- The UK jobs report for September is set to show ongoing strength.

- Concerns from the BOE set a low bar for an upside surprise.

- GBP/USD has room to advance, also thanks to optimism about the elections.

Signs of a turn in the labor market – that warning by two members of the Bank of England will now come to the test. And those words by Michael Saunders and Jonathan Haskell – who dissented in favor of cutting rates – may determine sterling's reaction to the upcoming jobs report.

Market expectations and BOE conditioning

The jobless rate stood at 3.9% as of August – above the low of 3.8% seen earlier this year – but an excellent figure that is of envy to other countries. Economists expect the same result to be repeated in September.

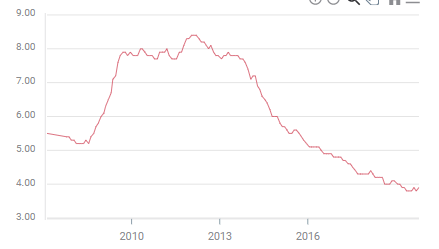

The chart below is showing how unemployment hit historic lows – below pre-crisis levels:

Average Earnings – which have been gaining traction in impacting the pound in recent years – were at 3.8% yearly growth in August. Also, here, a repeat is on the cards for September. With inflation standing at 1.7% that month, that would represent a real wage rise of 2.2% yearly – upbeat as well.

The UK labor market is booming and pushing salaries higher.

Is this about to change? The UK economy expanded by 0.3% in the third quarter and 1% on an annual basis – both figures below expectations and reflecting meager growth. Brexit uncertainty may have resulted not only in slower growth – but also in disappointing employment data.

An increase in the unemployment rate to 4% or deceleration of wage growth below 3.8% may, therefore, push the pound lower. However, after the warnings from the central banks – real expectations are probably more downbeat.

GBP/USD positioning and scenarios for the jobs report

Britain's jobs report is published against the backdrop of a pound-positive political development. Nigel Farage, leader of the Brexit Party, has announced that his new outfit will refrain from fielding candidates in seats won by Conservatives.

That may make it easier for Prime Minister Boris Johnson to secure an absolute majority. Investors prefer the certainty of Johnson's Brexit deal to the hard-left policies of Jeremy Corbyn, Labour leader.

1) As expected: Farage's dramatic decision joins lower BOE expectations in setting the stage for further GBP/USD advances. It would probably take an "as expected" – and it this case "unchanged" outcome to send the sterling higher. That is the base-case scenario.

2) Small disappointment: As mentioned earlier, a minor disappointment is probably priced into the pound. A minor miss of 0.1% or even 0.2.% in either or both key metrics may trigger choppy trading, but no substantial move in GBP/USD.

3) Considerable crash: To guarantee a slump in sterling, a miss of 0.3% is probably needed – the unemployment rate leaping to 4.2% and/or wage growth slowing to 3.5%. And that is highly unlikely.

4) Minor beat: Cable has room to rally upon a minor beat – a return of the unemployment rate to 3.8% or earnings advancing to 3.9%. That would defy the BOE's worries and also push the pound higher within the trend.

Conclusion

GBP/USD is entering the jobs report with upbeat political developments and downbeat expectations. It has room to fall only in one scenario out of four.

More GBP/USD Forecast: Levels to watch after Farage's fireworks, outlook bullish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD softens to near 1.1350, overbought RSI condition eyed

The EUR/USD pair attracts some sellers to around 1.1365 during the early European session on Thursday. Traders might prefer to wait on the sidelines ahead of the European Central Bank interest rate decision later on Thursday.

Gold price remains on the defensive below all-time peak amid positive risk tone

Gold price enters a bullish consolidation phase after hitting a fresh all-time peak on Thursday. A modest USD bounce and a positive risk tone cap the commodity amid overbought conditions. US-China trade war concerns, recession fears, and Fed rate cut bets support the XAU/USD pair.

GBP/USD trades below 1.3250 after retreating from six-month highs

GBP/USD snaps its seven-day winning streak, easing to around 1.3230 during Thursday’s Asian session after retreating from a six-month high of 1.3292 reached on Wednesday. Traders now await key US data releases later in the day, including Building Permits, Housing Starts, and more.

RAY sees double-digit gains as Raydium unveils new Pumpfun competitor

RAY surged 10% on Wednesday as Raydium revealed its new meme coin launchpad, LaunchLab, a potential competitor to Pump.fun — which also recently unveiled its decentralized exchange (DEX) PumpSwap.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.