The euro on Thursday suffered its worst day against the dollar since the UK's Brexit vote nearly two years ago after the European Central Bank unexpectedly indicated that it planned to keep interest rates at record lows into the summer of 2019. That stance contrasts with the steady rate hike campaign that the U.S. Federal Reserve signaled on Wednesday as it dropped its pledge to keep rates low "for some time."

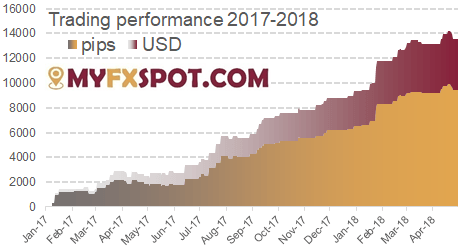

This is how MyFXspot.com trades now:

EUR/USD

Trading strategy: Sell

Open: 1.1710

Target: -

Stop-loss: 1.1810

Recommended size: 1.50 mini lots per $10,000 in your account

Short analysis: Rally towards May 16 high is soundly rejected. The ensuing slide results in a bearish outside daily candle and the pair falling back below the 10 & 21-DSMAs. RSIs are biased down and an monthly inverted hammer candle forms. An offer is placed at 1.1710 and the 2018 low will be targeted at a minimum.

GBP/USD

Trading strategy: Await signal

Open: -

Target: -

Stop-loss: -

Recommended size: -

Short analysis: Abrupt change in direction and bears back in control. Direction now clouded by severe price chop. Pair targets 1.3205 2018's May 29 low, below October 6 low at 1.3027 in focus.

USD/JPY

Trading strategy: Buy

Open: 110.30

Target: 111.90

Stop-loss: 109.50

Recommended size: 2.07 mini lots per $10,000 in your account

Short analysis: We see only limited recovery in USD/JPY today given what happens on other pairs. May high at 111.39 and the weekly Cloud base and downtrend line from Aug 2015 in the 111.90s are in play. We have placed a bid at 110.30.

USD/CAD

Trading strategy: Await signal

Open: -

Target: -

Stop-loss: -

Recommended size: -

Short analysis: The USD/CAD rallies with broad USD strength after dovish ECB hold. The pair rose to two-and-a-half-month high. Global/NAFTA trade tension angst lingering aids USD lift. We stand aside.

AUD/USD

Trading strategy: Sell

Open: 0.7540

Target: -

Stop-loss: 0.7600

Recommended size: 2.50 mini lots per $10,000 in your account

Short analysis: Bear sentiment increases as the 21-DSMA turns into resistance and the daily cloud and trend line off May's low get broken. An inverted monthly hammer candle and falling RSIs bolster bear sentiment. A sell offer is placed at 0.7540 and the target will be the 2018 low at a minimum.

EUR/GBP

Trading strategy: Sell

Open: 0.8750

Target: -

Stop-loss: 0.8810

Recommended size: 1.88 mini lots per $10,000 in your account

Short analysis: The pair falls back below the 100 and 10-DSMAs, RSIs are biased down and the trend line off April's low gets pierced. We have placed a sell order at 0.8750.

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD stays in daily range slightly below 1.0900

EUR/USD continues to move up and down in a narrow band slightly below 1.0900 in the second half of the day on Monday. The modest improvement seen in risk mood makes it difficult for the US Dollar to find demand and helps the pair stay in range.

GBP/USD treads water above 1.2900 amid risk recovery

GBP/USD is keeping its range play intact above 1.2900 in the American session on Monday. The positive shift seen in risk sentiment doesn't allow the US Dollar to gather strength and helps the pair hold its ground ahead of this week's key data releases.

Gold drops to fresh 10-day low below $2,390

Gold stays under persistent bearish pressure after breaking below the key $2,400 level and trades at its lowest level in over a week below $2,390. In the absence of fundamental drivers, technical developments seem to be causing XAU/USD to stretch lower.

Crypto Today: Bitcoin is less than 10% away from all-time high as Ethereum ETF approval anticipation brews

Bitcoin trades around $68,000 early on Monday, less than 10% away from its all-time high of $73,777 on Binance. Ethereum ETF anticipation brews among traders and Ether investment products see inflow of over $45 million in the past week.

Election volatility and tech earnings take centre stage

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

The US Dollar managed to end the week higher as Trump Trades ensued. Safe-havens CHF and JPY were also higher while activity currencies such as NOK and NZD underperformed.