- Economists expect the UK jobs report to show a slowdown in wage rises in November.

- The BOE closely watches the figures ahead of its all-important rate decision.

- A series of data disappointments may have led many to expect even worse outcomes.

If everybody is short, who is left to sell? Pound bears may be stretched, allowing room for gains if UK pay has rises have not fallen far.

Fourth consecutive disappointment? Not so fast

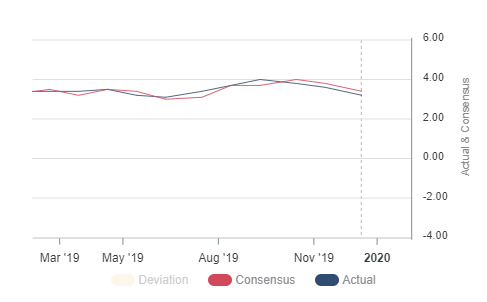

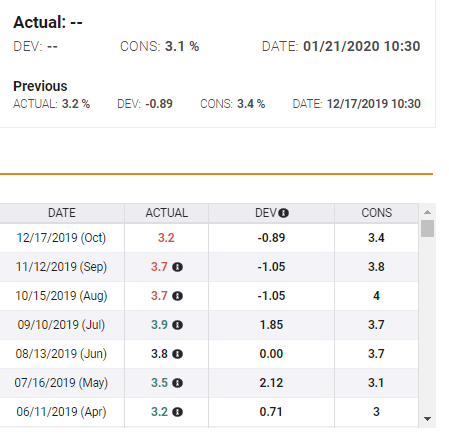

While the economic calendar is showing that the Unemployment Rate is expected to remain at 3.8% – the historic low – the focus is on wages. Economists project a deceleration of 0.1% in both Average Hourly Earnings that include bonuses and those that exclude them – from 3.2% to 3.1% in the headline and 3.5% to 3.4% in the core.

Examining the broader headline measure, the data shows that salaries' figures missed expectations in the past three months. Back in October, a lower estimate of 3.4% was followed by a disappointing increase of only 3.2% yearly.

For November, forecasts stand at a slower rate of 3.1%. Will pay rises fall short of expectations for the fourth time in a row? That was last seen in mid-2016 – and chances of it reoccurring now are slim.

Investors are already pricing in a rate cut

While the probability of another miss is low, investors may still be bracing for yet another shortcoming. Last week, the UK reported dreadful figures. Markets learned that the economy contracted by 0.3% in November, that retail sales dropped in December despite Christmas shopping and inflation – which the Bank of England targets – slowed to lowest levels since 2016.

The pound plunged as investors began preparing for the Bank of England to cut rates as soon as this month. In this atmosphere, even an "as expected" number would be good enough to trigger a recovery.

Here are three scenarios

1) As expected – GBP/USD edges up

If wage growth meets estimates of 3.1% – or even misses with 3% – the pound has room to rise. As mentioned earlier, the absence of yet another downfall may leave BOE expectations for this month unchanged – but would leave investors speculating about the next moves.

It would show that not all is doom and gloom in the UK economy, as long as wage growth holds above the round 3% level. The probability is high.

2) Above expectations – GBP/USD shoots higher

After three consecutive shortfalls, perhaps economists have been undershooting, and the salary increases may have stabilized at 3.2% or even accelerated to 3.3%. Some of the previous downbeat streaks were followed by upside surprises rather than with figures that met expectations.

In this scenario, GBP/USD has considerable room for an upside correction as the markets will begin casting doubts about next week's rate decision. The probability is medium.

3) Below expectations – GBP/USD falls

If earnings dig at the bottom and fall below 3%, sterling bulls may have to surrender, and bears would push it lower. The statistics would join weaker data and cement the rate cut next week. Speculation would move to the timing of the next rate cut.

The probability is low, given everything discussed above.

Conclusion

The UK jobs report for November and especially salary figures are critical for the pound. Given low expectations, GBP/USD has room to rise even if the data marginally misses expectations. An upside surprise would send it higher, and only a substantial miss would send it lower.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Gold trades near record-high, stays within a touching distance of $3,100

Gold clings to daily gains and trades near the record-high it set above $3,080 earlier in the day. Although the data from the US showed that core PCE inflation rose at a stronger pace than expected in February, it failed to boost the USD.

EUR/USD turns positive above 1.0800

The loss of momentum in the US Dollar allows some recovery in the risk-associated universe on Friday, encouraging EUR/USD to regain the 1.0800 barrier and beyond, or daily tops.

GBP/USD picks up pace and retests 1.2960

GBP/USD now capitalises on the Greenback's knee-jerk and advances to the area of daily peaks in the 1.2960-1.2970 band, helped at the same time by auspicious results from UK Retail Sales.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.