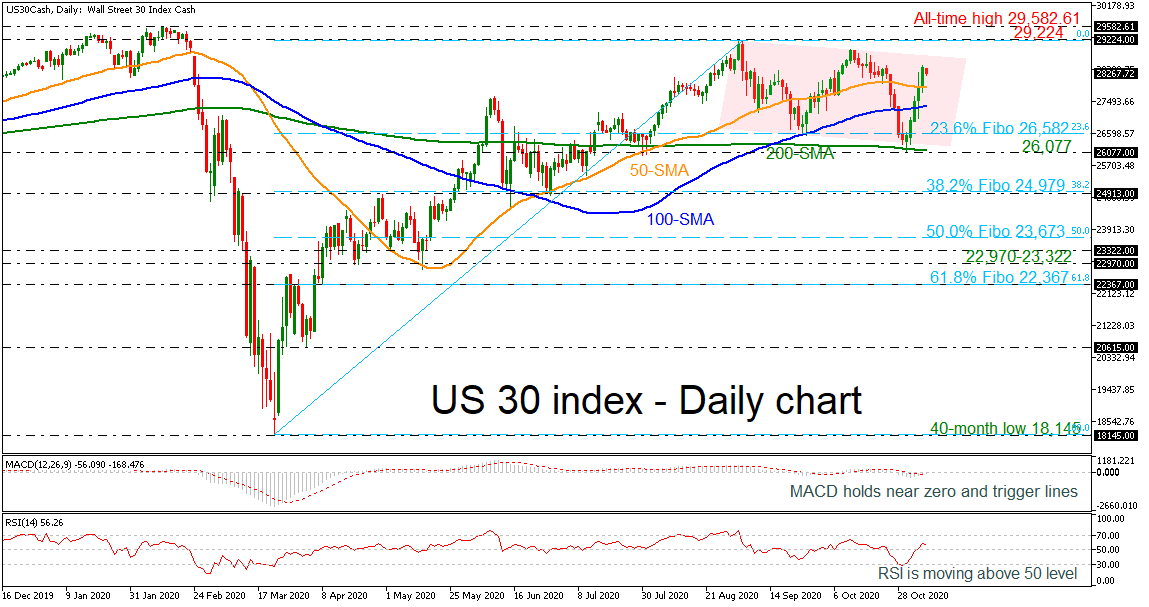

The US 30 index (cash) created five straight positive days after the bounce off the 200-day simple moving averages (SMAs) around the 26,077 support level. Over the last four months, the price has been developing within a slightly bearish channel and the technical indicators are mixed. The MACD is standing near the zero level, while the RSI is extending its bullish movement above the neutral threshold of 50

Further increases could take the bulls towards the 29,224 resistance before revisiting the all-time high at 29,582.61. More advances could send the price into uncharted territory, flirting with the 30,000 round number.

In case the index changes its current upside direction to the downside, the bears will probably challenge the 50- and 100-day SMAs at 27,885 and 27,325. A break lower could last until the 23.6% Fibonacci retracement level of the up leg from 18,145 to 29,224 at 26,582. Even lower, the area around 26,077 and the 200-day SMA could be another potential obstacle for downward moves. Steeper declines could send the market until the 38.2% Fibonacci of 24,979.

Summarizing, the US 30 index maintains a bullish bias in the long-term picture, whereas in the medium-term it holds a somewhat negative profile.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

AUD/USD trims a part of heavy intraday losses; moves little after Aussie trade data

AUD/USD attracted heavy selling during the Asian session on Thursday after Trump imposed sweeping trade tariffs, fueling the global risk-aversion trade and undermining the Aussie. Spot prices moved little following the release of Australian Trade Balance data, which missed consensus estimates by a big margin and showed a surplus of A$ 2.968 billion.

USD/JPY slumps to three-week low amid Trump's tariffs-inspired risk-off impulse

USD/JPY dives to a three-week low during the Asian session on Thursday as Trump's sweeping trade tariffs provide a strong boost to traditional safe-haven assets. The anti-risk flow triggers a steep decline in the US Treasury bond yields, which drags the USD back closer to a multi-month low touched in March.

Gold price hits fresh all-time peak in reaction to Trump's tariffs

Gold price spiked to a fresh record high on Thursday as investors grew increasingly concerned over the economic impact of Trump’s sweeping tariffs. This triggers a global risk-aversion trade and boosts the safe-haven bullion. Fed rate cut bets, declining US bond yields, and heavy USD selling benefits the non-yielding yellow metal.

Bitcoin and top altcoins slide as Trump kicks off reciprocal tariffs

Bitcoin and the entire crypto market saw a quick correction on Wednesday following President Donald Trump's reciprocal tariff announcements based on half of each country's respective rates.

Trump’s “Liberation Day” tariffs on the way

United States (US) President Donald Trump’s self-styled “Liberation Day” has finally arrived. After four straight failures to kick off Donald Trump’s “day one” tariffs that were supposed to be implemented when President Trump assumed office 72 days ago, Trump’s team is slated to finally unveil a sweeping, lopsided package of “reciprocal” tariffs.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.