United States and Mexico: Special partners

The election of Donald Trump as President of the United States has raised fears that protectionist measures will be stepped up. Customs duties would be applied to all products from all of the United States’ trading partners. In addition to China, the main country targeted, concerns about the macroeconomic and financial consequences of such a policy have risen sharply in Mexico.

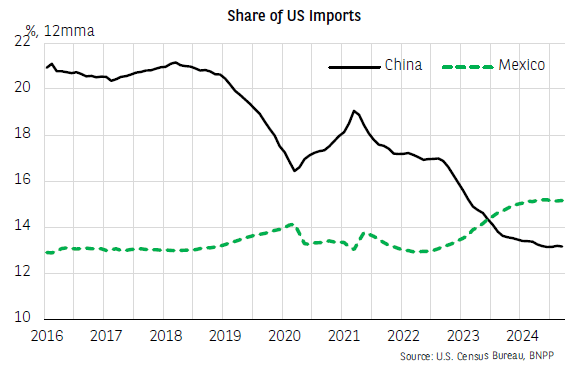

Mexico is now the United States’ main trading partner (15% of imports), ahead of China (13%). Its market share of total US imports has grown over the past ten years, following the introduction of US tariffs on Chinese products from 2018 (during Trump’s first term in office), and then the shortening of value chains as a result of the pandemic.

Mexican exports to the United States (almost 85% of total exports, or almost 30% of GDP) have diversified, and now make up a growing share of the value chains connected to the United States. However, the share of Mexican value added in exports is still relatively low, at around 11% according to the Comtrade database, well below the OECD average (22%).

It is against this backdrop that negotiations will shortly begin on revising the trade agreement between the United States, Mexico and Canada (UMSCA, which has been in force since July 2020 and is due for review in mid-2026). The incoming Trump administration is already putting a great deal of pressure on the Mexican government. The main demands are for a tougher anti-immigration policy, strict controls on imports of goods containing Chinese inputs and controls on Chinese investment in Mexico (even though this is still small, accounting for less than 2% of total FDI). The protection afforded by the trade agreement against a unilateral increase in customs tariffs could even be threatened by the ongoing reform of the Mexican judicial system. If this reform is actually implemented, the independence of the judiciary could no longer be guaranteed, which would be an op-out clause in the trade agreement.

The strategy that the incoming Trump administration will ultimately adopt cannot yet be ascertained. However, we think that it is highly unlikely that the trade agreement will be terminated, in view of the integration of the two economies. Although the balance of power remains in favour of the United States, a dramatic reduction in trade with Mexico would ultimately adversely affect both economies, especially against a backdrop of intensifying trade retaliation against China (or other emerging countries integrated with it). The Mexican economy would be hit harder, however, mainly in the short term through exchange rate depreciation, imported inflation and a fall in remittances from foreign workers.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.