UK banks a bargain?

According to the FTSE 350 banks index UK banks have a slight lead over their euro-area controlled neighbours so far this month. The relief of Brexit in the UK’s rear mirror should remain a general tail wind for the UK. Also note that British lenders have become relatively cheaper compared to the Euro Stoxx index. See chart below.

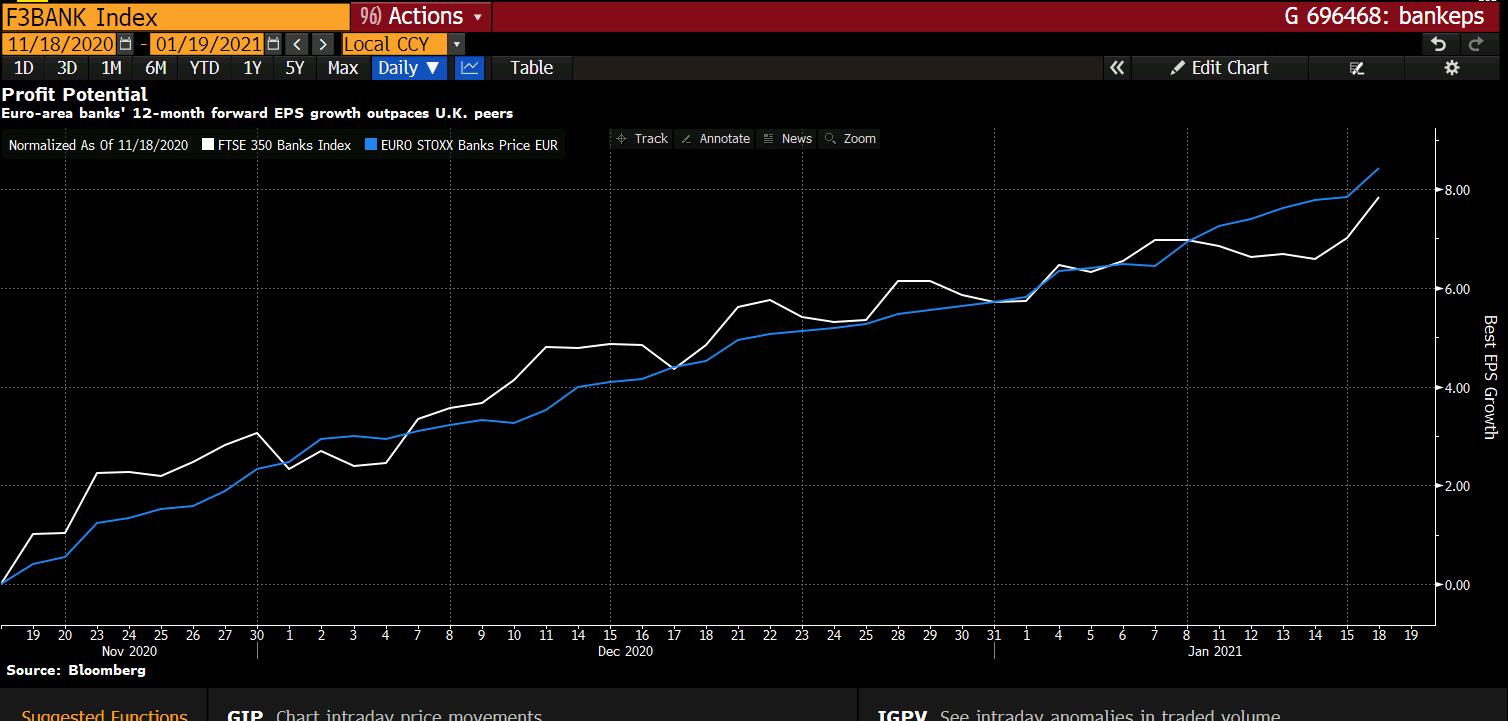

Over the last few months the euro-area lenders12 month forward EPS estimates have risen a slightly more than UK estimates.

In the future the key challenges for European banks are as follows. Firstly, that the COVID-19 impact in Europe could weigh on loan-loss provisions. Remember that even the return of dividends has some restrictions applied to them. The UK banks share prices have not risen as high as they might have done post Brexit as prices have been held back on the overall negative risk tone from last week. Furthermore, the UK is struggling with the London variant of COVID-19. So, should COVID-19 be finally controlled in the UK and domestic banks continue with plans to shut around one third of their retail branches then UK banks could still offer good value for medium term buyers in relation to their European counterparts.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.