UK Inflation Preview: Will softer CPI raise odds of a BoE pause?

- UK annualized Consumer Price Index is seen falling further to 10.3% in January.

- BoE could weigh a pause after March on softer CPI data but wage inflation remains a concern.

- GBP/USD braces for volatility ahead of the critical US and UK CPI reports.

GBP/USD has entered a phase of consolidation heading into a data-packed week on both sides of the Atlantic, with the United Kingdom’s Consumer Price Index (CPI) slated for release this Wednesday at 07:00 GMT. Will the Pound Sterling extend its correction against the United States Dollar (USD) on the UK inflation report?

Wage inflation – a cause for concern for BoE

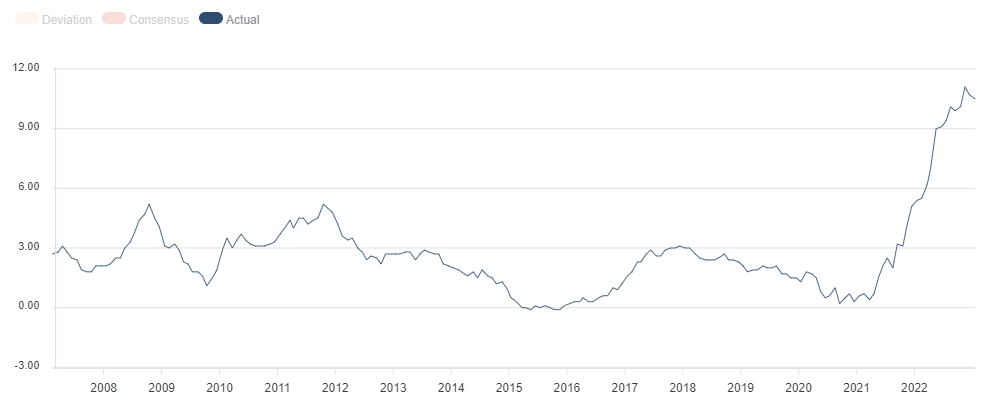

The January month annualized UK Consumer Price Index (CPI) data is expected to drop to 10.3%, moving further away from a peak of 11.1% seen in October and down from December’s 10.5%. The inter-month CPI is also seen falling by 0.4%. The annualized core inflation rate is likely to edge a tad lower to 6.2% vs. 6.3% reported in December. Despite the continued deceleration in the UK headline inflation, the figure is likely to have stayed above the 10.0% level last month.

In December, lower prices for petrol and clothing pushed down the headline rate but the cost of food and non-alcoholic beverages was 16.8% higher than a year earlier, the sharpest increase since September 1977, led by eggs, milk and cheese.

Source: FXStreet

With the UK economy having skirted a recession last year and inflation easing, the Bank of England (BoE) is under pressure to put a brake on its tightening cycle, as British households continue reeling from the cost-of-living crisis.

However, the UK labor market remains extremely tight and that could threaten the central bank’s intent to pause interest rate hikes. According to the latest Reuters poll of economists, the Bank of England will likely deliver another 25 basis points (bps) hike on March 23, taking the rate to 4.25% before pausing.

BoE Governor Bailey and company have warned against a shortage of workers fuelling upward pressure on wages, which could eventually keep inflation at elevated levels.

Ahead of the UK CPI data release, the UK's Office for National Statistics (NBS) is due to release its employment report for December, which could show that Average Weekly Earnings excluding bonuses probably grew 6.5% in the fourth quarter, up from 6.4% in the previous three-month period. Those wage growth would be the highest on record after 2021.

It’s worth noting that British companies are boosting pay at the quickest pace on record. The Chartered Institute of Personnel Development (CIPD) said earlier this week,'' with the Bank of England fearing the surge in inflation could be harder to tame if pay deals keep rising, 55% of recruiters planned to lift base or variable pay this year as they struggle to hire and retain staff in Britain's tight labor market.''

Reuters explained that ''expected median annual pay awards in 2023 rose to 5% - the highest since CIPD records began in 2012 - from 4% in the previous three months.

In light of this, BoE policymaker Jonathan Haskel sounded hawkish, noting that “economic theory suggests that uncertainty around the persistence of inflation should be met with more forceful action.”

On the other hand, the BoE dove, Silvana Tenreyro, said last week she was considering a cut to interest rates as she believes the monetary policy is “already too tight”.

The divide amongst the BoE policymakers is very evident and could keep Pound Sterling bulls at bay even though the core CPI continues to remain sticky above the 6.0% mark.

To conclude

A softer-than-expected headline print could prompt the Bank of England to weigh a pause in its rate hike trajectory, sending GBP/USD sharply lower.

With the United Kingdom Core Consumer Price Index - excluding energy and food prices, however, seen higher in January yet again, it could keep the Pound Sterling bulls lurking at lower levels.

If the Consumer Price Index rises higher than the previous 10.5% figure, GBP/USD could extend the weekly gains. Any reaction to the UK inflation could be tempered by Tuesday’s US CPI data release, which is likely to be the main event risk for traders this week.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.