UK PMIs Quick Preview: First coronavirus-linked read is a lose-lose situation for GBP/USD

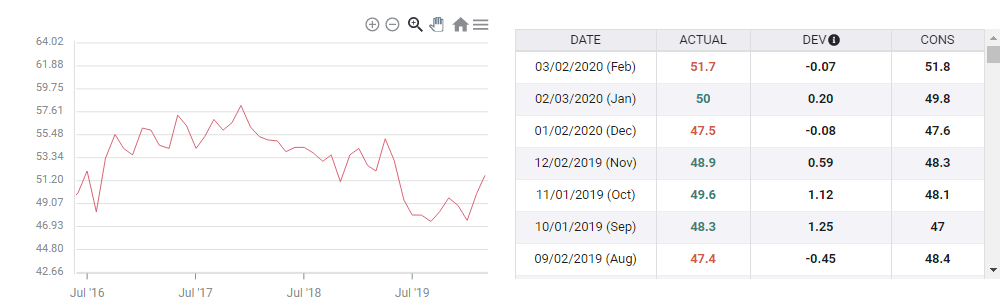

- Markit's preliminary PMIs for March are expected to drop to contraction territory amid the coronavirus crisis.

- The data has been collected before stricter lockdown measures have been collected.

- GBP/USD has room to the downside in almost any outcome.

How is the UK economy coping with coronavirus? So far, economic figures have been for the pre-crisis period, and now some forward-looking data are due. Nevertheless, Markit's preliminary Purchasing Managers' Indexes for March may already be out of date.

The highly-regarded surveys have been taken while Britain was transitioning from being lax on lockdowns – opting for the "hed-immunity" strategy – to shuttering significant parts of the economy.

Economists expect scores of 45 in both the manufacturing and services sectors – significantly below the 50-point threshold that separates expansion from contraction. However, these levels are relatively upbeat as they are relatively close to recent lows seen in the manufacturing sector. They do not reflect downright depression – as seen from China's figures.

The services sector is the UK's largest, and it may hold up as restaurants, bars, museums, and other sites were conducting business as usual until very recently. The manufacturing sector – dependent on exports – may have suffered more.

GBP/USD potential reactions

If the statistics miss expectations, the pound may suffer on an instant response – some by algorithms – to the disappointment. On the other hand, if they beat estimates, the knee-jerk reaction may be positive, but investors may suspect that this is already old news.

Perhaps the best outcome for GBP/USD would be hitting projections on the head – staying out of the spotlight. In this case, traders will move onto chasing the next coronavirus-related headlines.

Overall, the trend in cable is to the downside, as the country is going into harsher economic hardship and as the dollar continues benefiting from safe-haven flows.

Markit's initial PMIs can send sterling even lower and leave it unchanged in the best-case scenario.

More GBP/USD Forecast: Sell the rally mode as the coronavirus crisis could get worse

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.