US ADP Jobs/ISM Service PMI Preview: Slowing but still positive

- US March ADP Employment change expected at +200,000.

- US ISM Service PMI is estimated to slide marginally to 54.5 in March.

- Numbers likely to show a tight labor market and service sector expanding.

Automatic Data Processing will release its National Employment Report for March Wednesday, 12:15 GMT. Later, at 14:00 GMT, the Institute for Supply Management (ISM) will release its Service PMI report, about economic activity in the sector during March.

ADP Private Employment

Private payrolls look poised for a slowdown after an upbeat February report that showed private businesses created 242,000 jobs, above the 119.000 of January. US private sector is forecast to have added 200,000 new jobs in March.

A slowdown in the job market is expected as the impact of tighter monetary policy hits the economy. It won’t necessarily be bad news for the Fed. A tight labor market is not helpful in fighting inflation.

Still, the ADP has not been a good predictor of the Nonfarm Payrolls (NFP). In January, NFP surprised with a 504,000 increase, the highest since July 2022, while the ADP came in at 119,000 the lowest in two years.

The market’s reaction to ADP has been trending lower over the years. The response could be short-lived but is still a relevant macroeconomic report about a crucial market.

Source: ADP

ISM Service sector PMI

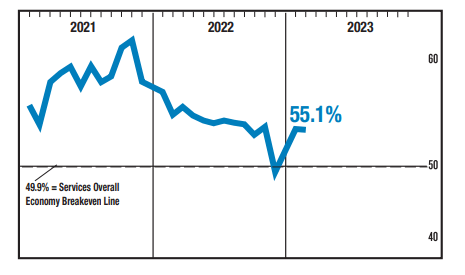

The ISM Service Sector is seen expanding for the third month after unexpectedly falling below the 50 threshold in December. In February, the index came in at 55.1, around the 55.2 registered in January. Market consensus anticipates 54.5 in March, a number in line with the downtrend the index has been showing last year.

The employment index recorded the highest reading since 2021 (54.0) in February and now is expected to pull back a bit to 52. The Price Paid Index is seen falling marginally from 65.6 to 65.2.

Source: ISM

Are bad news still good news for markets?

Both employment and service sector reports are expected to show a slowdown compared to the previous months, but with the labor market still adding jobs and activity in the service sectors expanding. March data comes too soon and won’t reflect the effects of the banking crisis, if there are any. Another weekend passed without bank failures, suggesting that, for the moment, the worst could be behind and market participants will likely turn their attention to macroeconomic data.

Will the job market remain hot? Will the first signs of a real slowdown finally emerge?

In December, the bad news from the ISM Service PMI became good news for equity markets. It is not that clear if that situation could repeat again. Positive news should favor the US Dollar, by boosting expectations that the Federal Reserve (Fed) could keep the tighter monetary policy for longer and at the same time, it will show the economy is growing. However, negative news could also lead to a rally of the US Dollar if it triggers risk aversion across financial markets. For that to happen, numbers would have to be shocking.

The key employment report will be released on Friday, with the official report including Nonfarm Payrolls (expected 240,000), Unemployment Rate (expected 3.6%) and Average Hourly Earnings (expected 0.3%). Employment data surpassing expectations has been usual over the last months, particularly Nonfarm Payrolls, which accumulate an 11-month streak of upside surprises.

All the economic numbers have the potential to influence market expectations on Fed’s monetary policy, which are steady regarding the very short-term but fluctuate sharply considering what could happen from the third quarter onwards. Recession fears and recent banking developments have led markets to price in rate cuts later in 2023. The economic outlook is uncertain and even the Fed does not know what it will do. The forward guidance is vague. This week’s economic data could help to shed some light but it won’t bring clarity.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.

-638162264116474816.png&w=1536&q=95)