Trend in uncertainty indicators in September

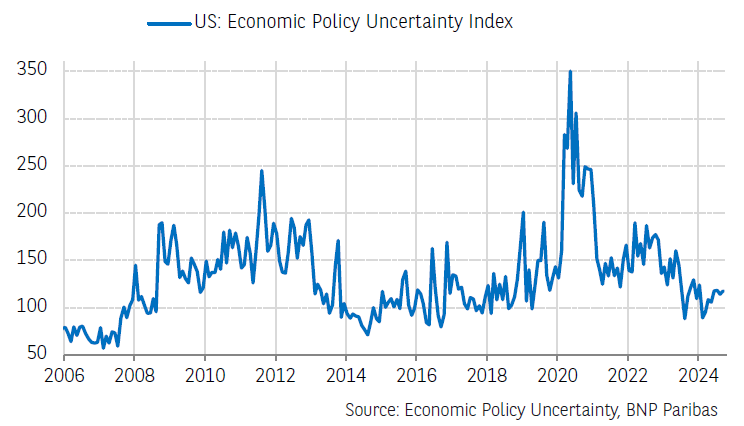

In the United States, economic policy uncertainty, based on media coverage, picked up again in September, after a brief decline in August. This increase is due to the political uncertainty in the country in the run-up to the presidential elections on 5 November.

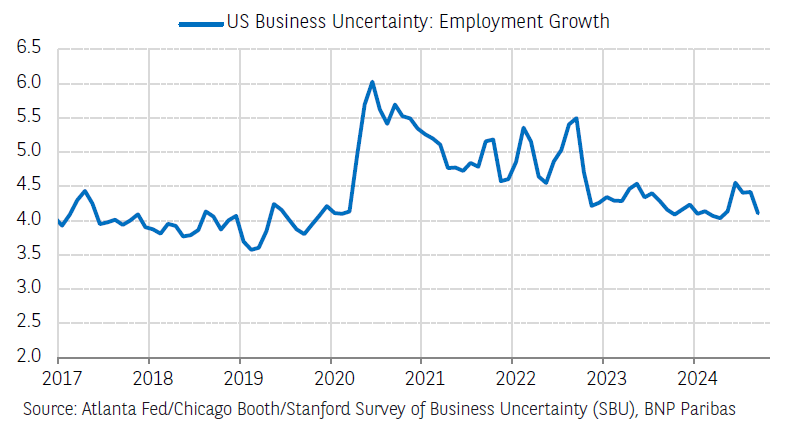

On the other hand, uncertainty about the employment outlook diminished significantly in September, after rising slightly in August. This improvement reflects the much better-than-expected non-farm payrolls gains in September, which highlighted the strong resilience of the US labour market, after a series of reports pointing to a gradual yet unmistakable slowdown.

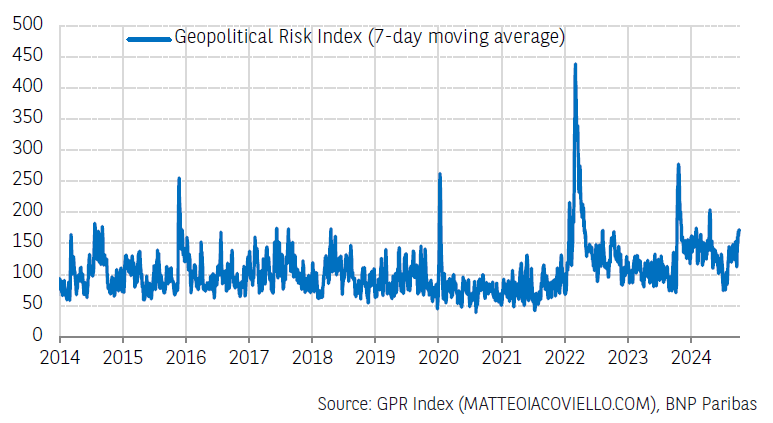

The geopolitical risk index, which is also based on media coverage, has risen sharply over the past two weeks. This was due to escalating tensions in the Middle East, attacks in the Red Sea and the conflict in Ukraine.

In September, the slight upward trend in uncertainty among US companies about growth in their turnover, which has been evident since April 2024, continued. This rise probably reflects increased concerns about the US economic slowdown, the exact scale of which is difficult to assess, accentuated by fiscal and geopolitical uncertainty in the run-up to the presidential elections on 5 November.

In the Eurozone, the European Commission’s economic uncertainty index remained broadly stable in September (black curve), masking sectoral differences. In the services sector, uncertainty fell slightly (green curve) while it remained stable in industry (grey curve). However, consumers’ uncertainty picked up again sharply (blue curve), as did retail uncertainty (yellow curve), while it continued to trend upwards in the construction sector (red curve).

The stock market-based uncertainty indicator* continued to trend slightly downwards in the United States and the Eurozone, likely thanks to the ongoing monetary easing, and despite the multiple sources of uncertainty elsewhere.

Read the original analysis: Trend in uncertainty indicators in September

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.