling for the same maturity for 1.2% now? Yes, you read that right: A 100-year bond yielding about 1.2%.

If you wanted to buy any of those 2.1% 2117 Austria bonds right now, you’d have to pay 60% more than their issue price; they’ve been a great success.

Got that? If you bought 2117 bonds two years ago yielding 2.1%, you are now sitting on a 60% gain.

Flattest Curve in World History?

A quick check shows that Austria's 10-year bond yields -0.02%

Investors get just over 1 basis point per year over the course of 100% years.

Good Reasons?!

Axios attempts to rationalize negative-yield bonds in the Resurgence of Negative-Yielding Debt.

The big picture: The benchmark 10-year bond yield is negative in Germany, the Netherlands, Switzerland and Japan; it's also this close to going negative in France. Even Greece has seen its 10-year bond yield fall to just 2.4%, an all-time low.

Be smart: You'll see a lot of chatter about how the investors in these bonds would get a better return were they to just stash cash under a mattress. Ignore that chatter. If you're an institutional investor managing trillions of dollars in assets, you can't convert that money into cash, and while a bank will probably pay you 0% for that money, you still end up taking significant counterparty risk. Bonds have negative yields for good reason.

Negative Yields Logically Impossible

In the real world negative-yield bonds are impossible. No one would prefer a dollar ten year from now to a dollar today.

Bond yields are negative only via direct, constant manipulation by central banks for no good reason at all.

In fact, negative yields hurt bank profits and savers as well.

I suspect but cannot prove, a negative yield derivatives mess is partially responsible for the collapse of Deutsche Bank.

Regardless, whereas the Fed bailed out US banks by paying interest on excess reserves, the ECB charged banks interest on excess reserves (hoping to spur lending) but it didn't, and won't.

I do not agree with Fed-sponsored bank bailouts, but the ECB policy is pure madness.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.