Top commodities to trade during 2021 amid global reflation: Silver and copper to outshine gold price

- Investors brace for a new commodity super-cycle in 2021.

- Global economic recovery and reflation trades to play out strong.

- Copper and silver to outperform gold price amid US and China’s decarbonization shift.

Commodities witnessed an interesting end to a decade in 2020, which was for the most part unfriendly for the resources sector. Traders were caught off-guard by the unprecedented coronavirus crisis last year. Likewise, a strong recovery across the commodities board came as a surprise, bringing them in vogue and kick-starting a super cycle.

The year 2021 is likely to see an extension to the structural shift in commodities, driven by two main narratives; China’s quick post-pandemic economic turnaround and the global reflation play. Reflation theory refers to an expansion in the level of economic output by fiscal or monetary support offered by governments.

The covid setback on commodities and the comeback

"Sell everything" was the key underlying theme at the start of 2020 and the decade, as the coronavirus contagion hit the world and knocked down higher-yielding assets such as commodities, stocks, etc. Restrictive measures and lockdowns imposed worldwide started to hit supply and demand that ensued a global economic recession.

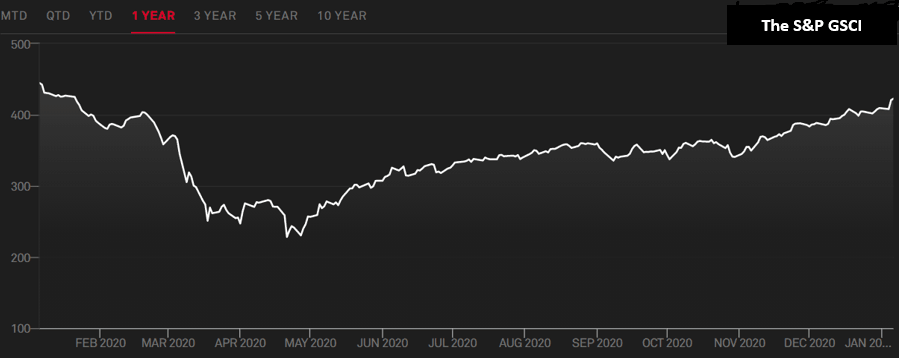

S&P Goldman Sachs Commodities Index

By April, the commodities complex reached multi-year troughs. Among the most widely traded commodities, copper, the best bellwether, tumbled to a six-year low of $4617 on the London Metal Exchange (LME). Gold hit the lowest point for the year at $1451. Meanwhile, global oil benchmark Brent crude plunged to almost a two-decade low on-demand recovery concerns for fuel and its products.

The S&P Goldman Sachs Commodities Index (S&P GSCI), one of the most widely recognized benchmarks, recovered nearly 80% after bottoming out in mid-April. It is worth noting that the industrial metals all eclipsed price gains made by gold, which scaled all-time highs of $2,075 in August.

The recovery kicked-off in the second half of 2020, as the world’s top consumer, China, staged a stellar economic rebound. China was the first major economy to return to expansion in the second half last year, with the International Monetary Fund (IMF) predicting a 1.9% GDP growth in 2021.

Further, the coronavirus vaccines progress and the resultant expectations of a swift global economic upturn also collaborated with the comeback in commodities. In November, major American pharma companies, including Pfizer/BioNTech and Moderna announced that their coronavirus vaccines showed over 90% efficacy in preventing infections.

However, the great reflation play emerged as the main catalyst behind the robust recovery in the industrial metals, energy complex and bullion. To cushion the economic blow from the coronavirus pandemic, major global central banks and government unleashed massive monetary and fiscal stimulus.

For 2021, a new commodity supercycle remains in the offing, as investors scurry to commodities as a bet on the recovery of the global economy as well as a hedge against the prospect of high inflation.

Additionally, a Joe Biden victory in the US Presidency along with a Democrat-controlled Senate has boosted expectations of a bigger fiscal stimulus while the Federal Reserve (Fed) is likely to maintain its accommodative policy stance. Biden’s push for higher fiscal stimulus has revived reflation trades, pushing US inflation expectations higher and the safe-haven dollar to the south.

As the stars are aligning for higher commodities prices this year, we take a look at which commodities will shine or at the least maintain 2020 recovery momentum.

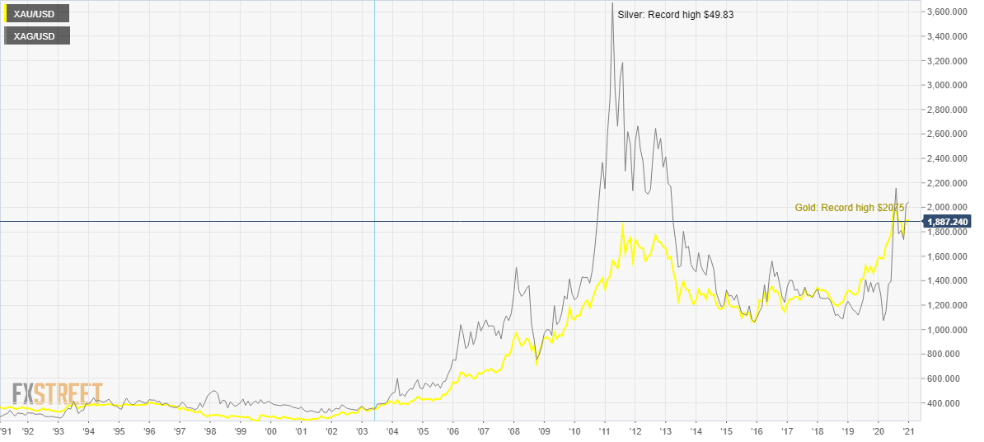

Silver price set to outshine gold

It is more apparent than ever, silver has much more room to rally this year than gold should the love for commodities extend.

Silver has wider applications in the industrial sector as it is also seen as the next best hedge against inflation after gold. Therefore, if a potential vaccine, as well as stimulus-driven global economic recovery, materializes, the white metal could see a strong revival in demand for industrial applications.

Looking at the supply-side scenario, strict COVID-19 lockdowns in major silver producing countries, including China, Mexico and Peru, have caused disruption in the metal’s production. The covid restrictions also triggered supply constraints for gold, although its impact on silver prices is more pronounced, as mined silver supply is much more concentrated in the key silver producing countries.

Mined silver supply is expected to decline by 6.3% YoY, a greater drop than for gold, Adam Webb, Director of Mine Supply at Metals Focus, noted.

Further, the US and China’s pledge to move towards decarbonization could likely add credence to the upbeat outlook on the white metal. A significant shift toward solar energy to generate electricity could likely boost the demand for silver in photovoltaics.

Having said that, gold prices are likely to remain supported by the continuance of massive fiscal and monetary stimulus globally and higher inflation prospects. However, the extent of the rise may not match that seen in 2020, as governments could hold back on rolling out additional stimulus should the vaccine-driven economic turnaround gain momentum.

Empirically, gold hit fresh record highs above $2,000 in August while silver reached seven-year highs at $29.85. Therefore, silver has enough scope to challenge the all-time highs of $49.83 registered in 2011.

In another evidence of silver outperforming gold, the Gold/Silver ratio has reverted towards August 2020 troughs just below 70.00. The gauge sold-off aggressively last year and hit the lowest since March 2017. Amid a brighter outlook for the semi-precious metal, a significant influx in exchange-traded funds (ETF) could probably back the surge in the prices.

Copper price: Too hot to handle

Copper’s stellar performance in H2 2020 makes it one of the most favorite industrial metals starting out 2021. The red metal topped 2020 at $7741.50, with investors eyeing a break above the $8000 threshold this year.

One of the three key reasons behind copper’s expected bull run is seen as the reflation induced pent-up consumer demand, which will keep the global manufacturing sector humming. The optimism over the economic recovery will keep the safe-haven US dollar pressured, which could underpin copper prices.

The most obvious factor remains the continued growth in Chinese demand for the non-ferrous metal, fuelled in part by the State Reserve Bureau’s (SRB) strategic and record-high cathode imports.

Chinese net imports of refined copper jumped by 45% YoY to 4.2 metric tonnes in Jan-Nov 2020, according to data published by the China Customs.

An unprecedented move towards copper-intensive renewable electricity wind power generation projects by the US and the dragon nation has bolstered the demand for copper.

US President-elect Joe Biden has pledged for a “Clean Energy Revolution”, which calls for the installation of 500,000 electric vehicle charging stations by 2030 and would provide $400 billion for R&D in clean technology. This effort will require extensive use of copper.

Kitco

The technical breakout confirmed on LME Copper’s monthly chart makes it the last and a key catalyst that could collaborate with a potential upside in prices. The metal dived out of a decade-long descending channel around mid-2020, fuelling the surge seen in the latter part of the year. A rally towards the $10K level cannot be ruled out on an acceptance above $8000.

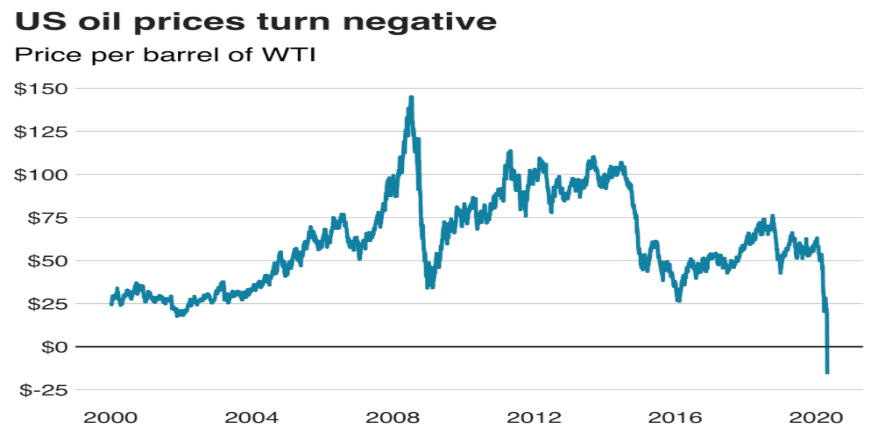

Oil price to stabilize at higher levels

Both crude benchmarks have staged a phenomenal recovery after the slump to historic lows in March 2020. The WTI futures on Nymex even steered into the negative territory for the first time ever.

The global covid lockdown and travel curbs dried up the physical demand for the black gold. As a result, oil firms resorted to renting tankers to store the surplus supply, which forced the price of US oil into negative territory.

BBC

In order to aid the recovery in oil prices and stabilize the market, the OPEC and its allies (OPEC+), in April, agreed to cut its combined output by an unprecedented almost 10 million bpd, or 10% of global pre-crisis demand.

Oil prices are likely to see an evenly balanced 2021, with the first half coming in as a struggle for the buyers to sustain the recovery. The re-imposition of stricter lockdowns in the UK, Japan and parts of Europe and Australia is expected to re-ignite demand recovery concerns.

Although the alliance’s unexpected decision to delay a 500K barrels per day (bpd) output hike in February could offer a much-needed reprieve to the markets. At the time of writing, WTI sits at the highest levels since February 2020 just below the $52 threshold.

With travel, tourism and hospitality likely to take a few years to return to pre-pandemic normality, the room for additional upside in oil remains limited. Even so, the vaccine-driven optimism about an economic recovery and stimulus measures could likely keep a floor under the prices.

Conclusion

A new structural commodity bull market remains in the offing this year amid a V-shaped Chinese economic recovery, revival of reflation trades and a shift to decarbonization. Industrial metals such as silver and copper are likely to outperform gold and oil prices.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.