US ADP Employment March Preview: Private job creation slows while yield curve flattens

- US ADP payrolls are foreseen at 438K in March, NFP at 475K.

- US yield curve is flattening, rings recession alarm amid 50-bps May Fed rate hike bets.

- Fed Chair Powell believes the labor market is strong enough, recession unlikely.

The US private sector hiring is seen slowing in March after the American companies added more jobs than expected in February. The US ADP private employment report, due on Wednesday at 12.15 GMT, usually provides a good hint at Friday’s full jobs report, so investors will be looking for clues on any potential labor market slowdown.

Pace of jobs creation slows in the US

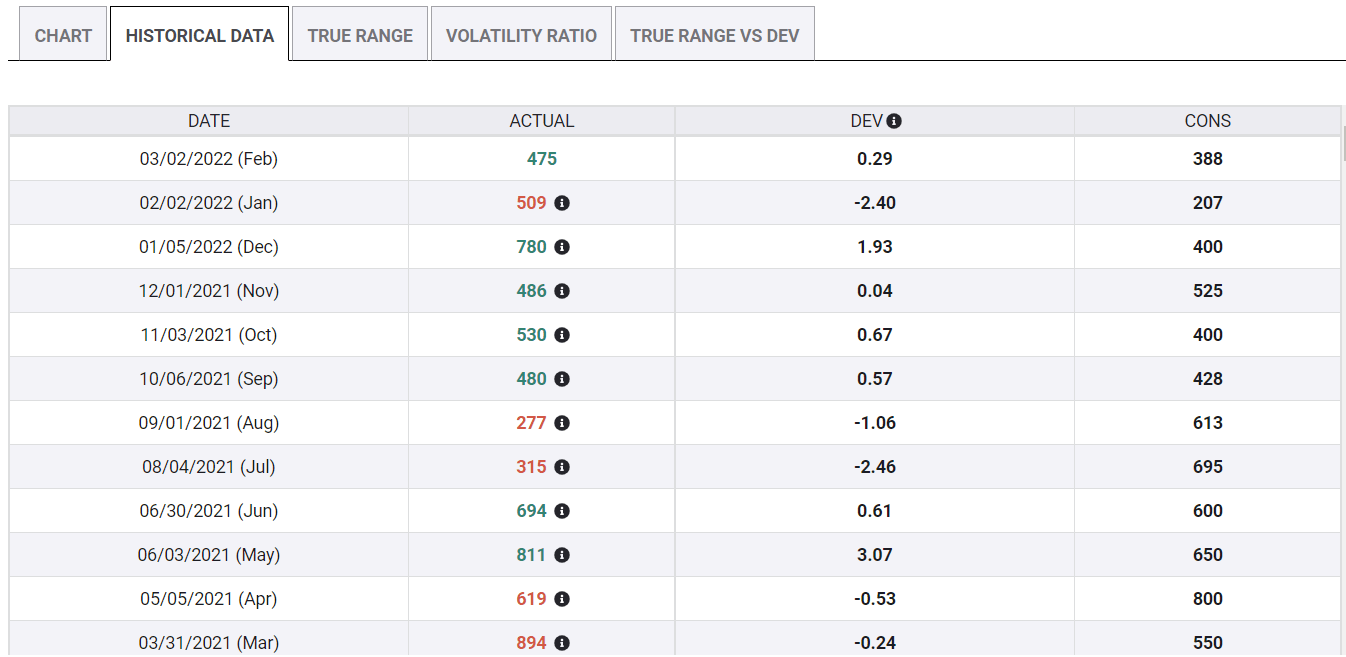

The Automatic Data Processing (ADP) is forecast to show that US companies have created 438,000 new jobs in March, less than the previous month’s addition of 475,000. In February, business payrolls rose more than the expected 375,000 figure. ADP’s payroll data represent firms employing nearly 26 million workers in the US and its monthly release shows the employment change in the economy.

Source: FXStreet

On Friday, the US Labor Department will release the Nonfarm Payrolls, which is expected to show that the economy has likely added 475,000 new jobs in March after a surprise increase of 678,000 reported in February.

The Automatic Data Processing ADP jobs report is usually considered a proxy to the official Nonfarm Payrolls figures, which will be released on Friday, April 1.

The disparity between the two indicators in recent months, however, makes the ADP result unreliable to gauge the NFP trend and, therefore, could have a limited market impact.

US yield curve flattens, Fed remains hawkish

Heading into the monthly payrolls data, the Russia-Ukraine conflict rages on while the odds of a 50-basis points (bps) Fed rate hike in May almost appears a done deal.

Against this backdrop, the yields on the US Treasuries have rallied to three-year highs, although the increase in the longer-dated yields has failed to match the pace of the advance in the shorter ones. The spread between the two- and 10-year yields narrowed to its lowest since early 2020 on Tuesday.

The flattening of the yield curve is usually indicative of a likely recession, as investors remain worried that the aggressive Fed’s tightening would damage the US economy over the longer term.

At the March FOMC meeting, Fed Chair Jerome Powell said that the labor market is strong enough that a recession is unlikely. Although Powell remains optimistic about the economy and labor market, he said in his speech last week, “this is a labor market that is out of balance," adding "we need the labor market to be sustainably tight."

To conclude

Markets are pricing in a roughly 60% chance of a 50-bps rate hike at the Fed’s May meeting.

A slowdown in the hiring pace in the world’s biggest economy could likely feed the risks of a recession, especially in the face of soaring inflation. This could pour cold water on the recent Fed’s hawkishness.

The ADP report, however, is unlikely to have any major impact on the US dollar and other related markets. Friday’s NFP release will hold the key to gauging the Fed’s policy action going forward.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.