United States: Concerns about growth

Concerns are mounting over US growth. Fears of a rebound in inflation and the shock of political uncertainty are weighing on households and businesses. Initial hard data for Q1 are adding to fears of an ongoing deterioration. And at this stage it is unlikely that the Fed will come to the rescue of the economy. Here is a quick overview of the warning signals sent out by the US economy.

Sentiment in the doldrums

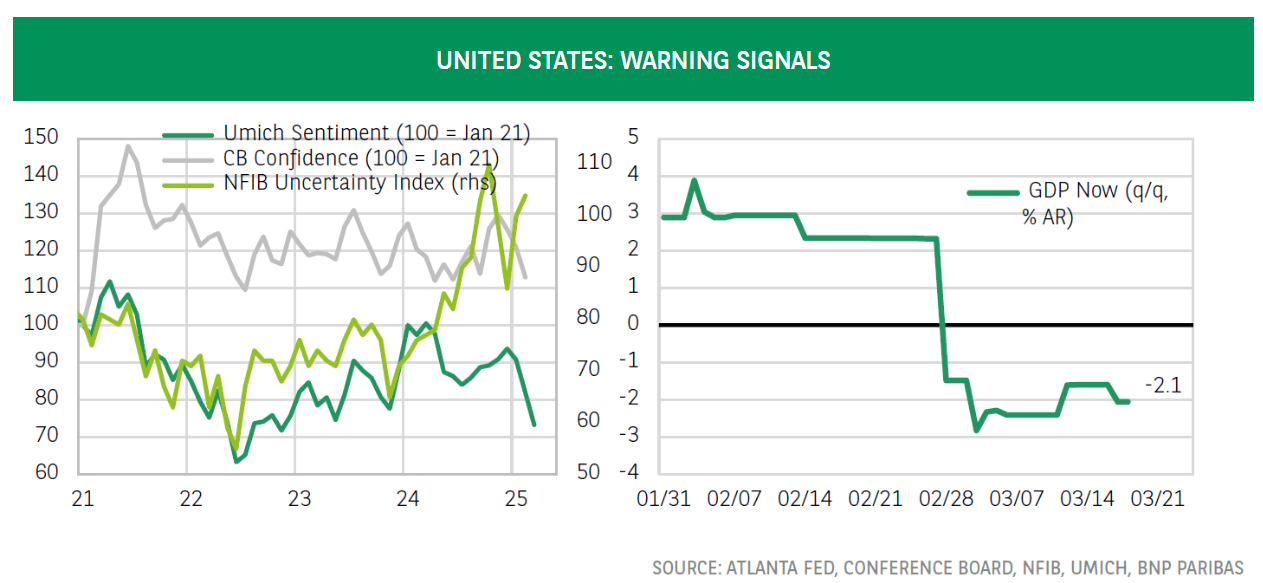

According to the surveys conducted by the Conference Board and the University of Michigan, household sentiment has fallen to its lowest level since the end of 2022, at a time marked by price increases, interest rate hikes and fears of recession. The 1-year inflation forecast stands at +4.9% y/y (+2.7% in October), while the 5-year forecast stands at +3.9%, a record since 1992. Meanwhile, the post-election surge in small business sentiment (NFIB) has fizzled out. The decline in the NFIB’s optimism index remained limited (-3.5 pts in two months), but the uncertainty index reached its second highest level ever in February, which could affect investment and hiring decisions.

Hard data in hard times

Retail sales (-1.2%) began 2025 with their worst monthly performance since July 2022, before disappointing again in February. In addition, the stock market correction (-9.0% between 19 February and 14 March on the S&P 500) could start to have an impact on the wealth effect on consumption. In addition, the trade deficit reached an all-time high in January, ahead of the implementation of additional tariffs. This is reflected in the Atlanta Fed's nowcast, which estimates real GDP growth at an annualised rate of -2.1% q/q (-4.4pp compared with Q4 2024). This result clearly points to a deterioration in the economic situation, but the figure needs to be qualified by the structure of the model and the automatic impact of the rise in imports. This deterioration could be magnified by the likely impact of the uncertainty shock on demand and the tariff shock on prices. As a result, the risk of recession has reappeared in the United States, albeit at a moderate level to date.

Not enough to unsettle the Fed... for now

The FOMC is expected to maintain its rate target at +4.25% - +4.5% at its meeting on 18-19 March. Looking further ahead, it does not seem appropriate to consider preventive action by the Fed: inflation figures do not allow for it and tariffs would be likely to hinder further disinflation. Only an unexpected slump in the labour market could hasten the movement. We are therefore maintaining our call of a stable key rate throughout 2025.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.