UK Inflation Preview: Another hit to British households, and to the pound?

- UK inflation is foreseen at 5.9% YoY in February, refreshing a 30-year high.

- BOE expects inflation to be “several percentage points” higher than its 7.25% previous forecast.

- Soaring inflation to accentuate BOE’s dilemma, posing downside risks to the GBP.

GBP/USD has stalled its recovery momentum from the 2022 lows, as the driving theme of central bank divergence comes back to the fore. The Bank of England (BOE) delivered a cautious rate hike at its March policy meeting while Jerome Powell and Co. remain on course for aggressive tightening.

How far can UK inflation go?

This week, the UK inflation print for February stands out amid a lack of significant economic releases and no major central bank policy announcements.

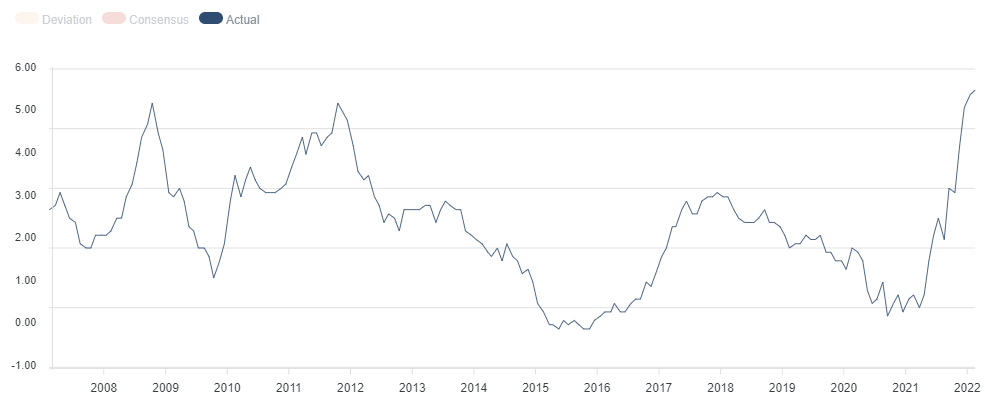

The month of February UK Consumer Price Index (CPI) data is forecast as recording another 30-year high of 5.9% YoY while inter-month, CPI is seen rebounding by 0.6% vs. -0.1% previous. The annualized core inflation rate is expected to jump to 4.8% vs. 4.4% booked in January.

Economists polled by Reuters expect the annual pace of inflation to accelerate to 5.9% in February.

Source: FXStreet

The January inflation figures from the Office for National Statistics (ONS) showed that the strongest clothing and footwear sales since 1990 were responsible for the 0.1% increase in the annual inflation rate, pushing it higher for the 13th straight month to 5.5%.

The surge in inflation expected in the second month of this year will be mainly due to the oil shock, in the face of the Russian invasion of Ukraine. This forced the BOE to revise its forecast for the peak of inflation this year, now expecting to be “several percentage points” higher than the 7.25% previous forecast.

Last week’s dovish BOE rate hike only underscores the British central bank’s concerns over the risks to the country’s growth, as it looks to curb raging inflation. Another increase in the inflation rate will exacerbate the pain of hard-pressed UK households while at the same time accentuating the BOE’s dilemma.

Trading GBP/USD with UK inflation

Maintaining the post-pandemic economic recovery amidst soaring inflation will be a big challenge for the BOE going forward, as the central bank has shifted its attention to growth, reflected in the March policy announcement.

A UK CPI print above the expected 5.9%, therefore, could further put the BOE in a tricky spot. The uncertainty surrounding the central bank’s next policy move will likely weigh on the pound.

In case the inflation figures fall short of market expectations, it could provide temporary relief for GBP bulls, although Russia-Ukraine developments and Fed sentiment are likely to lead the way.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.