- UK elections are critical for sterling traders this week, held on 12th Dec and results in for the morning of 13th Dec.

- Opinion polls point to a Conservative victory, but it is not a foregone conclusion.

- Market euphoria could see GBP push higher across the board on a Tory victory.

- It is not clear how the markets would react to an opposition party.

- GBP will not like the prospects of a hung parliament.

It is a critical week for sterling traders as the UK electorate go to vote on Thursday 12 December in a highly anticipated UK general election. The election result will be decisive for what will happen on the Brexit front which matters for FX markets.

Opinion polls point to a Conservative victory, but it is not a foregone conclusion by any means and this is where the risk lies for sterling which has been gaining ground since the end of November on the presumption of a Tory victory. However, it might be well-advised not to get overly bullish on GBP ahead of the vote – there will plenty of those positioned speculatively seeking to cash in ahead of voting.

The first thing to note is that the voting stations will close at 23:00 CET or 22:00 GMT when we should also expect to get our first exit poll. 'Winner-takes-all', or otherwise known as, the 'first past the post' system, means the candidate who receives the most votes wins. The vote count starts immediately and we should know the final result by early morning on Friday 13 December. Opinion polls show that the Conservative Party is around 10pp ahead of Labour.

Polls as of 8th December

Following the latest Survation poll, the current Tory leads for all pollsters are: ICM 7pts, ComRes 8pts, BMG 9pts, Panelbase 9pts, YouGov 10pts, Deltapoll 11pts, MORI 12pts, Kantar 12pts, Survation 14pts, Opinium 15pts.

YouGov's so-called MRP model, predicts a solid majority win for the Conservative Party (359 seats versus 211 for Labour, 13 for LibDems and 43 for SNP. 326 seats are needed to secure a majority).

Key scenarios

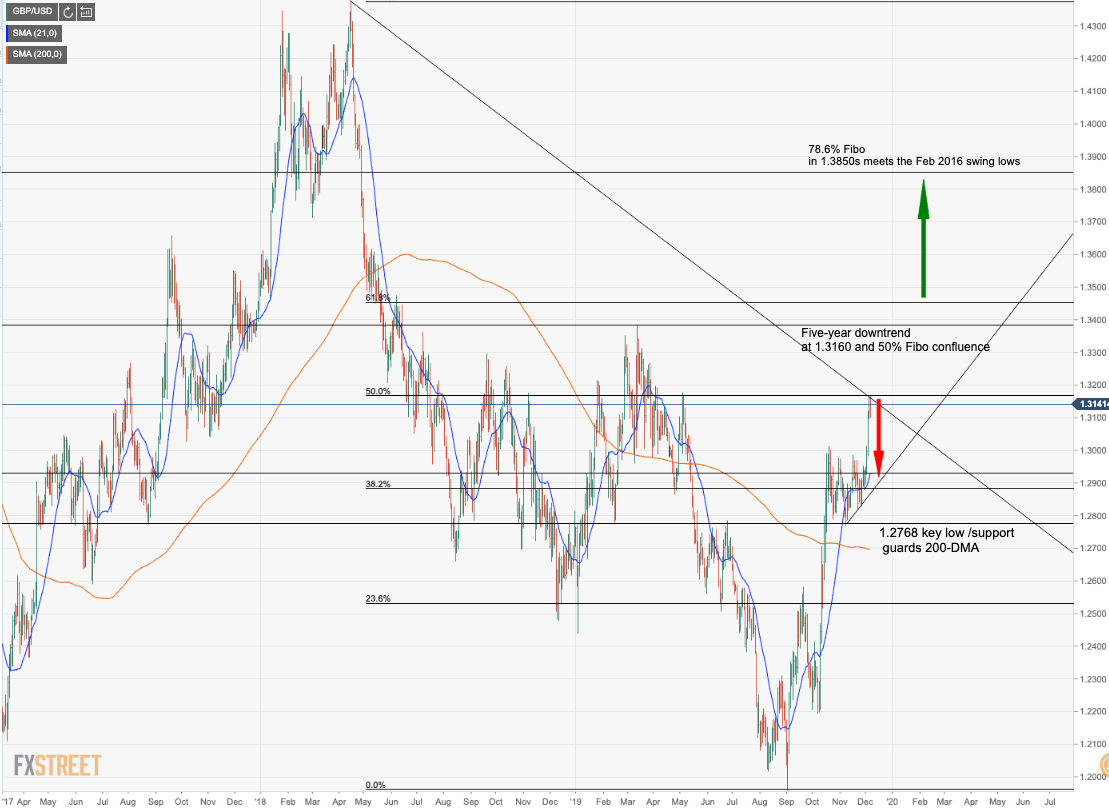

Chart of the week: GBP/USD bulls target closes above critical 1.3160/90 on UK election week

GBP/USD daily chart

- (GBP Bullish) – The markets base case is that should the UK Prime Minister Boris Johnson win, the UK will leave the EU on 31 January. Johnson will first get his Brexit deal through Parliament before Christmas from a more loyal party and without the need to rely on DUP votes – (Moderate Conservative rebels who voted against him have either been expelled or are not seeking re-election). Friday 20 December has been mentioned as a potential voting day. Then, the focuses will be on a trade deal between the UK and EU yet it is unlikely that Johnson could realistically get one next year and thus a pragmatic temporary tariff-trade arrangement might be the best the UK and EU can hope for. On such an outcome, market euphoria could see GBP push higher across the board. For cable, beyond the March 2019 highs of 1.3380, the 78.6% Fibonacci of the mid-April to 3rd September range in the 1.3850s that meet the Feb 2016 swing lows will be a keen target.

- (GBP bullish/bearish) It is not so clear how the markets would react should an opposition party (Labour, LibDems, SNP, Plaid Cymru and Greens) secures a majority. However, the uncertainty of such an outcome would likely see an unwind of the speculative Tory victory trade and send GBP markedly lower on the knee-jerk. It would be then presumed that a second EU referendum with "remain" as one of the options. Indeed, opinion polls show that "remain" is slightly ahead, but not by much. This could be a bullish factor for GBP as Brexit is priced out. Failures below the 1.3160s open downside risks towards the minor support area between the 1.3013 October high and the 21-day moving average around 1.2930, just above a prior 38.2% retracement. The 8th November low comes in at 1.2768 and guards the 200-day moving average at 1.2695.

- (GBP bearish) – What we can be sure of is that FX will not like the prospects of a hung parliament which is unable to pass anything. In this scenario, we will be back to the drawing board as the UK would have to seek yet another extension. The first risk is that the EU will not grant it, as Brexit fatigue and impatience with the UK from Brussels kicks in. However, that is unlikely. Another snap election would be the ultimate outcome but bearish for the pound. Again, failures below the 1.3160s open the aforementioned downside risks

Conclusion: GBP Bulls to hold their horses

Further afield, the UK economy will be next in line for market scrutiny where markets will be looking for fiscal stimulus from the Tories. However, a scenario when the UK would be eventually be trading with the EU on WTO rules after December 2020 would likely cap any ambitious rallies in the pound considering the negative impact such a scenario has been forecasted to have on UK GDP growth.

Or, on the flip-side, in a scenario whereby Labour was to pull off a surprise election victory, the first time around or second time around, this could lead to no Brexit at all. The FX market would likely factor in Labour’s unfriendly business policies. As such, the political hangover from this week's election will prevent interest rates and the pound from moving too much higher.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD stays defensive below 0.6650 amid China slowdown worries

AUD/USD stays weak below 0.6650 in Asian trading on Tuesday, undermined by mounting worries over China's economic slowdown. The Aussie shrugs off small rate cuts by the PBOC and a subdued US Dollar. Pre-US earnings results caution also weighs on the pair.

USD/JPY extends losses toward 156.00, as risk-off mood returns

USD/JPY accelerates declines toward 156.00 early Tuesday. The Japanese Yen stays bid as risk-off flows return in the Asian session, sustaining the US Dollar weakness-driven downside in the pair. The pair looks to Japanese verbal intervention and mid-tier US data.

Gold price moves away from over one-week low, climbs back above $2,400 mark

Gold price extended its recent corrective slide from the record high touched last week and fell to a more than one-week trough on Monday. US President Joe Biden's withdrawal from the 2024 Presidential election increased the chances of Donald Trump becoming the next US President, raising hopes of a looser regulatory environment.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin finds support around the $67,000 level

Bitcoin and Ripple prices are holding steady around their respective weekly and daily support levels, hinting at an imminent rally. Meanwhile, Ethereum is encountering resistance at the $3,530 mark; a decisive close above this level would signal a bullish breakthrough.

Earnings review

In recent years, the focus has been on the Magnificent 7, particularly Nvidia’s monster earnings reports, which have dominated the market. While Nvidia’s results are still extremely important for overall sentiment, there is a hope that sales growth and revenues can pick up across a broad range of global markets and sectors.