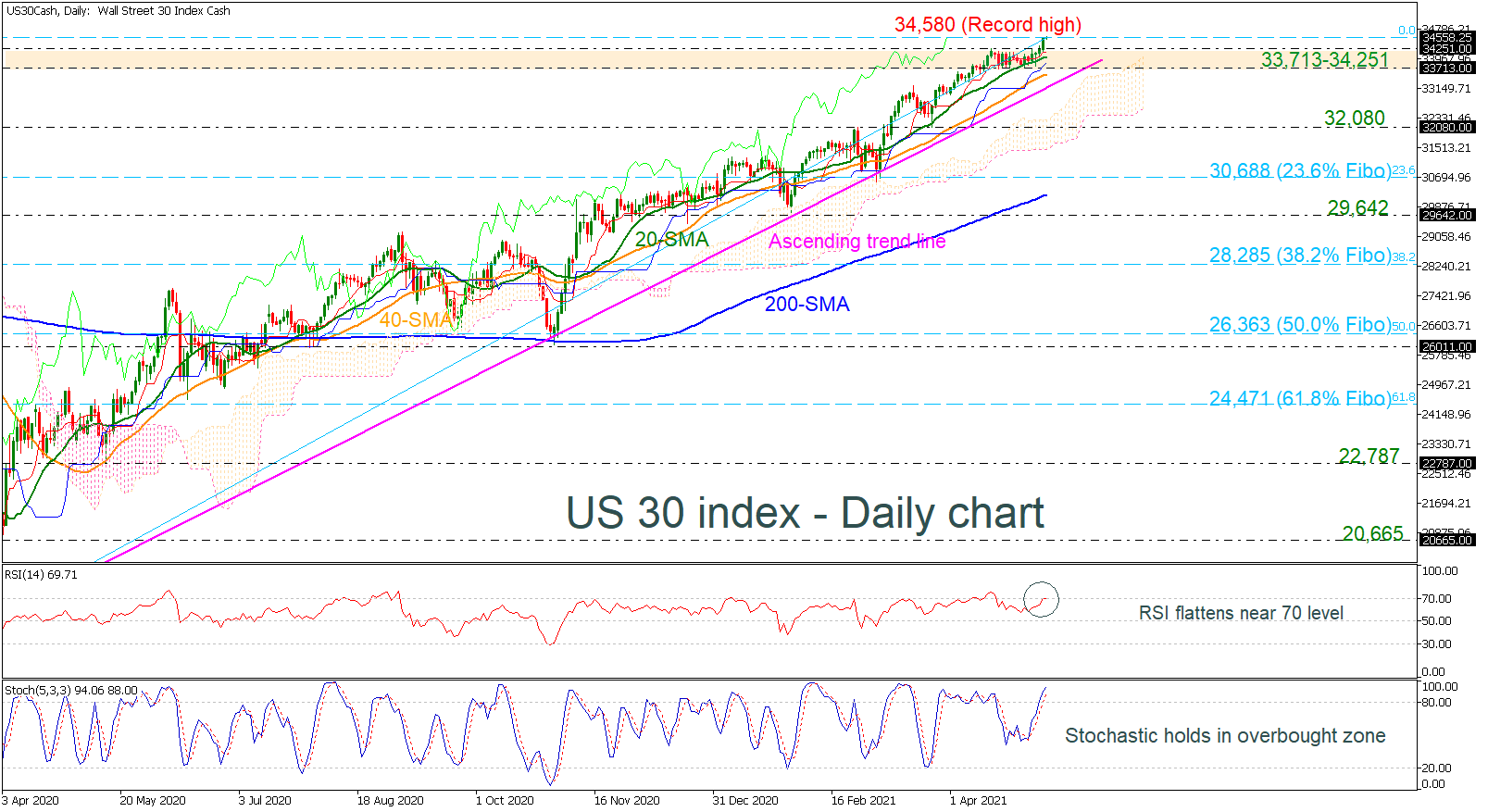

The US 30 index achieved a fresh all-time high around 34,580 earlier today after several days of sideways moves. Currently, the price is hovering near its opening level with the RSI confirming the flat momentum. Moreover, the stochastic oscillator is jumping in the overbought territory suggesting that the upside extension on price may come to an end.

If the index successfully jumps to uncharted levels, it may find a strong obstacle near the next psychological marks such as 35,000, 35,500 and 36,000.

In the negative scenario, the price may meet the 33,713-34,251 strong support zone ahead of the long-term ascending trend line, which stands near 33,360. The Ichimoku cloud also lies around the aforementioned level and any decreases below it could find support at 32,080. More declines could take the bears until the 23.6% Fibonacci retracement level of the up leg from 18,170-34,580 at 30,688.

Summarizing, the US 30 index has been creating higher highs and higher lows in the long-term timeframe, without any significant downside correction. However, a fall below the uptrend line and the 200-day SMA may change this outlook to bearish.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

AUD/USD remains weak below 0.6300 despite upbeat Chinese PMI data

The AUD/USD pair remains under selling pressure around 0.6280 during the early Asian session on Thursday. The Australian Dollar pares losses against the Greenback after the stronger Chinese economic data. However, the upside might be limited as US President Donald Trump announced sweeping global reciprocal tariffs, prompting traders to turn cautious.

USD/JPY slumps to three-week low amid Trump's tariffs-inspired risk-off impulse

USD/JPY dives to a three-week low during the Asian session on Thursday as Trump's sweeping trade tariffs provide a strong boost to traditional safe-haven assets. The anti-risk flow triggers a steep decline in the US Treasury bond yields, which drags the USD back closer to a multi-month low touched in March.

Gold price hits fresh all-time peak in reaction to Trump's tariffs

Gold price spiked to a fresh record high on Thursday as investors grew increasingly concerned over the economic impact of Trump’s sweeping tariffs. This triggers a global risk-aversion trade and boosts the safe-haven bullion. Fed rate cut bets, declining US bond yields, and heavy USD selling benefits the non-yielding yellow metal.

Bitcoin and top altcoins slide as Trump kicks off reciprocal tariffs

Bitcoin and the entire crypto market saw a quick correction on Wednesday following President Donald Trump's reciprocal tariff announcements based on half of each country's respective rates.

Trump’s “Liberation Day” tariffs on the way

United States (US) President Donald Trump’s self-styled “Liberation Day” has finally arrived. After four straight failures to kick off Donald Trump’s “day one” tariffs that were supposed to be implemented when President Trump assumed office 72 days ago, Trump’s team is slated to finally unveil a sweeping, lopsided package of “reciprocal” tariffs.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.