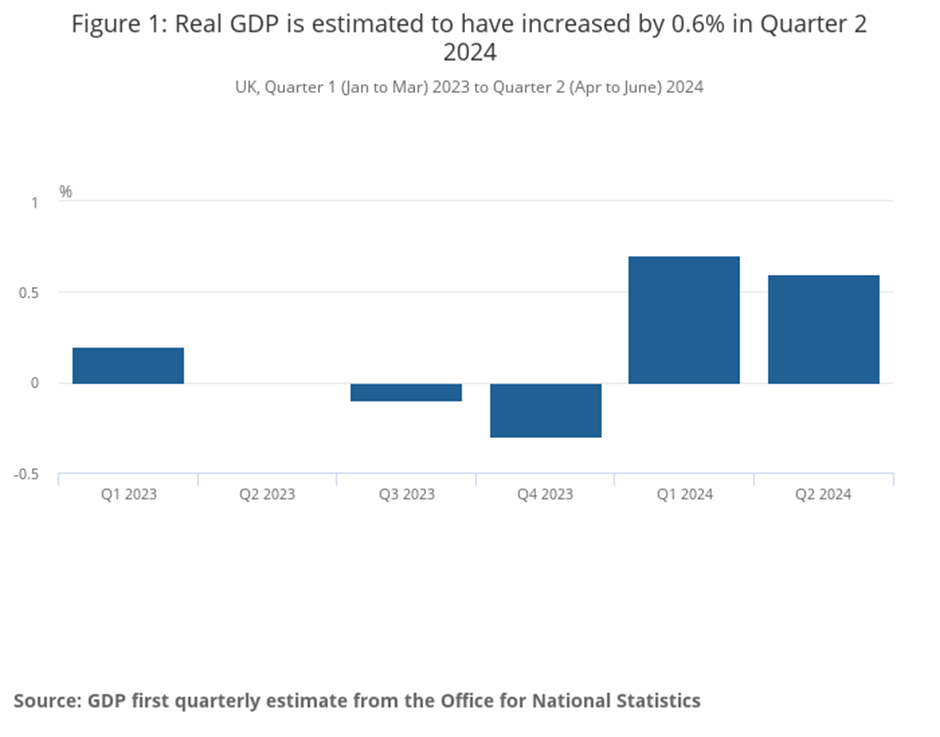

According to the Office for National Statistics (ONS), UK economic activity increased by +0.6% in the April to June quarter (Q2), following the UK economy's growth of +0.7% in Q1 (January to March). This fell in line with economists’ estimates and indicates that the UK economy has so far had a solid year: +1.3% growth in H1 (annualised: +2.6%). You may recall that the UK economy fell into a shallow ‘technical recession’ in the second half of last year (two consecutive negative quarters of economic growth).

ONS director of economic statistics, Liz McKeown, commented: ‘The UK economy has now grown strongly for two quarters, following the weakness we saw in the second half of last year. Growth across the three months was led by the service sector, where scientific research, the IT industry and legal services all did well’.

Comparing UK economic activity to other G7 economies, Q2 economic activity in the US showed an expansion of +0.7%, with the euro area expanding +0.3% in the quarter (matching the previous quarter).

Service sector output increased in Q2

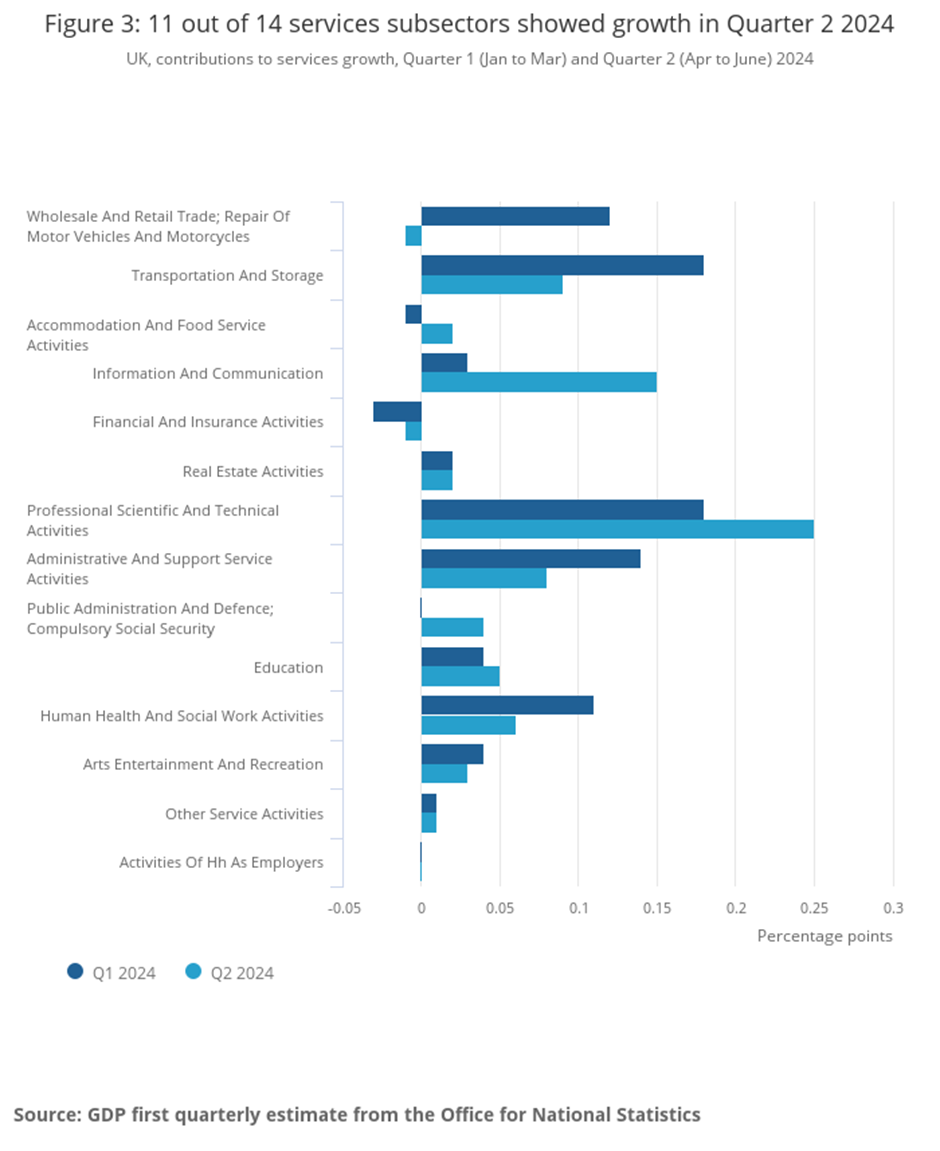

Driving Q2 economic activity was strong growth in the services sector.

According to the latest data, services increased by +0.8% in Q2; 11 of the 14 service categories exhibited growth, with the largest upward contributor coming from ‘Professional, Scientific and Technical Activities’ – ‘Scientific Research and Development’ is estimated to have grown +11.0%. Additional upward contributors were from ‘Transportation and Storage’ and ‘Information and Communication’. The report also added that consumer-facing services fell -0.1% in Q2, powered by declines in ‘buying and selling, renting and operating of own or leased real estate, excluding imputed rental, and a fall in wholesale and retail trade; repair of motor vehicles and motorcycles’.

Offsetting the increases in the services sector were declines in production and construction, which both fell -0.1% in Q2. Of note, manufacturing was the largest downward contributor, with 9 of the 13 manufacturing categories showing a decline in Q2.

Economic activity flat between May and June

Economic activity exhibited no growth between May and June, following an increase of +0.4%. The 0.0% print also fell in line with economists’ forecasts.

Surprisingly, while services underpinned growth in Q2, services output dropped -0.1% between May and June, following +0.3% growth in May (this follows five straight months of growth and 7 of the 14 services categories falling in June). This, however, was offset by strength in production and construction on the month, up +0.8% and +0.5%, respectively. The ONS added: ‘The largest contribution to the growth in June 2024 was +1.1% growth in manufacturing’.

Market reaction limited

Given that the data came in as expected, the market reaction was muted. A slight uptick in sterling (GBP) was seen, though price action has since reversed gains and is testing pre-announcement levels.

Following softer UK wage growth (Tuesday’s report), a solid miss on the UK Consumer Price Index (CPI) inflation (Wednesday), and a reasonably solid start to the first half of 2024 in terms of economic activity, this is ideally what the Bank of England want to see. Markets are still pricing in around -50 basis points of cuts for the entire year, with -10 basis points implied for September’s meeting and -27 basis points for November.

This material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP Markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for Difference (CFDs) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading CFDs you do not own or have any rights to the CFDs underlying assets.

FP Markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A Product Disclosure Statement for each of the financial products is available from FP Markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First Prudential Markets Pty Ltd (ABN 16 112 600 281, AFS Licence No. 286354).

Recommended Content

Editors’ Picks

EUR/USD hovers above 1.1000 ahead of US Retail Sales data

EUR/USD consolidates above 1.1000, within a familiar range in European trading on Thursday. A positive risk tone and a pause in the US Dollar recovery underpin the pair but the upside remains capped, as traders turn cautious ahead of the key US Retail Sales data.

GBP/USD clings to gains near 1.2850 after UK data

GBP/USD trades with moderate gains near 1.2850 in the European session on Thursday. The data from the UK showed that the GDP expanded at an annual rate of 0.9% in Q2 as expected, helping Pound Sterling stay resilient against its peers. US data is next in focus.

Gold price rises above $2,450 on growing expectations of Fed rate cut in September

Gold price gains above $2,450 as traders widely anticipated the Fed will begin reducing interest rates from September. The US CPI data for July boosted confidence that price pressures will return to the desired rate of 2%.

AAVE price eyes for rally after retest of support level

Aave (AAVE) price trades slightly higher during the Asian trading session on Thursday after surging on Wednesday. On-chain data shows that open interest, daily active addresses and development activity are rising, signaling a bullish trend.

Fed rate cut in September? The data will decide

The US economy is currently navigating a period of slowing growth, persistent inflation, and a tight labour market. The Fed's aggressive monetary policy tightening over the past year has started to show results in moderating inflation