- The US-Sino trade spat is raising market volatility.

- Five significant developments are indicating President Trump is losing.

- The US Dollar has yet to react to developments.

"Trade wars are good and easy to win" – said US President Donald Trump on March 2018. Nearly a year and a half later, Chinese Industrial Output growth has fallen to the lowest levels since 2002 and Germany is on the verge of recession. However, the US economy continues growing at a satisfactory pace of 2.1% annualized in the second quarter.

So is Trump triumphant? No.

Recent developments have revealed the president's weaknesses. Here are five signs that expose it.

1) Huawei goes unpunished

The US has decided to delay the ban on Huawei – the Chinese telecom giant – by another 90 days. Commerce Secretary Wilbur Ross has announced his decision just after his boss said he "does not want the US to do business" with the firm and also due to security reasons.

The US and several allies suspect that Huawei equipment may contain backdoors allowing the Chinese army to spy on users of its network and phones. However, banning American companies – such as Google – any interaction with the firm may inflict economic damage.

Is the White House sacrificing American security interests for fear of inflicting damage on the economy? Or are security risks overblown, and the delay serves as a gesture of goodwill by a magnanimous president?

Both answers are possible if the decision is isolated.

2) Flip-flop on tariffs

The about-turn on Huawei comes less than a week after the White House announced another delay – postponing tariffs on around $160 billion worth of Chinese goods from September 1st to December 15th.

Trump announced these duties – initially covering around $300 billion worth of products – on August 1st. The administration realized that slapping levies on consumer goods such as phones, computers, and clothes would hurt the American consumer in the run-up to Black Friday and Christmas. That was not an analysis by Trump critics but the words of the president, who said that "We’re doing this for the Christmas season."

The 180-turn within 12 days was the first admission that the US tariffs are hurting US consumers – a self-inflicted loss in the trade war.

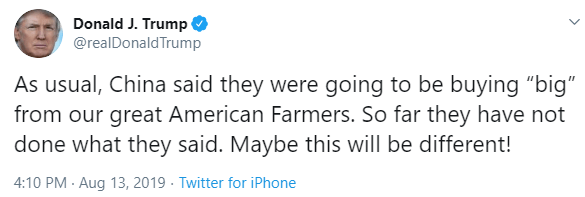

Apart from easing the pressure on American shoppers, it serves as a relief to Chinese exporters – an act of goodwill. After the announcement, Trump tweeted that China promised to be buying "big" from American farmers, "but have not done what they said. Maybe this will be different!" The tweet may be seen as a hint that China has agreed to purchase agricultural goods.

3) Farmers are struggling

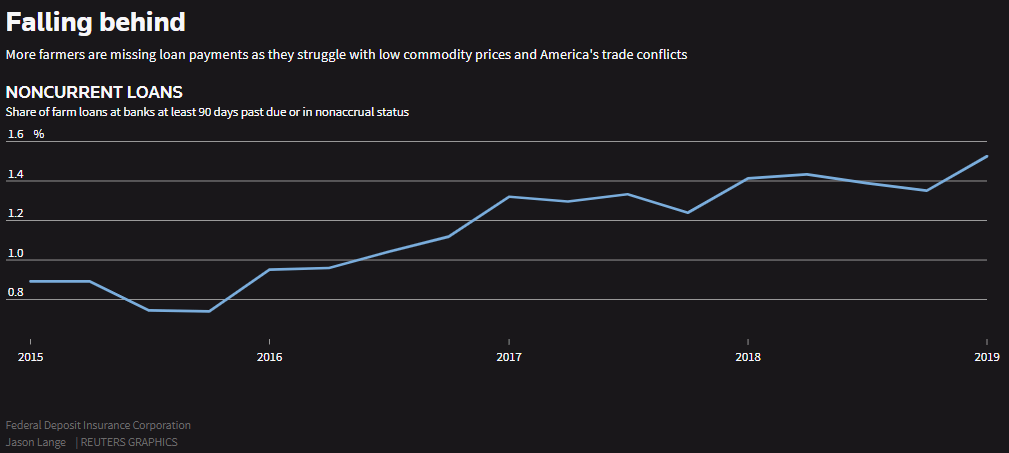

Reuters has analyzed bank loans to farmers and has noted a decline of 17.5% in recent years. The publication also shows that Chapter 12 bankruptcies are jumping as "banks are calling in the loans and cutting them [farmers[ off."

The pain is mostly felt in the Midwest and among soybean and grain producers. Sales of these agrifoods have fallen since both Mexico and China hit them with counter-tariffs.

Banks "do not want to be the ones caught holding the bad loans," said David Oppedahl of the Federal Reserve Bank of Chicago.

Even if farmers are struggling, did Trump get anything else in return from China?

No.

4) China promises countermeasures

On August 15th – just two days after the White House relented on most new levies – China said it "would be forced to take necessary countermeasures" if Trump moved forward with the new duties – even after reducing their span.

Stock markets, which had begun to recover from fears of a recession after only temporarily rising on Trump's tariff relief announcement, struggled once again.

And this brings us to another sign of weakness.

5) Constant blaming of the Fed

The president continually boasts about equities' performance, and some say he measures his success by the Dow Jones Industrial Average (DJIA).

And what happens when stocks fall? Trump blames the Federal Reserve. He called Fed Chair Jerome Powell "clueless" when the yield curve inverted and said the "Fed is holding us back." The president may have forgotten that he nominated Powell to lead the central bank.

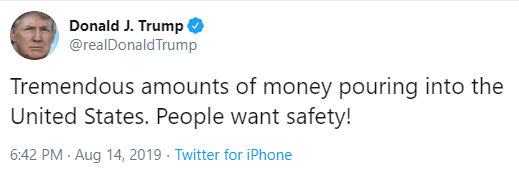

And while he boasts that money is pouring into the US:

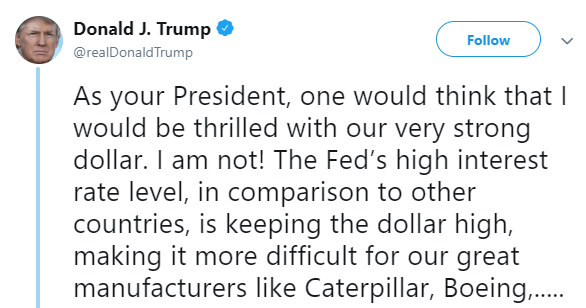

He is "not thrilled" by the consequence – a stronger Dollar, and blames the Fed for its high interest rate – days after the central bank cut rates.

The frustration, contradictory tweets and rising rhetoric against the Federal Reserve and its Chair – nominated by the president – are all a sign of despair. This is not a president winning a trade war.

He is losing it.

The Dollar may rise if Trump continues losing

Trump's concerns about stock markets may push him to make further concessions to China and incur additional losses in the trade war. For markets, calmer commerce relations between the world's largest economies would be a boon. Tariffs and high uncertainty about them have caused investments in the US and elsewhere to halt. Lower duties and a better relationship between Washington and Beijing would not only lift stocks: may push investment higher as well.

If the Fed sees more certainty on the trade front and higher valuations for shares, the pressure to loosen monetary policy would wane. In turn, it would likely refrain from cutting interest rates in September and perhaps signal tighter monetary policy going forward. On this background, the greenback has room to rise – whether Trump is thrilled or not.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.