- The pound has been suffering from a poor GDP read for April.

- A bitter disappointment in the same month's jobs report may be on the cards.

- GBP/USD may be unprepared for this outcome, potentially extending its falls.

UK economic output has already been hit from Brexit uncertainty – and the job market may suffer the same fate. UK GDP dropped by 0.4% in April, far worse than 0.1% that was expected. Manufacturing production was hit hardest with a plunge of 3.9% in April.

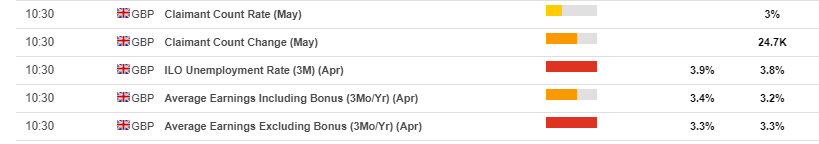

Economists expect the unemployment rate to rise from the historic low of 3.8% in March to 3.9% in April, but that may be too optimistic – as the drop in output may have already triggered a substantial loss of jobs.

And while trends in employment lag behind the economic activity, stockpiling towards Brexit – which was supposed to happen on March 29th – may have likely triggered a "payback effect" in April. The staff that was hired in March ahead may have been laid off as early as April.

Moreover, the claimant count change rose in April by 24,700 and this increase may affect the jobless rate. Unemployment benefits have been on the rise for many months while the jobless rate continued falling – this anomaly may now come to an end – perhaps worse than expected.

Expectations for wages also seem too high. Average earnings growth has decelerated to 3.2% in March and is now projected to rise back to 3.4% – the optimism seems unwarranted.

Overall, there is a higher chance of a disappointment than an upside surprise.

GBP/USD positioning

The pound has been unable to capitalize on the weakness of the US dollar – exposing its weakness. Other currencies such as the euro have been able to hold onto their gains against the greenback despite its own issues.

Sterling also looks vulnerable to recent political developments. The contest in the Conservative Party has kicked off with candidates competing to show who is tougher on Brexit – something that markets are not fond of. In addition, some insist that the EU may accept an accord without the thorny issue of the Irish backstop – also seemingly disconnected from reality.

Conclusion

Expectations for the UK jobs report seem too high after the weak GDP numbers. GBP/USD has exposed its vulnerability and may extend its falls on a disappointing outcome.

The UK jobs report is published on Tuesday, June 11th, at 8:30 GMT.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays around 1.0300 ahead of FOMC Minutes

EUR/USD stays under heavy selling pressure and trades around 1.0300 on Wednesday. News of US President-elect Donald Trump planning to declare an economic emergency to allow for a new tariff plan weighs on risk mood. US ADP misses expectations with 122K vs 140 anticipated.

GBP/USD drops to fresh multi-month lows, hovers around 1.2350

GBP/USD remains on the back foot and trades at its weakest level since April, around 1.2350. The risk-averse market atmosphere on growing concerns over an aggressive tariff policy by President-elect Donald Trump drags the pair lower as focus shifts to US FOMC Minutes.

Gold pressures fresh multi-week highs

Gold price (XAU/USD) advances modestly in a risk-averse environment. The benchmark 10-year US Treasury bond yield holds at its highest level since late April near 4.7%, making it difficult for XAU/USD ahead of FOMC Minutes.

Fed Minutes Preview: Key Insights on December rate cut and future policy plans

The Minutes of the Fed’s December 17-18 policy meeting will be published on Wednesday. Details surrounding the discussions on the decision to trim interest rates by 25 basis points will be scrutinized by investors.

Bitcoin edges below $96,000, wiping over leveraged traders

Bitcoin's price continues to edge lower, trading below the $96,000 level on Wednesday after declining more than 5% the previous day. The recent price decline has triggered a wave of liquidations across the crypto market, resulting in $694.11 million in total liquidations in the last 24 hours.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.