The morning note

China's Yuan surged to its highest level against the US Dollar since May 2018, despite data earlier this morning showing that China’s factory activity slowed down in May as commodity prices keep rising, weighing on the exporting sector.

USDCNY slipped below key support at 6.36 before quickly snapping back above it after a former Central Bank official said that the Yuan may have overshot in its rapid appreciation, and that the rise "is not sustainable". Regulators said last week that they will crack down on Forex market manipulation, while reiterating that China's currency policy will remain unchanged for now.

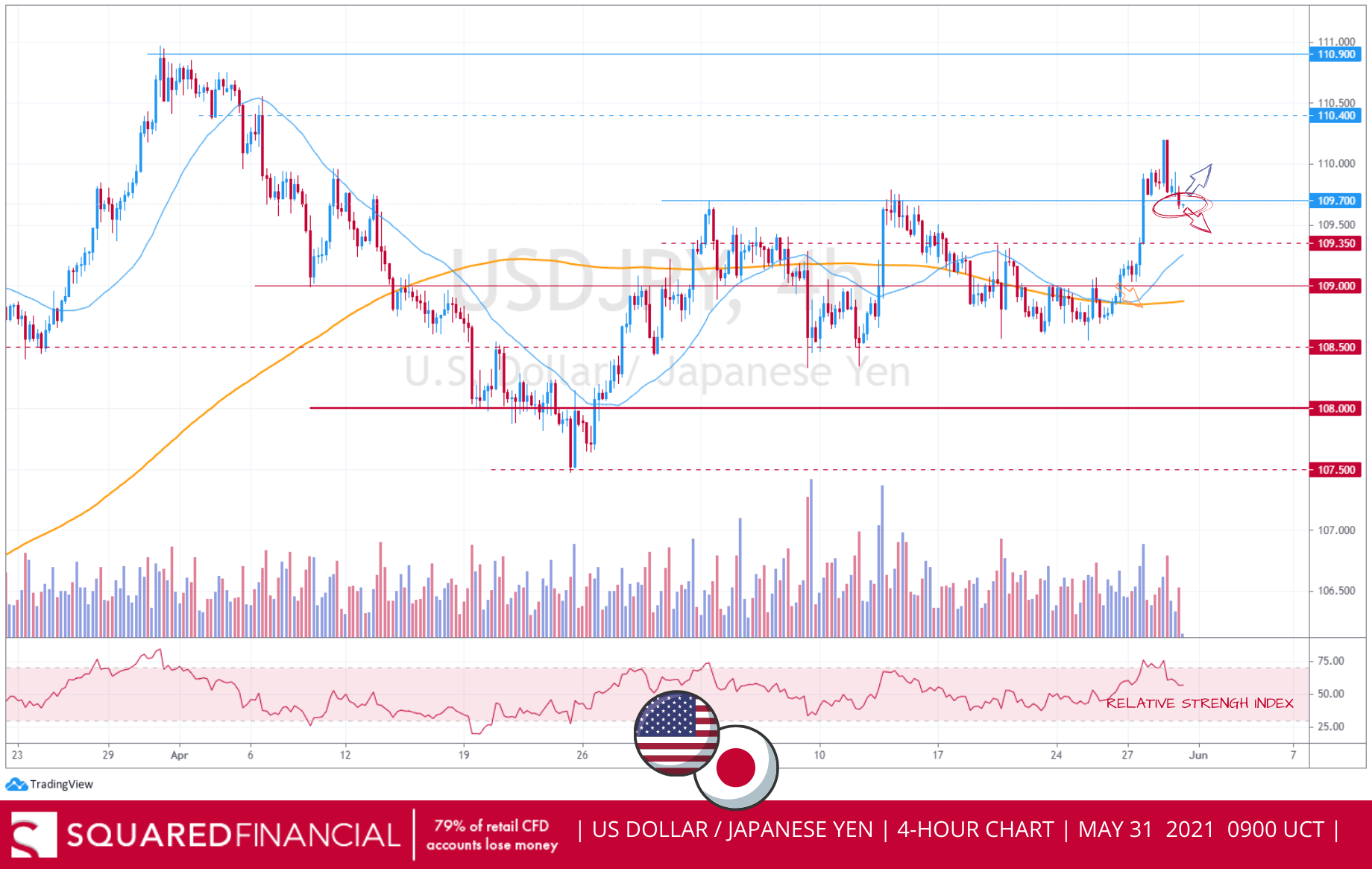

In Japan, retail sales surged 12% in April, following an increase of 5.2% in March. However, economists had forecast a 15.3% rise. The US Dollar pushed above ¥110 against the Japanese Yen for the first time in 2 months, possibly on month-end adjustments, before quickly pulling back below the ¥109.70 resistance level, suggesting momentum may have peaked. We will be closely watching the key pivotal ¥109.70 level today, as a clear close above it may trigger an acceleration to the upside.

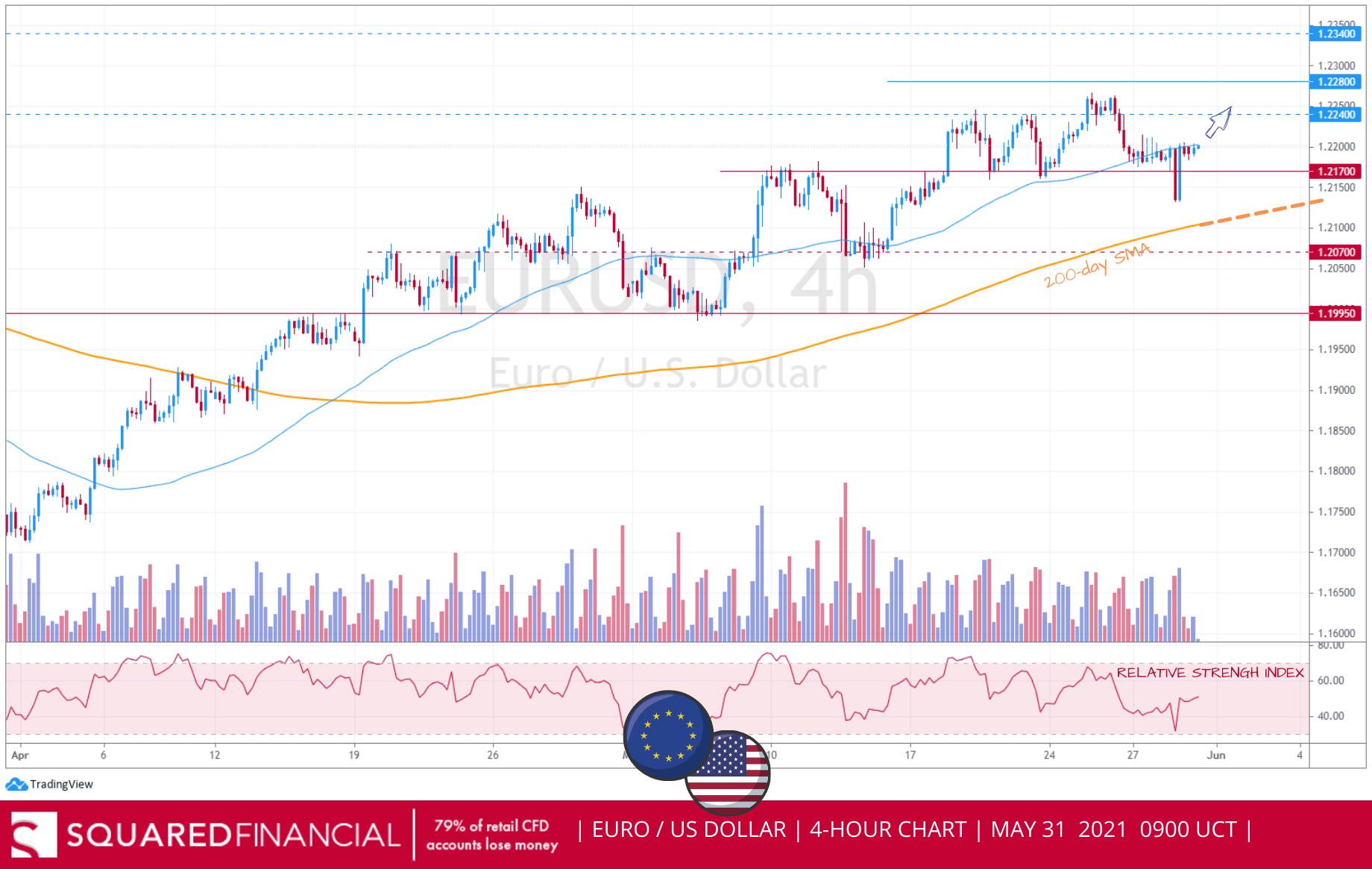

Inflation figures from the Eurozone and Germany put the Euro in focus. The nearest important technical area on the upside for EURUSD is seen at 1.2240/1.2280. Short around this area still makes sense for a pullback to the 1.2170 support around the 4H 200-SMA.

Stats from Canada also expected later in the day. USDCAD still in consolidative phase between 1.2020 and 1.2130. Holding firmly above important trend-defining 1.20 figure.

Markets are closed today in both the US and in the UK. Expecting very light range-bound trading in equity markets in both countries.

In European stock market news, Bloomberg reported that Qatar Airways Chief Executive Officer Akbar Al Baker lashed out at Airbus (Symbol: AIR Euronext) for the second time this month, warning his airline might stop taking deliveries from the European plane maker this year over an unspecified “serious” issue. This comes after the stock surged over 10% last week, as Airbus told suppliers to get ready for a rapid rebound in jet production as the plane maker plans to boost output of narrow-body jets to record levels within two years.

FX analysis

EUR/USD

Month-end adjustments triggered a selloff on the euro to 1.2135 before snapping back above the 1.2170 support area with the nearest important technical level on the upside seen at 1.2240 but the key level needed to breach to resume the EURUSD uptrend, remains the 1.2280 resistance level, ahead of the German CPI due to be released later today.

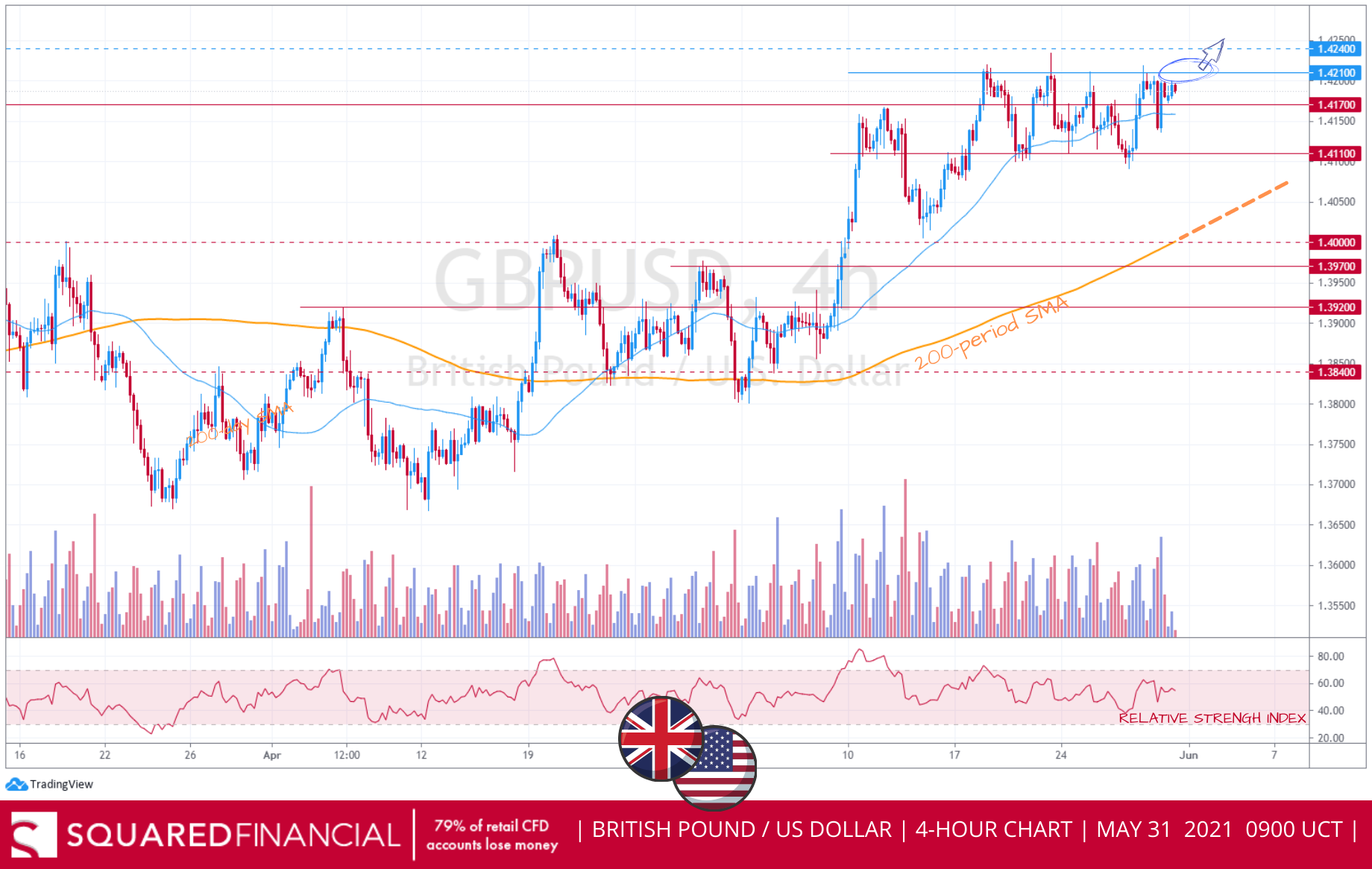

GBP/USD

BoE’s Vlieghe talked about higher interest rates as early as next year, but that was not enough to push the British Pound above the key important 1.4210 to 1.4240 multi-year resistance area, as the forex pair stands firmly in its consolidative range. Today, is a bank holiday in the UK and therefore we expect light trading and range-bound moves.

USD/JPY

The USDJPY pushed above ¥110 for the first time since the beginning of April, on month-end rebalancing, before quickly pulling back below the ¥109.70 resistance level, suggesting momentum may have peaked. Moreover, the RSI indicator is retreating from overbought territory signaling more selling ahead with ¥109.35 as nearest support level.

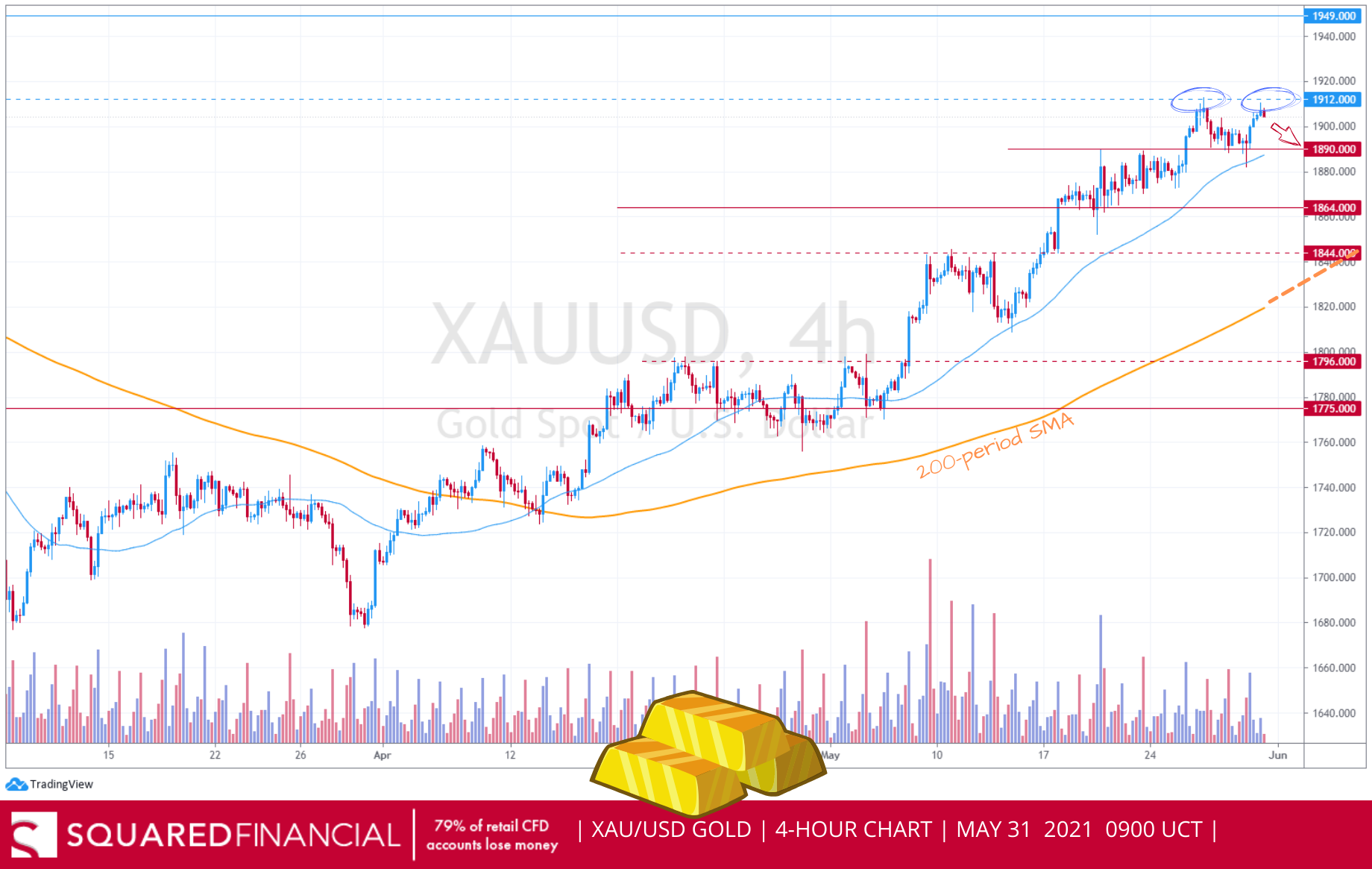

GOLD

Gold hit our support target on Friday, before bouncing off and printing a double top below $1912 resistance level with technicals favoring further downside in today’s session with $1900 and $1890 as next closest support targets. Higher than expected US CPI data kept the bullion supported while focus shifts this week to upcoming key jobs data.

US OIL

WTI Crude ended the week slightly in the red, hitting our support target at $66.35, as focus turns towards OPEC+ meeting tomorrow in Vienna where the allies are expected to stick with a decision to boost output in July. Technically, prints above $67 will favor a run towards $67.47, while an hourly close below $66.35 would open the door to further downside with $65.57 as next support target.

This information is only for educational purposes and is not an investment recommendation. The information here has been created by SquaredFinancial. All examples and analysis used herein are of the personal opinions of SquaredFinancial. All examples and analysis are intended for these purposes and should not be considered as specific investment advice. The risk of loss in trading securities, options, futures, and forex can be substantial. Customers must consider all relevant risk factors including their own personal financial situation before trading.

Recommended Content

Editors’ Picks

EUR/USD bounces off lows, retests 1.1370

Following an early drop to the vicinity of 1.1310, EUR/USD now manages to regain pace and retargets the 1.1370-1.1380 band on the back of a tepid knee-jerk in the US Dollar, always amid growing optimism over a potential de-escalation in the US-China trade war.

GBP/USD trades slightly on the defensive in the low-1.3300s

GBP/USD remains under a mild selling pressure just above 1.3300 on Friday, despite firmer-than-expected UK Retail Sales. The pair is weighed down by a renewed buying interest in the Greenback, bolstered by fresh headlines suggesting a softening in the rhetoric surrounding the US-China trade conflict.

Gold remains offered below $3,300

Gold reversed Thursday’s rebound and slipped toward the $3,260 area per troy ounce at the end of the week in response to further improvement in the market sentiment, which was in turn underpinned by hopes of positive developments around the US-China trade crisis.

Ethereum: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.