AUD/USD Forecast: Recovery limited by Chinese jitters

AUD/USD Current Price: 0.6712

- NAB’s Business Confidence down to -1 in January, Business Conditions up to 3.

- Worldwide policymakers are concerned about the coronavirus outbreak.

- AUD/USD holding above 0.6700, but further gains unlikely at the time being.

The AUD/USD pair advanced to 0.6736 and finished the day above the 0.6700 figure, amid easing dollar’s demand and in spite of poor Australian data. The NAB’s Business Confidence Index fell to -1 in January, while the Business Conditions Index rose to 3, both missing the market’s expectations. Home Loans in December, on the other hand, have beat the market’s forecast by rising 3.5% in December. Australia will publish this Wednesday, February Westpac Consumer Confidence, seen at 1.4% after printing -1.8% in January.

Another factor limiting Aussie’s bullish potential is the coronavirus outbreak in China. Despite contagion outside the country has decreased, bringing some relief to financial markets, inside China the virus continues to spread. Goldman Sachs analyst downwardly revised the country growth’s forecast for this year from 5.8% to 5.2%, while central bankers from abroad had expressed concerns about the effects on local economies. With that in mind, a bullish run in the commodity-linked currency remains quite unlikely.

AUD/USD short-term technical outlook

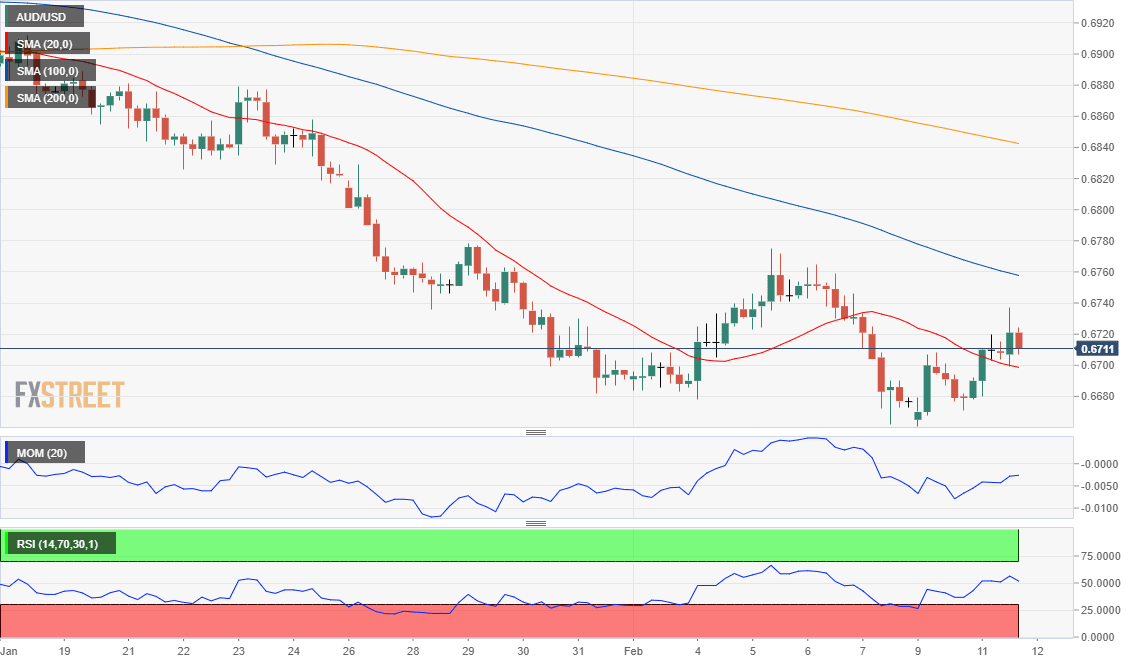

The short-term picture for the AUD/USD pair indicates that the upside remains limited, as despite moving above its 20 SMA, this last maintains its bearish slope as well as the larger ones, which stand above the current level. The Momentum indicator stands at daily highs and heads higher, but the RSI has turned flat at around 50, reflecting limited buying interest. Further advances are likely if the pair manages to extend beyond 0.6770 a strong static resistance level.

Support levels: 0.6700 0.6660 0.6630

Resistance levels: 0.6740 0.6770 0.6805

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.