UK wages surge to a new record high in June

There was always the likelihood that today’s unemployment and wages numbers would give the Bank of England a headache when it comes to deciding what to do when it comes to further rate increases, and this morning’s numbers have not just given the central bank a headache, but a migraine.

Not only has the unemployment rate jumped to its highest level since October 2021 at 4.2%, but wages growth surged in June, while the May numbers were also revised higher.

Average weekly earnings for the 3-months to June rose to a record 7.8%, while May was revised up to 7.5%, while including bonuses wages rose by 8.2%, in the process pushing well above core CPI inflation. This move to 8.2% was primarily due to NHS bonus one-off payments made in June, which is unlikely to be repeated.

The rise in wage growth saw public sector pay rise by 6.2%, while private sector wages rose 8.2% for the 3-months to June.

Inevitably this will increase the pressure on the Bank of England to raise rates again at its September meeting by another 25bps, even as headline CPI for July is expected to slow sharply below 7% in numbers released tomorrow.

On the broader employment picture there was a 97k increase in hiring during July as payrolled employees increased. On the overall UK employment rate, this fell back to 75.7%, and is still 0.8% below its pre-pandemic peak, with the economic activity rate also falling slightly to 20.9% on the quarter. Total hours work also declined.

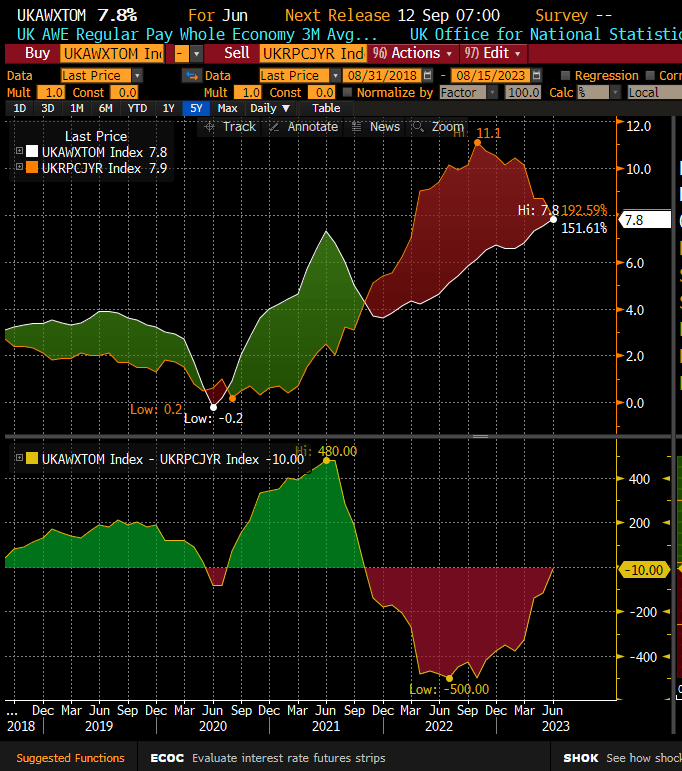

While many people will decry the strength of these numbers and warn of the risk of wage/price spiral they rather miss the point that consumer incomes have been squeezed for months, with the gap finally narrowing, and now starting to work in consumer’s favour.

UK wages against UK CPI last 5 years

Source: Bloomberg

This trend is likely to continue in the coming months as wage growth starts to slow and falling CPI starts to find a base, offering consumers some relief from the squeeze of the last 18 months.

It’s also important to remember that wage price gap leading up the end of 2021, was very much in the consumers favour, however this comparison also comes with several caveats due to furlough payments and other support structures which skewed the numbers.

While today’s wages data will undoubtedly grab all the headlines, there are growing signs of weakness in the labour market which may offer the Bank of England pause, and with another 2 CPI reports, one tomorrow, as well as another labour market survey before the next meeting, it doesn’t mean that we can expect to see multiple rate hikes in the coming months. While the pressure on the Bank of England to hike in September has undoubtedly risen and is fully priced for September it doesn’t necessarily mean we’ll see more rate hikes after that. Trends are important and the Bank of England needs to think about that before it raises rates further, and inflation is trending lower. UK 2-year gilts have edged higher and back above 5.1%

The Bank of England needs to remember that they’ve already raised rates 14 times in the last few months and there is still a lot more tightening that has yet to kick in. On this data another rate hike does seem likely but when you look at the graph above perhaps there’s a case for a pause in September given the direction of that graph above. What today’s data does mean beyond little doubt is that rates will need to stay at current levels for longer. More rate hikes aren’t necessarily the solution to every problem. Just because every problem is a nail, doesn’t mean you need a hammer. Just leave rates where they are for longer.

Consumers are already struggling and although we’ve seen Marks & Spencer update its full year forecasts for profits this morning, the upgrade has come against a backdrop of a strong performance in its food business, which saw like-for-like sales rise 11%.

Clothing and home sales saw like for like sales rise by 6%, with M&S warning that a tightening consumer market could act as a headwind into the year end.

Tellingly, management upgraded their outlook to show profit growth in fiscal 2022-23.

Author

Michael Hewson MSTA CFTe

Independent Analyst

Award winning technical analyst, trader and market commentator. In my many years in the business I’ve been passionate about delivering education to retail traders, as well as other financial professionals. Visit my Substack here.