USD: Dec '23 is Up at 106.710.

Energies: Dec '23 Crude is Up at 82.21.

Financials: The Dec '23 30 Year T-Bond is Down 16 ticks and trading at 108.30.

Indices: The Dec '23 S&P 500 Emini ES contract is 66 ticks Lower and trading at 4195.75.

Gold: The Dec'23 Gold contract is trading Down at 1991.70.

Initial conclusion

This is not a correlated market. The USD is Up and Crude is Up which is not normal, but the 30 Year T-Bond is trading Lower. The Financials should always correlate with the US dollar such that if the dollar is Higher, then the bonds should follow and vice-versa. The S&P is Lower, and Crude is trading Higher which is correlated. Gold is trading Lower which is correlated with the US dollar trading Up. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don't have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open. Asia is trading Higher with the exception of the Hang Seng and Sensex exchanges. All of Europe is trading Higher with the exception of the London exchange.

Possible challenges to traders

-

ADP Non-Farm Employment Change is out at 8:15 AM EST. This is Major.

-

Final Manufacturing PMI is out at 9:45 AM EST. This is Major.

-

ISM Manufacturing PMI is out at 10 AM EST. This is Major.

-

JOLTS Job Openings is out at 10 AM EST. This is Major.

-

ISM Manufacturing Prices is out at 10 AM EST. This is Major.

-

Construction Spending m/m is out at 10 AM EST. This is Major.

-

Wards Total Vehicle Sales - All Day by Brand. This is Major.

-

Crude Oil Inventories I s out at 10:30 AM EST. This is Major.

-

Federal Funds Rate is out at 2 PM EST. This is Major.

-

FOMC Statement is out at 2 PM EST. This is Major.

-

FOMC Press Conference starts at 2:30 PM EST. This is Major.

Treasuries

Traders, please note that we've changed the Bond instrument from the 30 year (ZB) to the 10 year (ZN). They work exactly the same.

We've elected to switch gears a bit and show correlation between the 10-year bond (ZN) and the S&P futures contract. The S&P contract is the Standard and Poor's, and the purpose is to show reverse correlation between the two instruments. Remember it's likened to a seesaw, when up goes up the other should go down and vice versa.

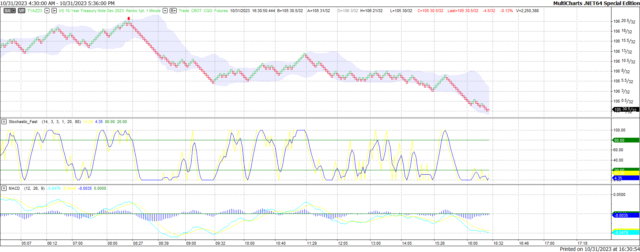

Yesterday the ZN migrated Lower at around 8:30 AM EST as the S&P hit a Low at around the same time. If you look at the charts below the S&P gave a signal at around 8:30 AM and the ZN started its Downward trend. Look at the charts below and you'll see a pattern for both assets. S&P hit a Low at around 8:30 AM and migrated Higher. These charts represent the newest version of MultiCharts and I've changed the timeframe to a 15-minute chart to display better. This represented a Shorting opportunity on the 10-year note, as a trader you could have netted about 20 ticks per contract on this trade. Each tick is worth $15.625. Please note: the front month for the ZN is now Dec '23. The S&P contract is now Dec' 23. I've changed the format to filled Candlesticks (not hollow) such that it may be more apparent and visible.

Charts courtesy of MultiCharts built on an AMP platform

ZN - Dec 2023 - 10/31/23

S&P - Dec 2023 - 10/31/23

Bias

Yesterday we gave the markets a Neutral bias as we saw no evidence of Market Correlation yesterday morning. The markets migrated Higher as the Dow closed 124 points Higher, and the other indices veered to the Upside as well. Given that today is FOMC Day, our bias will remain Neutral as the markets have never shown any sense of normalcy on this day.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

So, it appears as though the markets maintained their Upside stance as all indices closed Higher yesterday. Today is FOMC Day and we will finally learn if the Federal Reserve will hike rates or leave things as is. I hope that at the very least they leave things as is because we are about to enter the Holiday spending season and increasing rates won't bolster spending. It may shrink it. Besides being the holiday spending season, there will be a pent-up demand for autos as all three car manufacturers were on strike since September 15th and those autos will need to be financed. Additionally, mortgage rates are way too high and raising rates will only make it more difficult to purchase a home. Will the Fed listen? We'll find out at 2 PM EST.

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0400 in quiet trading

EUR/USD trades in positive territory above 1.0400 in the American session on Friday. The absence of fundamental drivers and thin trading conditions on the holiday-shortened week make it difficult for the pair to gather directional momentum.

GBP/USD recovers above 1.2550 following earlier decline

GBP/USD regains its traction and trades above 1.2550 after declining toward 1.2500 earlier in the day. Nevertheless, the cautious market mood limits the pair's upside as trading volumes remain low following the Christmas break.

Gold declines below $2,620, erases weekly gains

Gold edges lower in the second half of the day and trades below $2,620, looking to end the week marginally lower. Although the cautious market mood helps XAU/USD hold its ground, growing expectations for a less-dovish Fed policy outlook caps the pair's upside.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.