UK inflation jumps to eight-month high, Pound shrugs

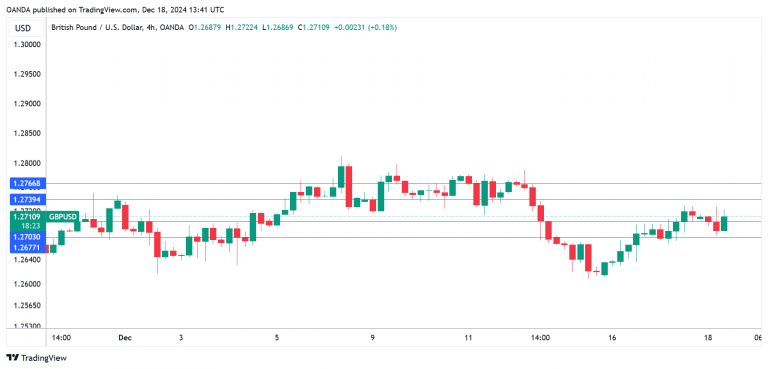

British pound is showing little movement on Wednesday. Early in the North American session, GBP/USD is trading at 1.2679, down 0.07% on the day.

UK inflation climbs to 2.6%

Inflation in the UK climbed to 2.6% in November, its highest level since March. The rise was driven by higher costs for petrol and food as well as an increase in the tobacco duty in the budget. Services inflation, which has been persistently high, was unchanged at 5%. The CPI reading was in line with the market estimate and the pound has showed almost no reaction. Monthly, CPI increased 0.1%, compared to 0.6% in October and also matching expectations.

Core inflation, which is considered a more reliable gauge of inflation trends, climbed to 3.5% y/y, up from 3.3% in October and just below the market estimate of 3.6%. This was the highest level since August. The acceleration in core inflation will be a source of concern for the Bank of England, as will be service inflation and Tuesday’s employment report which showed wage growth excluding bonuses rising to 5.2% from 4.4%.

The rise in inflation cements a pause from the BoE at Thursday’s rate meeting. The central bank has cut rates twice since June, bringing the cash rate to 4.75%. The BoE has largely contained inflation but will want to see evidence that inflation is moving towards the 2% target before delivering further rate cuts.

The BoE is widely expected to maintain the benchmark rate at 4.75% at Thursday’s rate meeting. The central bank lowered rates for a second time this year in November but will want to see inflation fall closer to the 2% target before resuming rate cuts.

The Federal Reserve makes its rate announcement later today. There isn’t much excitement around the decision, with the market pricing in a quarter-point cut at close to 100%. Investors will be interested in the updated economic and interest rate projections. President-elect Trump will take office in January which adds significant uncertainty for Fed policymakers.

GBP/USD technical

-

GBP/USD is testing support at 1.2703. Below, there is support at 1.2676.

-

1.2739 and 1.2766 and the next resistance lines.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.