US ADP Employment Change May Preview: Is something amiss in the labor market?

- ADP payroll clients expected to add 650,000 positions in May after 742,000 in April.

- Nonfarm Payrolls were a major disappointment in April at 266,000.

- Markets keyed on Friday’s May NFP report, forecast at 664,000.

- Manufacturing Employment was weak for the second month in May.

Until a month ago the US labor market was thought to be in a headlong rush to make good the lockdown job losses of last year.

March’s 916,000 new jobs were expected to be duplicated in April, giving the US economy the best two months of job creation since the third quarter of 2020.

ADP and NFP in April

Then, on May 7 Nonfarm Payrolls recorded just 266,000 new hires in April, barely one-quarter of the 978,000 forecast. The March total was revised down 146,000 to 770,000.

The miss and reduction were entirely unheralded.

Nonfarm Payrolls

Private payrolls from Automatic Data Processing (ADP) for April, released two days earlier, had added 742,000 new positions. While this was a minor miss of the 800,000 estimate, it was the best month since September 2020, seconded the Employment Purchasing Managers Indexes (PMI) from the Institute for Supply Management (ISM) and seemed to indicate that NFP would equal or surpass its prediction. The ADP total for March, unlike NFP, was adjusted higher to 565,000 from 517,000.

ADP Payrolls

Market reaction

Markets have responded to the dismal April payroll number with skepticism.

In the month since, the dollar has lost ground against the euro, sterling and Canada but gained versus the yen. Equites and Treasury rates are little changed from their positions at the close on May 7.

The verdict has been to wait a month to find out if the April result was an anomaly.

Perhaps, the dismal number was a product of the Bureau of Labor Statistics (BLS) seasonal adjustment gone awry. The unadjusted April payroll was 1.089 million.

Maybe, the recently enacted supplement and extension to federal unemployment insurance had encouraged workers to take another month or two of government funded sabbatical.

With 8.1 million unfilled positions in the March Job Openings and Labor Turnover Survey (JOLTS), likely more in April and May, and employers offering higher wages, the lack of hiring appeared inexplicable.

ADP

The client list of ADP is again under the market scrutiny for what it predicts of the national payroll figures from the BLS.

Private payrolls administered by ADP are expected to rise 650,000 in May.

Even though the monthly correlation of the two numbers is not reliable, as was proven last month, the two are still considered close statistical cousins.

April Employment PMI

The April Manufacturing Purchasing Managers’ Index had given a mild warning that the inability to find workers was creating serious problems for many firms.

Manufacturing Employment PMI

FXStreet

Employment PMI dropped to 55.1 from 59.6, missing the 61.5 forecast by a wide margin.

In the general expectation that an excellent NFP report was pending, the retreat was ignored, 55.1 was still a respectable expansion.

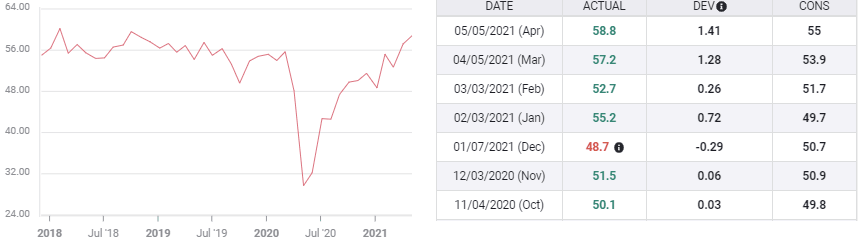

The services employment PMI, giving April conditions in the much larger sector belied the weaker manufacturing post. It rose to 58.8 from 57.2, surpassing its consensus forecast of 55.

The two April PMI reports, combined with ADP’s payrolls did not seem to indicate any dramatic problems in the US labor market.

May Employment PMI

Manufacturing managers have given a much more forceful warning in May that hiring is lagging. Employment PMI dropped to 50.9 from 55.1, just skirting the 50 dividing line between expansion and contraction. It had been forecast to rise to 61.5. The more than 10 point discrepancy between prediction and result is rare.

The Institute for Supply Management releases its service sector indexes on Thursday. Employment PMI is expected to slip to 58 in May from 58.8 prior. Given the weakness in the manufacturing index, the risk for this index is lower.

Services Employment PMI

FXStreet

Conclusion

Except for the minor signal from the April manufacturing employment index that all might not be well, there were no indications that the payroll report would be a debacle.

That is not the case for May.

The Manufacturing Employment PMI at 50.9 has lost 8.7 points in two months. It will not matter for payrolls if the problems reported by managers are lack of workers rather than lack of jobs. The impact on hiring will be the same, far fewer workers resuming employment.

In the current context ADP’s payroll numbers for May are a one-way street.

If they meet or exceed expectations, markets will remember that they nearly did so in April, predicting nothing of the NFP failure.

If they are worse than the 650,000 prediction, they will reinforce the poor performance of the May manufacturing employment index.

Equity, credit and currency markets are very sensitive to any signals that the US labor market is faltering.

A poor ADP report could send equities, Treasury yields and dollar into retreat.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.