Today‘s earnings aftermarket: GOOG, the key one

/stock-market-graph-gm523786073-51379002_XtraLarge.jpg)

In a reversal of uncertainty, S&P 500 repelled one serious intraday downswing, and rose on solid volume and market breadth improvements. The about to get tired move can continue into today‘s earnings aftermarket – with GOOG being the key one, followed by TXN (the latter one I expect to do better). Housing data and Richmond manufacturing are unlikely to upset equities much, yet it must be noted that rate cutting odds slightly retreated yesterday (no cut Sep has 6% odds now).

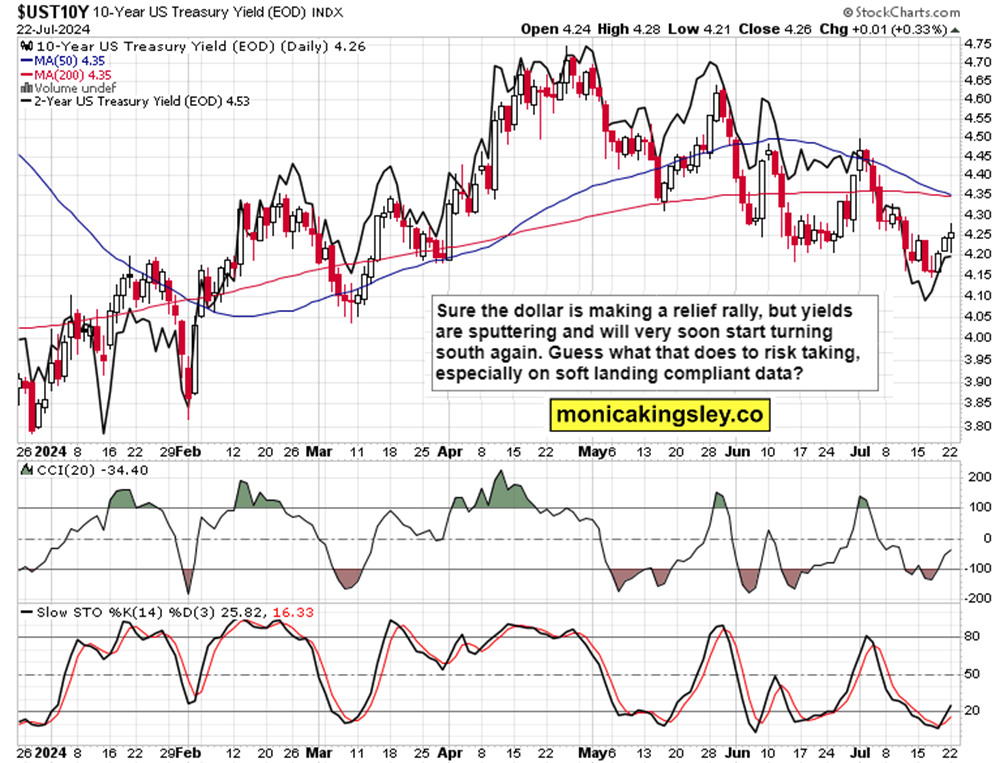

Based on the charts below (yields and S&P 500 market breadth), you can form your own opinion – as to the reversal‘s shelf life and best sectoral plays ahead. Let me just highlight select Bitcoin miners, out of which MSTR is most richly priced (call premium I mean, with COIN pulling up better). How about the dollar and what that means for industrials?

Way more details as usual in the individual chart section – suffice to add that latest real asset plays moved in line with my analytical expectations, be it gold and silver, or oil.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.