Trump's tariff announcement

‘Liberation day’ tariffs weigh on risk assets

In a widely anticipated global event, at approximately 4:00 pm ET (9:00 pm GMT) yesterday, US President Donald Trump rolled out a series of reciprocal tariffs on the majority of the country’s trading partners, which he dubbed ‘Liberation Day’.

In addition to a 10% baseline tariff on all countries – set to take effect on 5 April – higher levies on approximately 60 other trading partners with considerable trade deficits with the US are expected to go into effect on 9 April, according to a White House Fact Sheet. Consequently, the time between now and then is limited; some countries will attempt to negotiate and reach an agreement, while others will respond with countermeasures.

Which countries were tariffed?

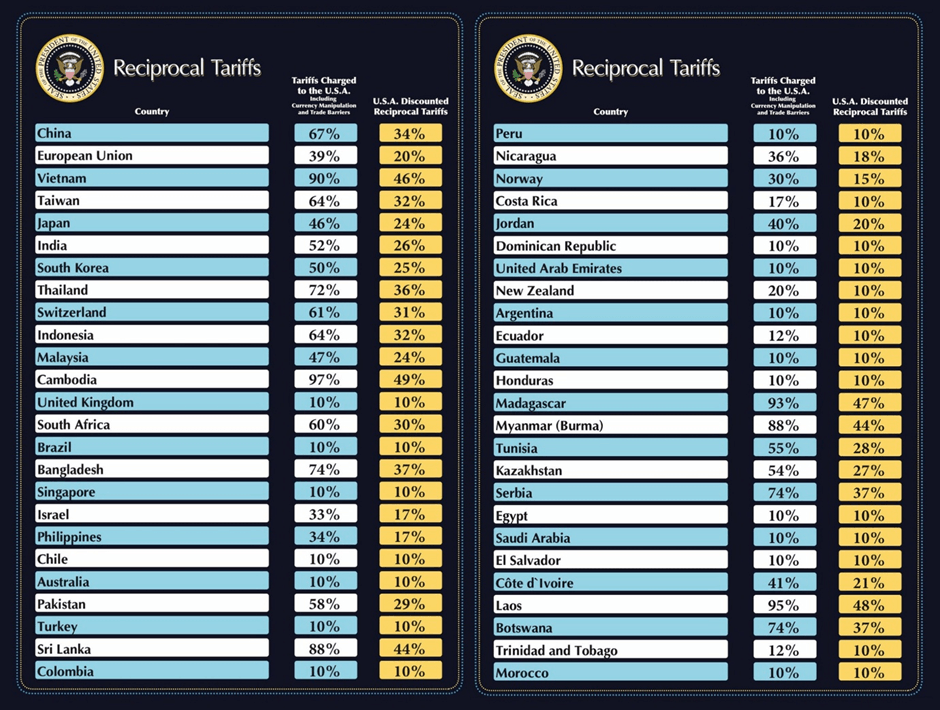

As seen in the image below provided by the White House, the Trump administration will impose a 20% tariff on all goods imported from the European Union (EU) and a 34% tariff on Chinese imports. This, in addition to the existing 20% tariff already applied, raises the total rate for China to 54%. Additionally, Trump slapped hefty tariffs on a number of imports from Asia Pacific countries. More specifically, Cambodian goods will now be taxed at 49%, Vietnamese at 46%, Bangladeshi at 37%, and Thai at 36%.

Also evident from the image below, Canada and Mexico were not subject to additional tariffs beyond those already levied. Consequently, goods that comply with the United States-Mexico-Canada Agreement (USMCA) remain tariff-free. However, goods that do not comply will incur a 25% tariff, while non-compliant energy and potash will be charged a slightly lower rate of 10%.

Source: White House

Liberation day is not a one-and-done event, what next?

I think it is fair to say that Trump’s so-called liberating event left many feeling not so liberated. In my opinion, this is certainly not a one-and-done occurrence, and we can expect countermeasures and further negotiations over the next couple of days.

Following Trump’s announcement, US Treasury Secretary Scott Bessent warned countries not to impose countermeasures, stating the following:

‘My advice to every country right now is do not retaliate. Sit back, take it in, let's see how it goes. Because if you retaliate, there will be escalation’.

However, as expected, the global response from world leaders has, shall we say, been one of dissatisfaction. European Commission chief Ursula von der Leyen stated that Trump’s tariffs represent a ‘major blow’ to the global economy; Italian Prime Minister Giorgia Meloni, one of the first leaders to express her opinion, described the tariffs as ‘wrong’. The EU is reportedly preparing countermeasures, with China also setting the stage for retaliatory measures.

Time will tell how this all plays out, but I think one thing is certain: this is far from over, and the markets know it.

How have markets responded?

Global equities remain lower across the board following Trump’s latest tariff announcements.

-

Asia Pacific markets tumbled at the open today; Japan’s Nikkei 225 shed nearly 3.0%, Hong Kong’s Hang Seng Index fell 1.5%, South Korea’s KOSPI fell 0.8%, and China’s CSI 300 dropped 0.6%.

-

European equities also kicked off the session lower, with Europe’s Stoxx 600, UK’s FTSE 100, France’s CAC40, and Germany’s DAX40 down 1.3%, 0.5%, 1.7%, and 1.4%, respectively. Stateside, ahead of the US cash open, US equity index futures have extended losses, with S&P 500 futures, Dow 30 futures, and Nasdaq 100 futures down 3.0%, 2.5%, and 3.3%, respectively.

-

In the FX space, the US dollar (USD) refreshed year-to-date lows of 101.95, currently down 1.5% and shaking hands with the 50-month simple moving average. Unsurprisingly, the USD is tanking against a well-bid Japanese yen (JPY), down 1.9%, while Europe’s single currency (EUR), the Australian dollar (AUD), and the British pound (GBP) are up 1.5%, 0.6%, 1.2%, respectively, versus the USD.

-

US Treasury yields are currently lower across the curve, and Spot Gold (XAU/USD) recently printed fresh all-time highs of US$3,167, coming within striking distance of key monthly resistance between US$3,264 and US$3,187.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,