Too much of low inflation

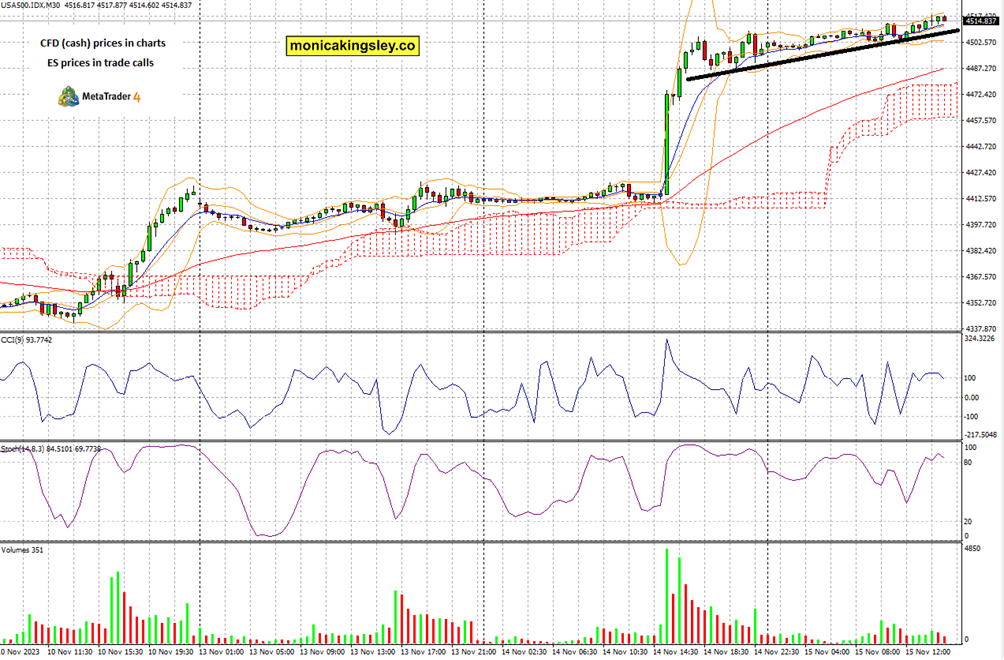

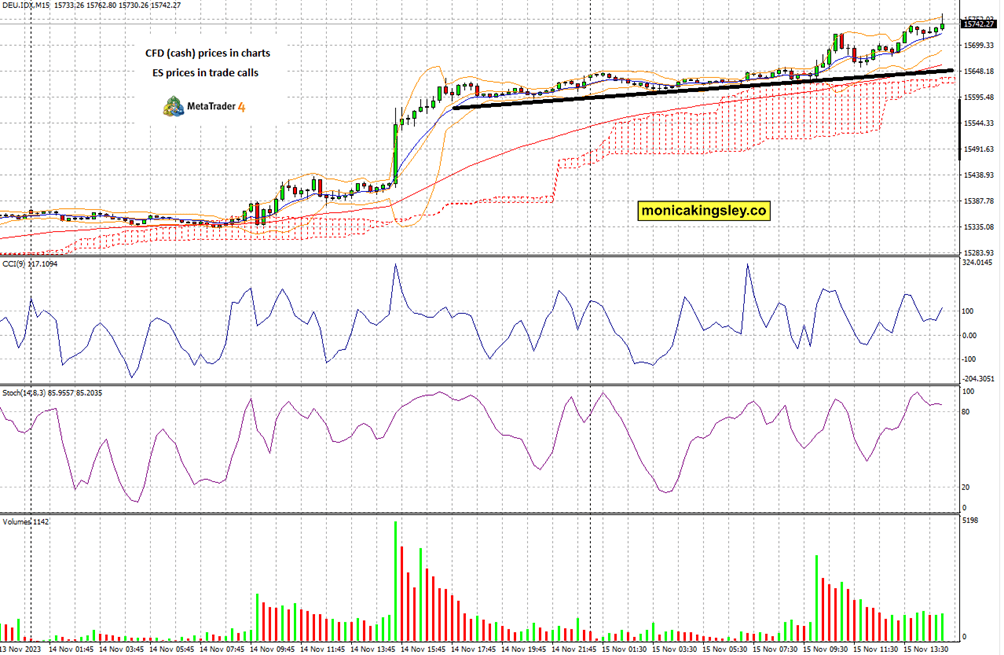

S&P 500 delivered on my muted CPI prediction (more muted than mainstream expected), and risk-on turn across the board was accompanied by duly sliding yields and USD – no surprise to any client. Both swing and intraday ones did great, and today‘s similarly subdued PPI figures (with retail sales almost flat) serve as correction invitation. Yet this premium intraday assessment posted, captures well the positive turns in stocks (chiefly in broadening breadth ushering in interesting rotations) – aka what matters.

As always, way more charts, such as this contribution summarizing how well also the intraday ES and DAX calls had been doing, and some of my ways of working with risk via trailing stop-losses to lock in gains, follow in the chart section of today‘s article.

Let‘s move right into the charts – today‘s full scale article contains 5 of them.

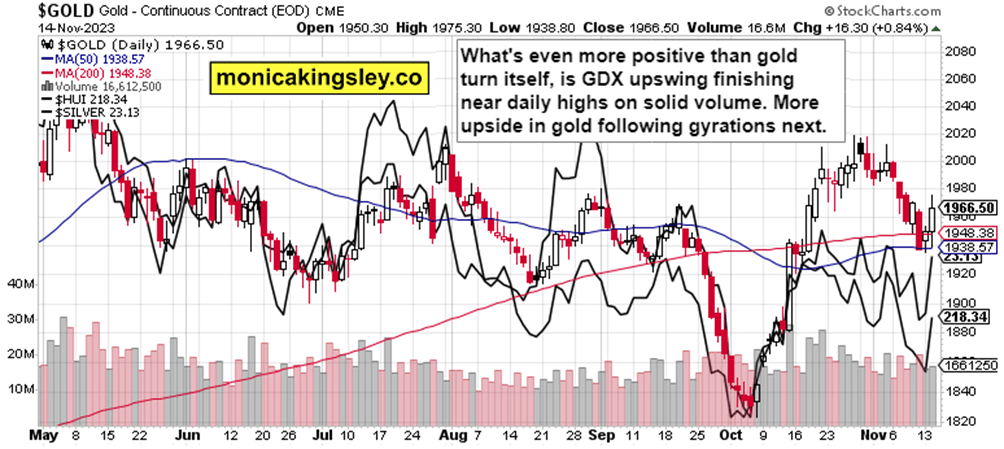

Gold, Silver and Miners

Precious metals have turned around, but gold would face headwinds – and may easily retrace a couple of dollars from yesterday‘s highs. Bulls need to wait with uncorking champagne for greater volume returning – we aren‘t quite there yet, but the lows are in, and slow grind higher is in as well.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.