Top Trade Setups in Forex - NZD Labor Report on Radar!

Market Wrap: Stocks, Bonds, Commodities

U.S. indices extended their rallies to mark all-time highs on Monday, as trade optimism continued to drive market sentiment. The Dow Jones Industrial Average added 114 points (+0.4%) to 27,462, the S&P 500 gained 11 points (+0.4%) to 3,078, and the Nasdaq Composite rose 46 points (+0.6%) to 8,433.

Regarding the U.S. economic data, factory orders dropped 0.6% on month in September (-0.5% estimated). Later today, economists expect a trade deficit of 52.4 billion dollars in September, and the Institute for Supply Management Non-Manufacturing Index is anticipated to climb to 53.5 in October from 52.6 in September.

XAU/USD - Bearish Bias Dominates

Gold prices edged lower on Tuesday, increasing losses to another straight session, as expectations of a U.S.-China trade pact supported the dollar and improved desire for riskier assets, counting on the safe-haven assets.

The U.S. dollar advanced versus the yen on Tuesday as rising confidence around the United States and China joining an introductory deal to scale back their long-held trade war, increased the greenback.

Beijing and Washington have conferred indications of improvement in trade discussions with the Financial Times, stating on Monday that the U.S. government is thinking of cutting some tariffs on Chinese assets.

XAU/USD - Daily Technical Levels

Support Resistance

1504.56 1514.94

1499.34 1520.1

1488.96 1530.48

Key Trading Level: 1509.72

Gold - XAU/USD - Daily Trade Sentiment

Gold is expected to maintain bearish bias below 1,514 zones until the 1,502 support level. On the 4 hour graph, the metal is anticipated to make a bearish engulfing pattern, which may drive more selling. Consider taking sell trade below 1,508 and buying trade above the 1,500 level.

USD/CAD - Labor Market Report In Focus

The New Zealand economy issues employment numbers just once per quarter, giving every edition important. New Zealand experienced an unemployment rate of 3.9% during the second quarter, and it is anticipated to increase to 4.1% in the third quarter. The employment change number is predicted to improve at a steady speed of 0.2% after a leap of 0.8% previously.

The USD/CAD pair is consolidating at 1.3122, down 0.22%. Canada will deliver trade balance later in the day so that we could see more substantial progress in Tuesday's U.S. session.

The USD/CAD has begun the week with a slight change, and it's presently trading within a range-bound territory. The USD/CAD had immediate support at 1.3120, but the level got violated, and now it's supporting the USD/CAD at 1.3080.

USD/CAD- Daily Technical Levels

Support Resistance

1.3141 1.3184

1.3117 1.3203

1.3074 1.3245

Pivot Point 1.316

USD/CAD - Daily Trade Sentiment

The strength in crude oil prices is the Canadian dollar, driving the bearish movement in the USD/CAD currency pair. The commodity currency pair is trading bearish to test and violate the support level of 1.3120 level, which may extend the bearish trend until the 1.3080 level. The USD/CAD may look for more selling until 1.3075 target so brace for selling.

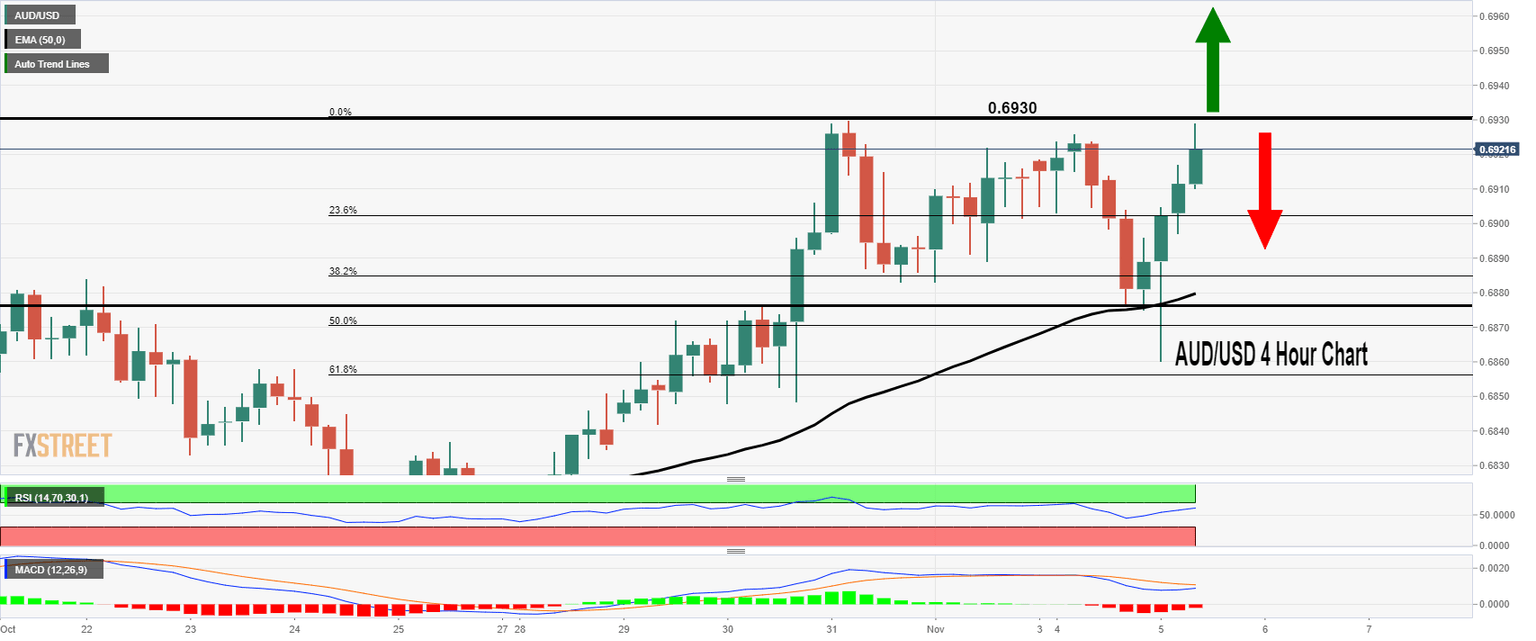

AUD/USD – Sideways Channel In-Play

The AUD/USD currency pair still consolidates in the narrow range after the Reserve bank of Australia's decision to maintain the status quo on interest rates.

The Reserve bank of Australia kept the rate unchanged a 0.75 according to plan after the 25-basis-points rate cut at the June, July, and October RBA meetings.

The central bank said that the central situation is for inflation to pick up gradually, and growth could pick up up to near 3% in 2021. However, the growth could remain around the current rate for some time.

So, the AUD currency still found on the unchanged to negative manner at 06680. Due to RBAs reduced rate cut bias, markets will likely to continue price out the prospects of the RBA cutting rates into the year-end. As of now, the possibility of the year-en move stands at 24%.

Therefore, the Australian Dollar may take a buying during the day ahead if the equities and other risky assets remain to cheer the Sino-US trade positive headline.

AUD/USD - Technical Levels

Support Resistance

0.6865 0.692

0.6829 0.694

0.6774 0.6995

Pivot Point 0.6885

AUD/USD - Daily Trade Sentiment

The AUD/USD bounced off to trade at 0.6920 level after retesting the 50% Fibonacci retracement level of 0.6870. The 50 periods EMA extended solid support at 0.6780 level, and it's still supporting the bullish trend in the AUD/USD. For now, the AUD/USD may find another resistance at 0.6930. Below this, we can expect to sell until 0.,6900 today.

All the best for the U.S. session!

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and

-637085510887898931.png&w=1536&q=95)

-637085511684165280.png&w=1536&q=95)