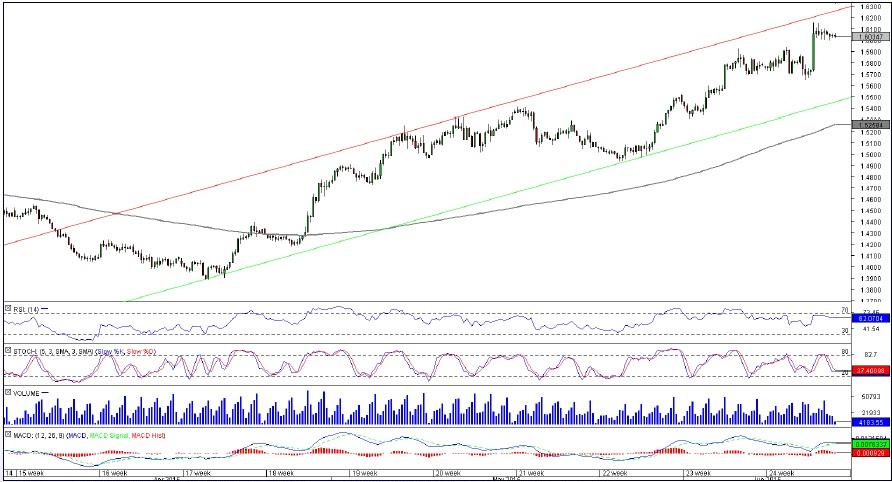

Comment: For the past two months the currency pair has been distinctly bullish, and there are good arguments in favour of the Euro appreciating further. The main reasons for a positive outlook are that the indicators are mostly pointing upwards, and there is a well-defined upward-sloping channel.

However, EUR/NZD is facing a critical resistance area around 1.6278, represented by the upper edge of the pattern and some of the late-2014 highs. This implies weakness in the short-term, but can also turn out to be the longer-term top. These concerns are reflected in the sentiment of the market participants. Right now 70% of open positions are short.

USD/DKK 4H Chart: Channel Down

Comment: Although USD/DKK is currently trading within the boundaries of a high-quality bearish channel, we should be wary of the fact that the US Dollar is currently undergoing a downward correction. This significantly increases the upside risks.

Still, there is some downward potential left. The 38.2% Fibonacci retracement of the May 2014—Mar 2015 rally is at 6.44, and we might descend down to the 50% retracement at 6.23 before the upper boundary of the patter is broken. In the meantime, the SWFX traders appear to be confident that the Greenback is going to outperform the Danish Krone: as many as 74% of open positions are long.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.