Understanding the Federal Reserve’s decision

Heading into the Federal Reserve’s latest decision many pondered whether the decision would be a pause, a skip, or a hold on rates. While the announcement appeared to be a skip, Fed Chair Powell cautioned against labeling it as such. This article aims to uncover the reasons behind Powell’s statement and delve into the key factors influencing the Fed’s stance. By examining data points like Core PCE and the labor market, we can better understand the implications for yields, USD, and the precious metal market, particularly gold. Additionally, we explore how this has now given the Fed’s flexibility to a data-driven decision-making process.

US Core PCE in focus: A determining factor

During the Q&A session, Powell highlighted the lack of significant progress in Core PCE (Personal Consumption Expenditures), an important inflation indicator for the Fed. The central bank wants to witness a decisive downward movement in Core PCE. Therefore, a substantial miss in Core PCE data would likely result in falling yields, a weaker USD, and a potential boost for gold prices.

The influence of the labor market: The Phillips Curve

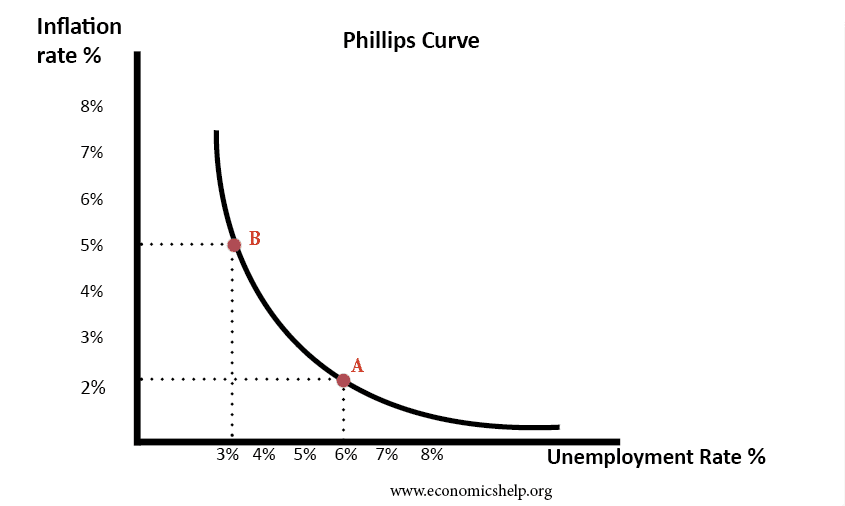

The Fed closely observes the Phillips Curve, an economic concept that relates unemployment and inflation. As per this concept, there exists an inverse relationship between the two variables. When unemployment is high, inflation tends to be low, and vice versa. The Fed considers a tight labor market to be inflationary, given the increased bargaining power of workers.

Strong jobs print and inflationary signals

The June jobs report revealed that the US economy added 339,000 jobs, surpassing market forecasts of 190,000. Powell views this as an inflationary reading, indicating potential upward pressure on prices. If the next jobs report shows a lower-than-expected figure or a deceleration in job growth, it could weaken the USD, push US 10-year yields lower, and potentially lift gold prices.

Flexibility in Fed’s approach

Despite the decision being labeled as a skip, it is crucial to understand that the Fed is maintaining flexibility. Chair Powell emphasised that the Fed’s projections are not set in stone, and decisions will be made on a meeting-by-meeting basis. The central bank will closely monitor jobs and inflation data, and if it trends lower, it could provide the Fed with the opportunity to transition from a skip to a pause.

Conclusion

The Federal Reserve’s recent decision, though perceived as a skip, requires deeper examination. By focusing on key data points like Core PCE and the labor market, we can better understand the implications for yields, USD, and gold prices. Chair Powell’s remarks highlight the Fed’s flexibility, indicating its willingness to adapt decisions based on evolving economic indicators. As investors, closely monitoring jobs data and inflation trends will provide valuable insights into the Fed’s potential shift from a skip to a pause stance.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.