UK Inflation Preview: Another soft CPI to hit Pound Sterling, here’s why

- UK inflation is seen easing to 10.6% YoY in December, away from a 41-year high.

- Another soft CPI data could prompt BoE toward ending its tightening cycle.

- GBP/USD could bear the brunt of dovish BoE expectations.

GBP/USD has paused its bullish momentum seen in the first full week of 2023, as markets gear up for a data-heavy week from the United Kingdom, with all eyes on the critical Consumer Price Index (CPI) due this Wednesday at 07:00 GMT. Will the Pound Sterling extend its correction against the United States Dollar (USD) on the UK inflation report?

Peak inflation and the Bank of England policy

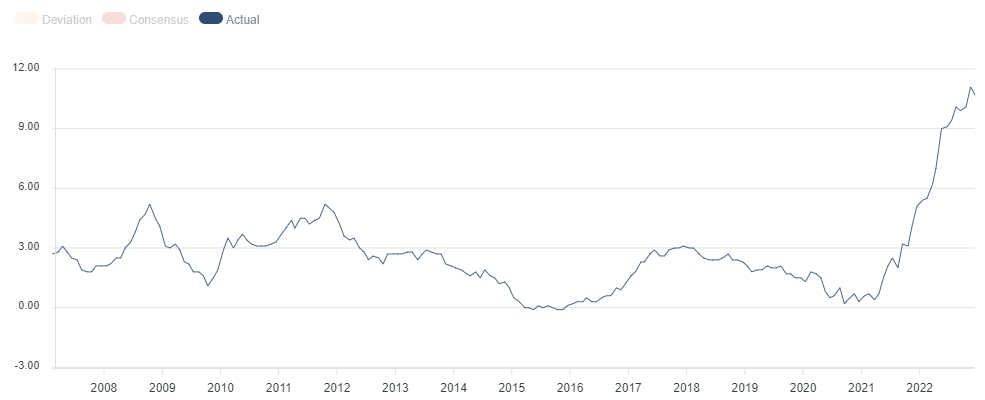

Having slowed to its lowest level in more than a year in November, the December month UK Consumer Price Index (CPI) data is seen easing further to 10.6% YoY while inter-month, CPI is seen steady at 0.4%. The annualized core inflation rate is likely to accelerate to 6.6% vs. 6.3% booked in November.

Source: FXStreet

In November, the UK Consumer Price Index fell more sharply than expected to 10.7% from October's 41-year peak of 11.1%, motivating the Bank of England (BoE) to hike the key policy rate by 50 basis points (bps) to 3.50%.

However, the Pound Sterling faced a bleak fate due to the divided voting composition. The vote was 6-3 in favor of the rate hike decision. Two Monetary Policy Committee (MPC) members, Silvana Tenreyro and Swati Dhingra, voted to hold rates at 3.0% while Catherine Mann voted to increase it by 75 bps to 3.75%.

The Bank of England doves could extend their control in the upcoming policy meeting on February 2, as economists are expecting the Consumer Price Index to keep moving away from the peak yet again.

The fall in the headline Consumer Price Index data could be partly driven by cratering energy prices, offering some comfort to households in the United Kingdom. The potential downtrend in UK inflation could fan expectations that the Bank of England may hint at an end to its tightening cycle as soon as at the start of next month.

Trading GBP/USD with UK Consumer Price Index

A softer-than-expected headline print could bolster expectations of a slowdown in the Bank of England’s rate hike pace or even an end to its tightening cycle, sending GBP/USD sharply lower.

With the United Kingdom Core Consumer Price Index - excluding energy and food prices, however, seen accelerating in December, it could cushion the impact of a softer headline figure on the British Pound.

In the case where the Consumer Price Index unexpectedly rises and outpaces the previous reading, GBP/USD could see a fresh upswing but the reaction will likely remain short-lived, as it could imply a tough road ahead for the Bank of England even though the country’s Gross Domestic Product (GDP) surprised with a 0.1% expansion in November.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.