UK GDP Preview: GBP/USD may rise with Boris' hopes if upbeat forecasts are realized

- The UK economy has likely rebounded in the second quarter after contracting beforehand.

- The data comes after downbeat forecasts from the central bank and ahead of the elections.

- GBP/USD has room to recover if economists' expectations are realized.

"We are close to where we move to something that starts to feel like a recession," said Mark Carney, Governor of the Bank of England, when referring to the global economy. Economists expect Gross Domestic Product (GDP) figures for the third quarter to show the UK averted a downturn – and that may lift the pound – as it also has political implications.

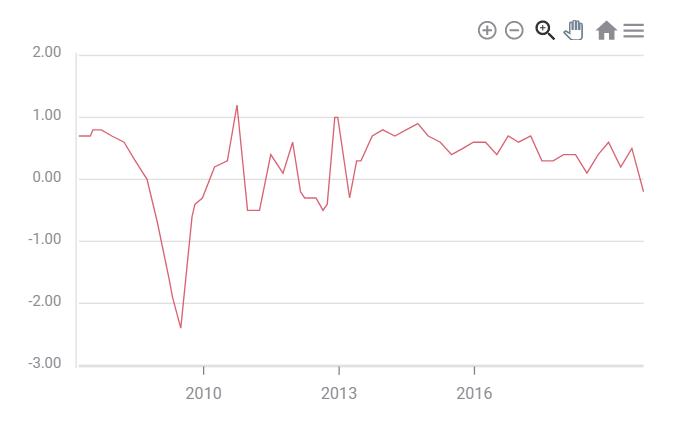

The bank does not foresee a downturn in the UK but signaled a slowdown is on the cards. The British economy contracted in the second quarter, and two consecutive quarters of shrinking output are the definition of a recession. That squeeze was attributed to the aftermath of Brexit preparations. The UK was set to leave the EU on March 29. Stockpiling in the first quarter led to a "hangover" in the second one, and the third quarter of 2019 will already see a return to healthy growth – that is the theory.

The recent quarterly GDP figures will test the theory. An increase of 0.3% in output is on the cards after a dip of 0.2% – the first since the last quarter of 2012.

Such a rise would surpass euro-zone growth – standing at 0.2% and would show that the UK economy is weathering the global headwinds and Brexit uncertainty. The BOE may maintain its cautious stance, yet without moving forward to cutting rates – contrary to the desire expressed by two members of the Monetary Policy Committee (MPC).

GDP implications for politics and GBP/USD

Coming one month ahead of the elections, it would also allow Prime Minister Boris Johnson to claim that the economy under his Conservative Party is doing well. Both an upbeat figure and one that is supportive of markets' preferred election outcome – an outright Tory majority – are positive for the pound.

However, there may also be something for the "doomsters and gloomsters" – as Johnson calls those warning about the ramifications of Brexit. Yearly GDP is set to decelerate from 1.3% to 1.1%. Labour leader Jeremy Corbyn may seize on that figure. Markets fear Corbyn's left-leaning economic policies.

In balance, 0.3% quarterly growth is satisfactory – and with Johnson already in the lead – GBP/USD has room to advance. That is the main scenario.

Any deviation from 0.3% quarterly growth – and to a lesser extent from 1.1% yearly expansion expected – may also have a political fallout, thus amplifying the impact of GDP on sterling.

A bump-up of 0.4% or 0.5% in output may send sterling higher and enable Sajid Javid, Chancellor of the Exchequer, to claim that Brits are set to continue prospering under the Tories.

A meager increase of 0.1% or 0.2% in growth may weigh on the pound and allow John McDonnell, Labour's shadow chancellor, to say that the economy under the Conservatives is struggling.

Conclusion

The UK economy is expected to have expanded by 0.3% in the third quarter, an upbeat figure that may allow sterling to recover, as it also has political implications that markets desire. A beat may further boost the pound, while a disappointment could push GBP/USD lower on higher chances for a Corbyn-led government.

See GBP/USD Forecast: Four Top-tier figures to determine direction after BOE blow, election mess

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.