Scope Ratings (Scope) affirmed the UK’s AA ratings on 28 March and kept the Stable Outlook. But fiscal deterioration and weaker debt sustainability increase risks to the rating, while 10% US tariffs on UK exports and 25% on steel and aluminium harm UK growth.

The UK’s robust institutional framework, the standing of sterling as a reserve currency, the role of gilts as safe assets, alongside deep domestic capital markets support the economy’s resilience. But the increasing levels of public debt, elevated financing costs, multiple recent episodes of gilt market volatility and a weak external sector with recurring current-account deficits present challenges.

The measures announced in the Spring Statement restored the UK’s fiscal headroom to GBP 9.9bn, reaching again the level projected as of last October, but this headspace is limited and leaves budgetary policies exposed to economic developments beyond the government’s direct control, presenting significant risks at a time of heightened global geopolitical and economic uncertainties.

There are also downside risks for the government’s fiscal and macroeconomic forecasts, making it likely that the Chancellor of the Exchequer might need to further adjust her policies in the upcoming Autumn Budget. Market expectations already reflect the possibility of additional tax measures, which could dampen the economy.

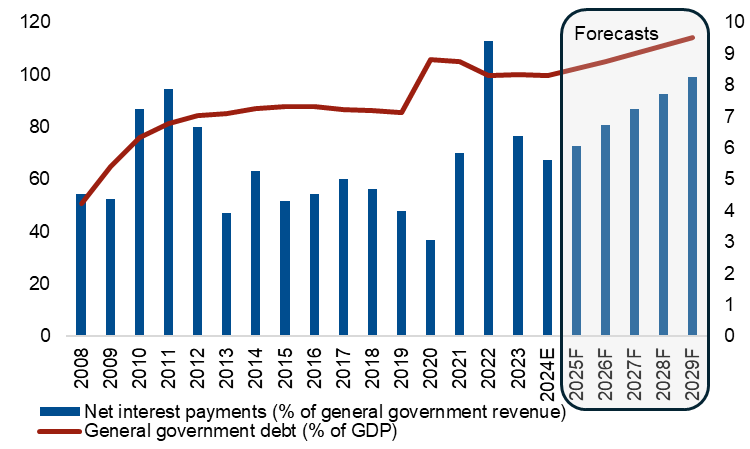

Borrowing costs have increased since last October: higher interest expenditure having effectively used up all of the GBP 9.9bn fiscal headroom left from the 2024 Autumn Budget. Scope forecasts net interest payments increasing to 8.3% of general government revenues by 2029, a near tripling from the 3.1% at their 2020 lows.

The higher military spending anticipated to aggravate the public-sector deficit

An increase in NATO-qualifying expenditure to 2.5% of GDP by 2027 is a challenge for the UK’s fiscal sustainability. Although the announced increase in UK military expenditure is not as significant thus far as that announced by many other European governments, any further rise aggravates the already elevated public-sector deficits. Political necessity aside, much of the currently-budgeted defence spending is classified as capital expenditure so does not count towards the UK fiscal rules to balance the current budget by the fiscal year 2029-30.

The Chancellor remains committed to reducing public-sector net financial liabilities. However, a more relevant market indicator: net debt excluding the Bank of England continues to rise. In view of continued subdued output growth, higher financing costs and significant spending requirements, Scope sees an increase in UK general government debt to 114.2% of GDP by 2029, from the estimated 99.5% as of end-2024.

The debt-sustainability outlook is becoming more challenging, %

Source: IMF World Economic Outlook historical data, Scope Ratings forecasts.

The “reciprocal” tariff announcements of the Donald Trump government are set to further weigh on the UK’s open economy. The newly imposed 10% US tariffs on UK exports (on GBP 60bn of exports to the United States last year or 2.1% of GDP) alongside 25% tariffs on steel and aluminium effective since last month present downside risks for the rating agency’s UK growth forecasts of 1.0% for 2025 and 1.3% for 2026.

Scope Ratings – the European credit rating agency – presents capital markets with opinion-driven, forward-looking and non-mechanistic credit-risk assessments, creating a greater diversity of opinion for institutional investors.

Recommended Content

Editors’ Picks

Gold trades in a rangebound mood around $3,300

Gold now seems to have embarked on a daily consolidation around the $3,300 mark per troy ounce following an all-time peak near $3,320 during early trade. Continued concerns over the escalating US-China trade tensions and a weakening Greenback, support the demand for the metal prior to Powell's speech.

EUR/USD remains consolidative around 1.1350 on firmer US Retail Sales

EUR/USD maintains its daily gains around the 1.1350 region on the back of the resumption of the bearish tone in the Greenback, which showed no reaction to the stronger-than-expected Retail Sales in March. Later in the day, investors are expected to closely follow Fed Chairman Powell’s comments on the economic outlook.

GBP/USD recedes from tops and revisits the 1.3250 zone

GBP/USD extends its positive streak on Wednesday, now coming under some selling pressure around the 1.3250 after earlier multi-month tops around the 1.3300 mark. The daily uptick comes on the back of the weaker US Dollar and easing inflationary pressure in the UK.

BoC set to leave interest rate unchanged amid rising inflation and US trade war

All the attention is expected to be on the Bank of Canada this Wednesday as market experts widely anticipate the central bank to maintain its interest rate at 2.75%, halting seven consecutive interest rate cuts.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.