Unemployment claims rise for the first time in 4 months

Initial unemployment claims rose for the first time since March 28

Job Warning Lights Flashing

Leading claims data flashed a huge warning sign about jobs today.

Initial claims rose from 1.307 million to 1.416 million, an increase of 109,000. This was the first rise in 16 weeks, a signal that the jobs recovery may be over.

Continued State Claims

Note: My Initial Claims and Continued Claims charts are Seasonally-Adjusted. The following PUA and Totals are NOT Seasonally-Adjusted.

Four Continued Claim Factors

- Continued claims lag initial claims by a week.

- People can find a job and drop off the unemployment rolls.

- People can expire their benefits and drop off the rolls.

- People can retire and drop off the rolls.

We are not yet at the point where state benefits have expired according to the Center on Budget and Policy Priorities as explained below,

Unemployment Compensation Basics

- Workers in most states are eligible for up to 26 weeks of benefits from the regular state-funded unemployment compensation program,

- Six states provide fewer weeks and one provides more.

- Under the CARES Act responding to the COVID-19 pandemic, all states provide 13 additional weeks of federally funded Pandemic Emergency Unemployment Assistance (PEUC) benefits to people who exhaust their regular state benefits.

- There are additional weeks of federally funded EB in states with high unemployment (up to 13 or 20 weeks depending on state laws).

- The maximum weeks of Pandemic Unemployment Assistance (PUA) for exhaustees equals 39 minus the number of weeks of regular UI and Extended Benefits (EB) received.

- No PEUC or PUA is available after December 31, 2020.

State Exceptions

- Massachusetts provides up to 30 weeks of UI except when a federal extended benefits program is in place (as it is now) or in periods of low unemployment (as was the case through February), when the maximum drops to 26 weeks.

- Montana provides up to 28 weeks of UI.

- Michigan normally provides up to 20 weeks of UI, but in the COVID-19 emergency that has risen to 26 weeks.

- South Carolina and Missouri provide up to 20 weeks of UI.

- Arkansas provides up to 16 weeks of regular benefits.

- Kansas was providing 16 weeks of UI before COVID-19, but that has been extended to 26 weeks through April 2021;

- Alabama currently provides up to 14 weeks of UI for new enrollees, with an additional five-week extension for those enrolled in a state-approved training program;

- Georgia was providing 14 weeks of UI, but in the COVID-19 emergency that has risen to 26 weeks;

- Florida currently provides up to 12 weeks of UI; and

- North Carolina currently provides up to 12 weeks of UI.

Nearly all of the improvement in continued claims is due to people finding jobs but people may have dropped off the rolls in Florida, North Carolina, and Georgia.

State Claims Provide Incomplete Picture

State claims do not provide a complete picture because many people are not eligible for unemployment insurance.

For example, self-employed are not eligible for state unemployment insurance even though they pay into the system.

The self-employed and small businesses were eligible for loans that in some conditions will not have to be paid back. The self-employed are also eligible for 13 weeks of Pandemic Emergency Unemployment Assistance (PEUC) but that may have expired.

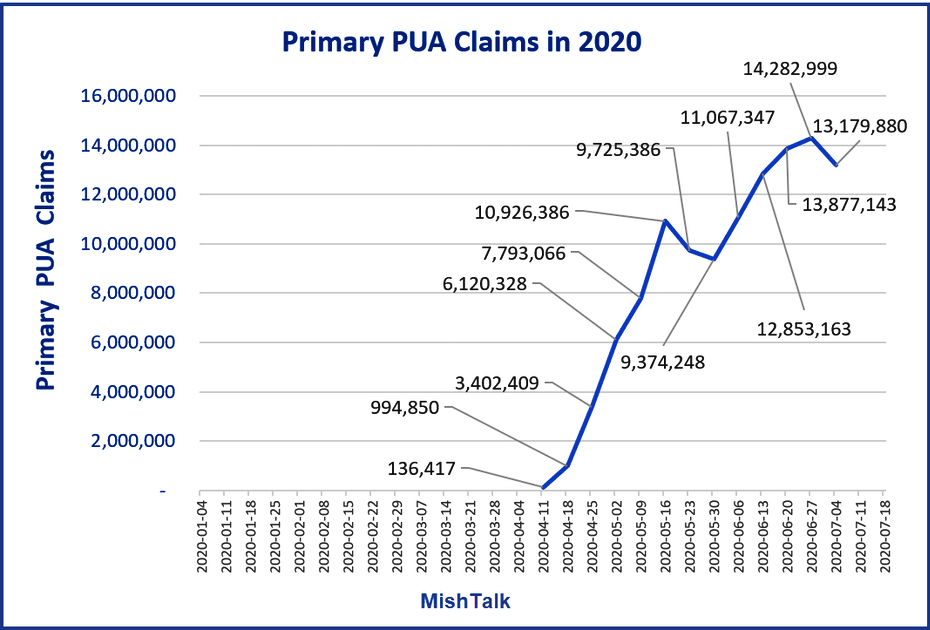

Primary PUA Claims

Primary PUA covers those who are not eligible to make state claims. The report lags initial claims by 3 weeks and continued claims by 2 weeks.

Based on state initial claims and state reopenings in reverse, I expect this number to jump in the weeks ahead.

All Continued Claims

All continued claims is the sum of state continued claims plus PUA claims and all other Federal programs.

All claims have topped 29 million for two months. There was little improvement in the current report.

Nearly 32 million people are collecting some form of unemployment insurance and as noted above I expect the number to rise.

Federal Benefits

About 25 million unemployed workers are on the last week of the expanded federal unemployment benefits. They get a monthly check of $600 and will soon only receive state unemployment benefits, which average $378 per week.

If not extended, this will be a big hit to the incomes of millions. Republicans, especially Trump, do not want to extend this benefit because many make more being unemployed than they did working.

Instead, Trump proposes a payroll tax cut (see point 3 below), but Republicans are balking at that too.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc