UK GDP Preview: Growth to stagnate but recession narrowly averted

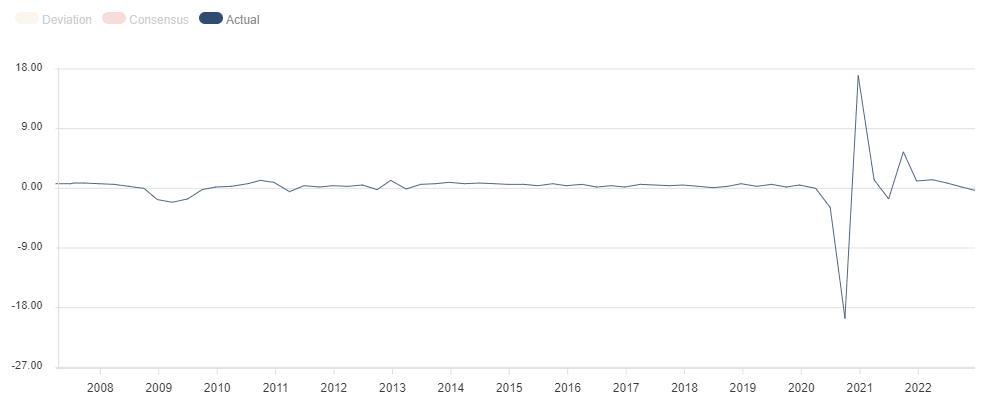

- The British economic growth is likely to stagnate at 0% in Q4 2022 vs. -0.3% previous.

- The Bank of England still expects the economy to shrink by 0.5% this year.

- The Pound Sterling could resume decline vs. the US Dollar if the UK GDP confirms a technical recession.

The optimism is already in the air that the United Kingdom (UK) economy has probably dodged a recession in 2022, which has provided some respite to the Pound Sterling bulls. But will it be enough?

Britain avoided entering into a technical recession in the third quarter after the UK Q2 GDP growth was revised upwards to 0.2% against the preliminary estimate of a 0.1% contraction. A technical recession is defined as two consecutive quarters of negative growth.

For the final quarter of 2022, the United Kingdom Gross Domestic Product (GDP) is likely to stagnate at 0% when compared to a 0.3% decline reported in the third quarter. On an annualized basis, the UK economy is seen expanding 0.4% in Q4, sharply lower from the 1.9% growth registered in the previous quarter. Meanwhile, the December month GDP is expected to shrink by 0.3% vs. 0.1% booked in November. The UK growth numbers are due for release on Friday at 07:00 GMT.

Source: FXstreet

The BoE growth optimism

At its February monetary policy announcement, the Bank of England (BoE) Monetary Policy Committee (MPC) voted, by 7 to 2, to lift Bank Rate to 4.0%, from 3.5%, its 10th rate rise in a row.

The central bank revised its economic growth forecasts up, now predicting that the UK economy avoided recession at the end of last year, with modest growth in Q4 2022. The bank still expects the economy to shrink by 0.5% this year.

In a CNBC interview following the first Bank of England policy meeting of 2023, Governor Bailey said there were “a number of reasons” to be more optimistic in its growth forecast, including falling energy prices, a lower market curve of interest rates, and an easing unemployment forecast. However, he cautioned markets against becoming complacent.

Meanwhile, the National Institute of Economic and Social Research (NIESR), in its latest UK economic outlook, said it expected the economy to avoid a technical recession in 2023, with a GDP growth forecast of just 0.2% for 2023. The forecast for 2023 has been downgraded from 0.7%, and the estimate for 2024 is 1%, a decrease from the previous estimate of 1.7%.

This comes after the International Monetary Fund (IMF) last week downgraded its projection for the United Kingdom GDP growth to -0.6% in 2023, making it the world’s worst-performing major economy, behind even Russia.

Trading GBP/USD on the UK GDP outcome

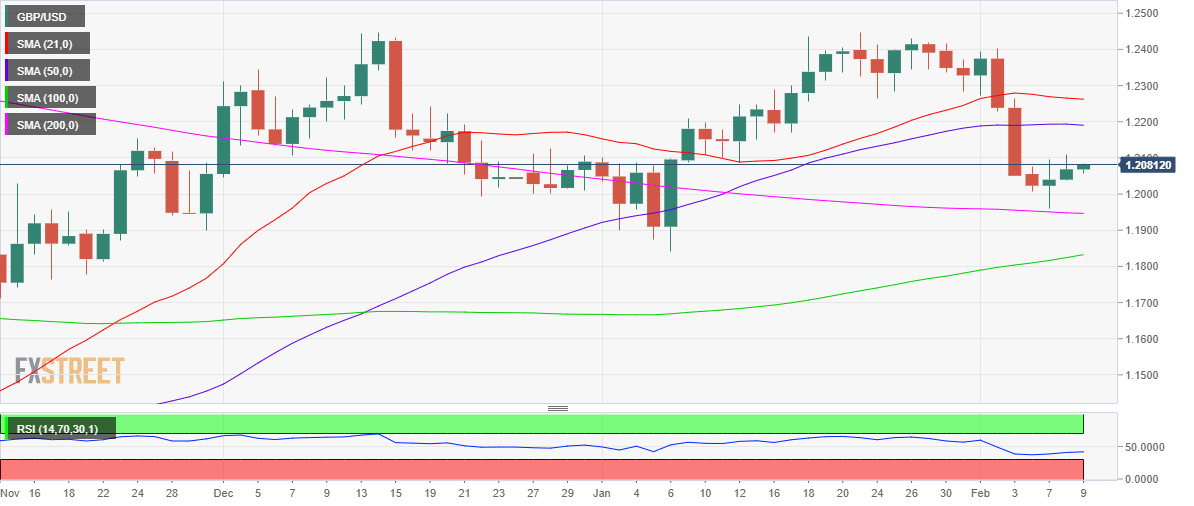

GBP/USD is in a tepid recovery mode from the five-week trough of 1.1961 in the run-up to Friday’s United Kingdom GDP release.

An unexpected negative UK GDP print for Q4 GDP will confirm a technical recession, fueling a fresh downswing in the Pound Sterling against the US Dollar. The critical 200-Daily Moving Average (DMA) at 1.1945 could regain bears’ attention once again.

On the expected stagnation in the UK economy, GBP/USD could encounter ‘sell the fact’ trading, as the optimism surrounding warding off recession seems to be priced in by the market in this week, thus far.

On the other hand, should the UK economy report a surprise expansion for the fourth quarter, the GBP/USD recovery momentum could gather strength toward the horizontal 50-DMA resistance at 1.2193.

Upside in the pair could remain limited as the 14-day Relative Strength Index (RSI) continues to hold below the 50.00 level – the bearish territory.

GBP/USD: Daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.