Time to buy this tentative bottom?

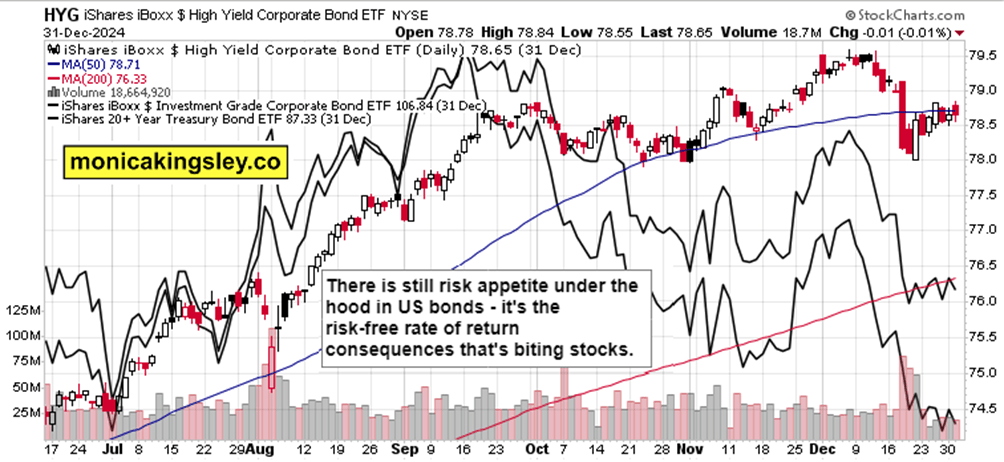

S&P 500 could have put a local bottom Dec 31, but instead we had to wait for today when we got the clear 5,930 breakdown and intraday reversal that I have talked in relation to market breadth developments in yesterday‘s video (forget not to be sending your chart requests for one of the upcoming videos). A slide not brought up there that became since way more prominent in implications, is the Bitcoin chart shown below – affecting through oh so wanted yields retreat precious metals positively. Also oil keeps moving towards my key level given to clients lately.

So what‘s so remarkable about today? Yields daily retreat fueling risk taking, helping Russell 2000 (this one had been only gradually losing altitude, and has MACD histogram as well positioned as S&P 500 (Nasdaq is a laggard in such a daily environment no matter what NVDA does) and crypto surge starting anew.

Let‘s dive into several charts, and continued with many more in the premium section – it‘s the start of the month, let me welcome you and serve you.

And what follows, is a little preview of the stock market setup – it‘s oversold, but is it enough oversold? We‘re seeing the answer being given as we speak.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.