United States – Under the bonnet: The Federal Reserve’s reaction function

Having a good understanding of a central bank’s reaction function is important. It influences inflation and interest rate expectations, the level of bond yields, investor risk appetite and economic confidence in general. In the US, different types of information help to improve our understanding of the Federal Reserve’s reaction function: monetary policy rules -which play a prominent role in the material prepared by the Fed staff for the FOMC meetings-, the relationship between inflation, growth, unemployment and the federal funds rate in the Summary of Economic Projections of FOMC members as well as speeches and press conferences. The latter continue to play a central role considering that the responsiveness of the FOMC to economic data (inflation, unemployment, output gap) fluctuates over time.

Having a good understanding of a central bank’s reaction function is important. It influences expectations in terms of inflation and official interest rates and, by extension, the level of bond yields, investor risk appetite and economic confidence in general. This is even more important as far as the Federal Reserve is concerned, given the international spillovers of its policy decisions. Fortunately, Fed watchers have a wealth of information available to improve their understanding of what the central bank may do next. Admittedly, at the end of the day the decision to hike, cut or leave the federal funds rate unchanged will depend on the data - Jerome Powell and his colleagues have insisted on this repeatedly-, but these data should not be looked at in isolation. What matters is what they tell us about the outlook for inflation and, given the Fed’s dual mandate, the unemployment rate. For the central bank watcher, this analysis forms a basis for formulating policy rate expectations. A formalised approach of this process consists of using monetary policy rules, in which a small number of macroeconomic factors are used to describe the reaction function of policy makers. In the US there is a long tradition of monetary policy rules, going back to the early 1990s with the work by John B. Taylor and the rule called after him. They also play a prominent role in the inputs prepared by the Federal Reserve staff for the FOMC meetings.

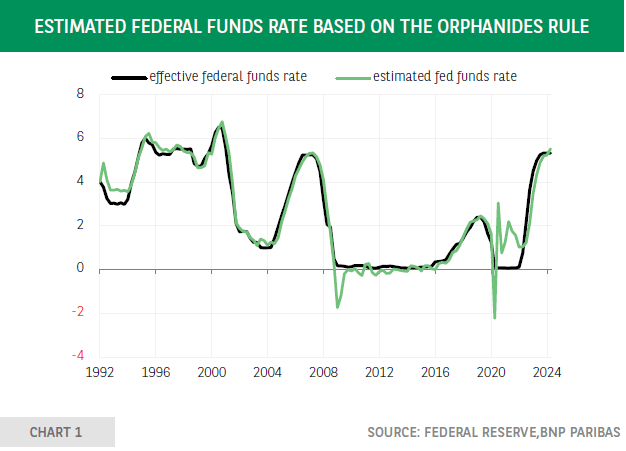

Key variables are the neutral rate of interest, target inflation, the inflation gap, the output gap, the unemployment gap, assumed weights of the respective variables and an inertia coefficient, which reflects the gradualism in the implementation of monetary policy. Although the limited number of variables focuses the attention on what really matters, the recommended policy rate varies a lot depending on the model specification. To illustrate this point, at the December 2018 FOMC meeting the target range for the federal funds rate was raised to 2.25-2.50% whereas this rate based on the various monetary policy rules ranged between 2.03% and 4.66%. With this in mind, it may make more sense to focus on the recommended change instead of the absolute level. A recent paper by Athanasios Orphanides presents a rule whereby the quarterly change in the federal funds rate is equal to 0.5 times the difference between the expected nominal GDP growth and the natural rate of growth. This rule closely tracks the observed evolution of the federal funds rate and can be useful for the Fed watcher to conduct scenario analyses based on different economic forecasts (chart 1).

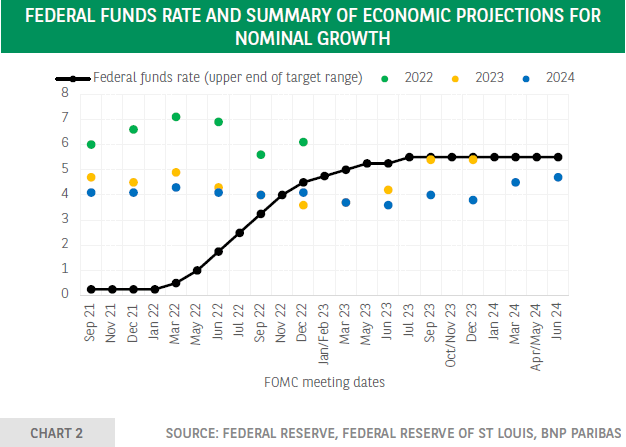

The Summary of Economic Projections (SEP) of the FOMC members also sheds light on their reaction function. Chart 2 shows the projections for nominal GDP growth and the upper end of the target range of the federal funds rate. Chart 3 shows the projection for personal consumption expenditures (PCE) inflation. The nominal growth projections for 2022 have been revised upwards during 2022 on the back of a significant upward revision of the inflation projection, so it seems that the latter has been the key driver of the monetary tightening that started that year. Until June 2023, the nominal growth projection for 2023 and 2024 showed no clear trend. However, it remained elevated, thereby justifying the restrictive monetary stance, even more so considering that in the second half of 2023 the nominal growth projections increased, driven by stronger real growth expectations.

Clearly, visual analysis of a single monetary tightening cycle does not allow to make general conclusions. A statistically rigorous approach has been followed in a recent Federal Reserve paper in which the authors analyse the reaction function of the median FOMC participant: how does the median projection for the federal funds rate respond to changes in the median projection for inflation and the unemployment rate? The results indicate that the responsiveness to inflation and the output gap fluctuates over time and that in the post-pandemic world the reaction to inflation has significantly increased. Clearly, such an outcome isn’t surprising given the recent inflation experience.

To conclude, the monetary policy rule proposed by Orphanides-, the analysis of the latest tightening cycle and an econometric estimation of what drives changes in the interest rate projections of FOMC members -the ‘dot plot’- show the key role played by inflation (versus target), nominal GDP growth and the difference between the latter and its long-term forecast in the policy decisions of the FOMC. However, the responsiveness of the Committee fluctuates over time every tightening or easing cycle is different-, which implies that Fed watchers should complement the analysis of the variables mentioned above with close attention to the speeches of FOMC members as well as Chair Powell’s press conferences.

In this respect, it is good to keep in mind that simple analytical approaches also may offer value. As shown in chart 4, between the early eighties and the global financial crisis, there was a close relationship between observed nominal GDP growth and the federal funds rate. Given the resilience of US growth and the slow disinflation in the current cycle, there is a good chance that this relationship might be re-established.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.