Three things driving the euro right now

There have been a few subtle moves over the last few weeks, so here are some of the key points not to miss.

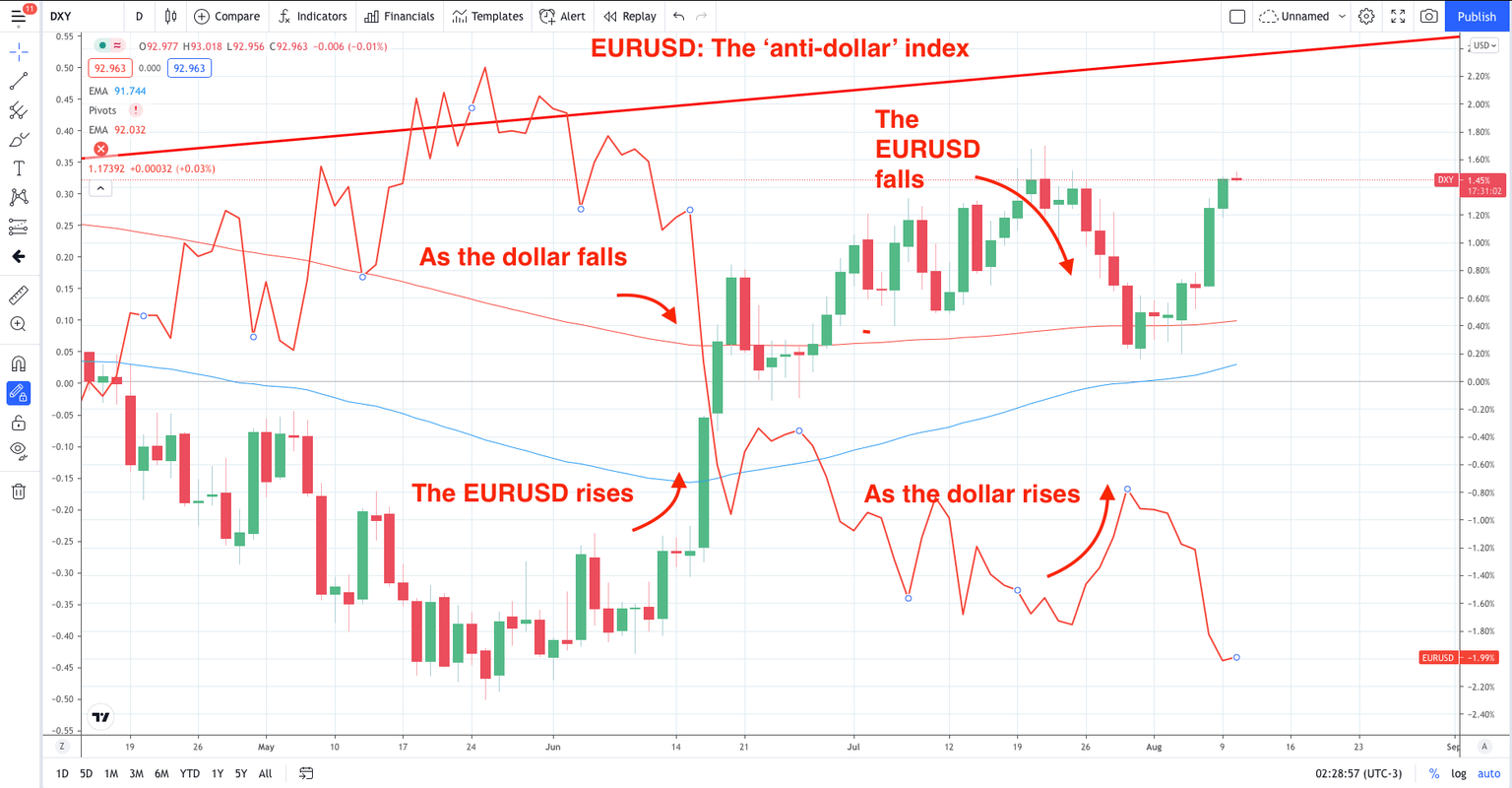

1. USD strength: The EURUSD is sometimes nicknamed the ‘anti-dollar index because it moves exactly opposite to the Dollar Index. The bullish Fed speak from Clarida, Bullard, and the latest strong NFP jobs data have all led to expectations that a taper announcement is coming. This sentiment all weakens the EURUSD pair.

2. New inflation target: The Euro has a weak bearish bias since the July meeting where the ECB put into place the action from their strategic review. Namely, a change of guidance of inflation. The new target is a 2% symmetric inflation target. This replaces the previous ‘close to, but below 2% strategy’.

3. Internal disagreement: President Lagarde did previously hint that there could be a ‘transition’ between the PEPP and APP in 2022, but the meeting offered no further comments. In other words, emergency bond purchases (PEPP) could be morphed into regular (APP) purchases. So, the emergency funds become a day to day funds. Dovish stuff. President Lagarde said there was some ‘marginal’ disagreement on the calibration of forwarding guidance. Lagarde did try to appease some of the hawkish Governing Council members by explaining that their guidance didn’t infer “lower for longer”. The irony is that it did really. Christine Lagarde will have difficulty harmonizing fiscal conservatives like Germany and Belgium with those of Greece and Italy.

The bottom line

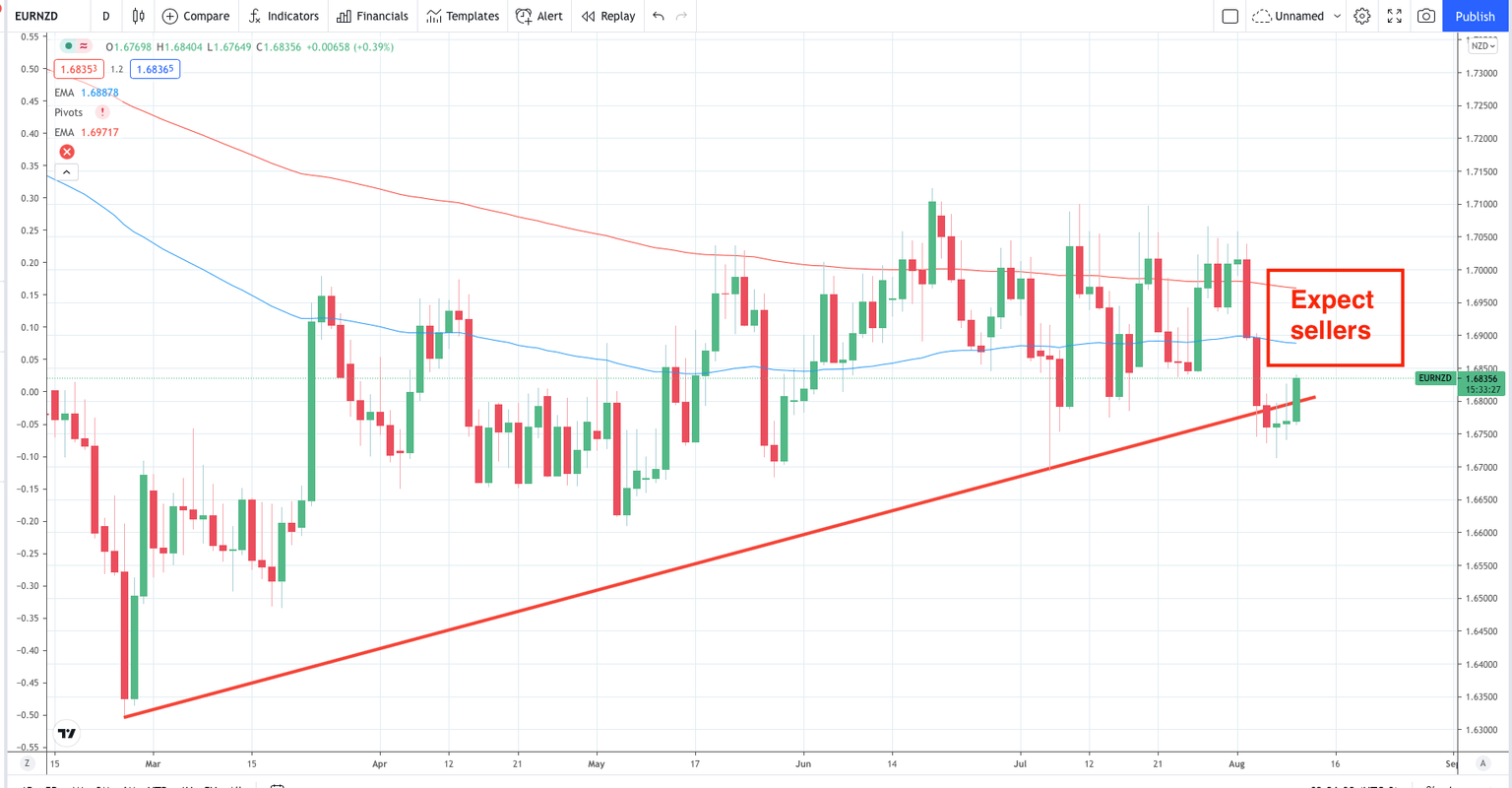

The Euro has a weak bearish bias, but the virus situation is more under control now. The intense focus will be on the September meeting as this will likely set the tone for the euro moving forward. Until then a bearish bias for the euro against the GBP and the NZD make sense.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.