Turkish lira under pressure: Key trading signals as USD/TRY nears record highs

The Turkish lira continues its downward spiral against the US dollar, with the USD/TRY pair trading near its all-time high of 33.75 liras per dollar. The Turkish Central Bank’s recent efforts to stabilize the currency, including a significant intervention in the foreign exchange market, have had limited success, leaving the lira vulnerable to further declines. Today’s trading signals suggest cautious opportunities for both bullish and bearish positions, depending on key price levels and market movements.

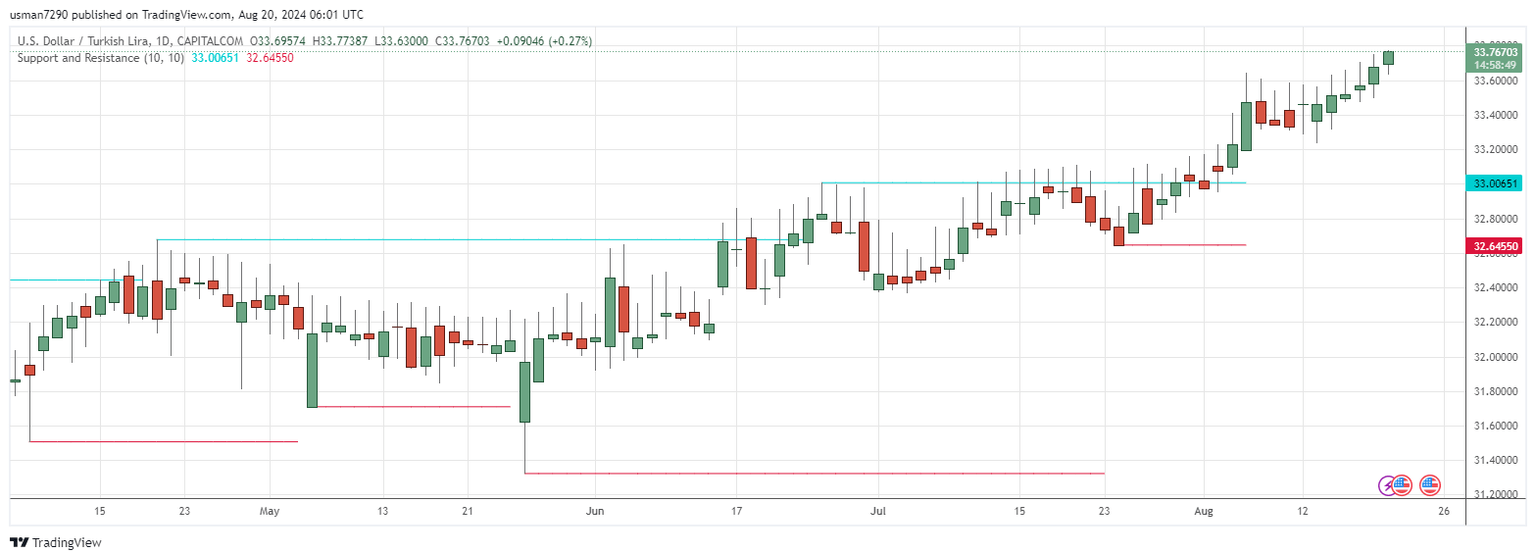

Technical analysis of USD/TRY: Key levels to watch

In early trading today, the USD/TRY pair remains close to its record highs, reflecting the dominance of the overall bullish trend. The pair has been on an upward trajectory for four consecutive weeks, maintaining its position above both the 50-day and 200-day moving averages. These averages have formed a positive intersection, known as the golden cross, on both the daily and four-hour charts, indicating a strong upward momentum. Key resistance levels are concentrated at 33.75 and 33.99 liras per dollar, while support levels are seen at 33.50 and 33.25 liras, respectively. A break above the upper limit of the wedge pattern could signal further gains for the pair, while a decline below key support levels might trigger a corrective move.

Supporting data and central bank actions

The Turkish lira's decline is exacerbated by a reduction in the Central Bank of Turkey's foreign exchange reserves, which dropped by $161 million in the week ending August 9, bringing the total to $92.33 billion. This follows a previous decline the week before, where reserves stood at $92.49 billion. Despite an increase in the Central Bank's gold reserves by $57 million, bringing the total to $41.57 billion, the overall reserves decreased by $153 million, signaling the ongoing struggle to support the lira. Western reports attribute this decline to the Central Bank's recent intervention, where approximately six billion dollars were injected into the market to curb the lira's fall. However, these efforts have not prevented the currency's continued depreciation throughout August.

Trading ideas: Capitalizing on USD/TRY movements

For traders looking to capitalize on the current market dynamics, two potential entry points stand out. A bullish position could be considered at 33.50, with a stop-loss set just below 33.20. The strategy here would involve moving the stop-loss to the entry point after a 50-pip movement in profit and closing half of the contracts after a 70-pip gain, leaving the remainder to target the resistance at 33.75. Conversely, a bearish position might be initiated at 33.75, with a stop-loss placed at or above 33.94. Similar to the bullish strategy, traders should move the stop-loss to the entry point after a 50-pip gain and consider closing half the contracts at a 70-pip profit, targeting the support at 33.50.

Lira's fate hinges on central bank moves and market sentiment

As the Turkish lira continues to hover near record lows against the US dollar, the currency's future will likely depend on the Central Bank's ability to stabilize reserves and manage market sentiment. Traders should remain vigilant, monitoring key technical levels and the broader economic context to navigate the volatile USD/TRY pair effectively.

Author

Usman Ahmed

Forex92

Usman Ahmed is a currency trader and financial market analyst with more than a decade of active trading experience.