Trend in uncertainty indicators in May

In the United States, economic policy uncertainty, based on media coverage, fell slightly in May, after increasing for two months in a row. This drop can probably be attributed, at least in part, to the encouraging fall in inflation in April and May, which is feeding expectations of interest rate cuts by the Fed.

Similarly, uncertainty about the employment outlook increased slightly in May, after falling for two months, probably linked to the slowdown in the US labour market in April, particularly in terms of non-farm payrolls’ gains. It will be interesting to see whether the uncertainty indicator falls again in June, following the strong job gains in May, or continues to rise, in the wake of the less positive signs from the JOLTS report.

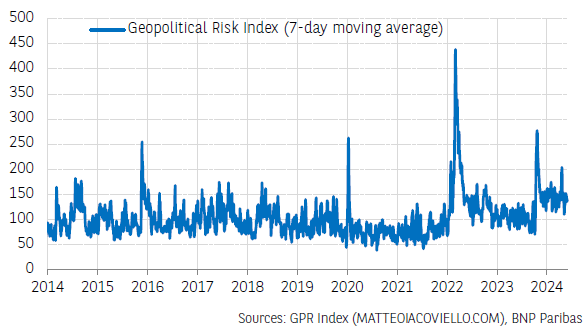

The geopolitical risk index, which is also based on media coverage, almost stabilised in the final week of May, after falling during the first week and increasing during the second and third weeks of the month. Despite this relatively high volatility, the index fell sharply on average compared with April.

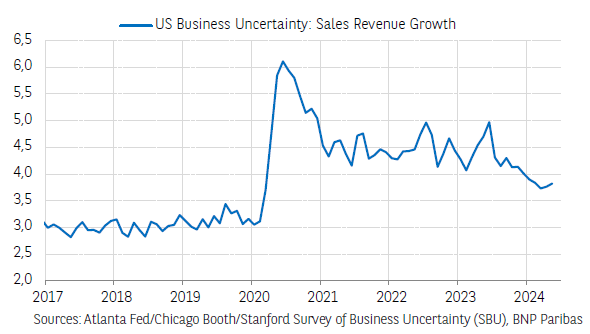

In May, US companies reported increased uncertainty, for the second consecutive month, regarding their sales growth. This rise in uncertainty, which remains slight at this stage, is possibly linked to a number of less positive economic indicators, including the downward revision of GDP growth in Q1 2024 (1.3% annualized q/q instead of 1.6% on the first estimate).

In the Eurozone, the European Commission’s economic uncertainty index continued to fall in May (black curve). Perceived uncertainty is declining in almost all sectors of activity, with the exception of a slight increase among consumers (blue curve).

The market-based uncertainty indicator resumed rising in the Eurozone during the first three weeks of May, before dropping in the final week of the month. In the United States, the indicator was marked by some volatility, in connection with the various macroeconomic indicators published in the same month, which blew hot and cold.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.