Three strikes and out for SPX?

S&P 500 fully retraced the FOMC celebration, and right off the opening bell, stocks lifted off again to great clients‘ satsfaction… triple of dozen ES pts captured, and Nasdaq with Russell 2000 of course participated It turned out quite a risk-off day, I had presented yesterday‘s setup before the open, and the same goes for profitable remarks served to all clients during the day regarding how to play triple witching (quad as we used to say years earlier when individual stock futures were there).

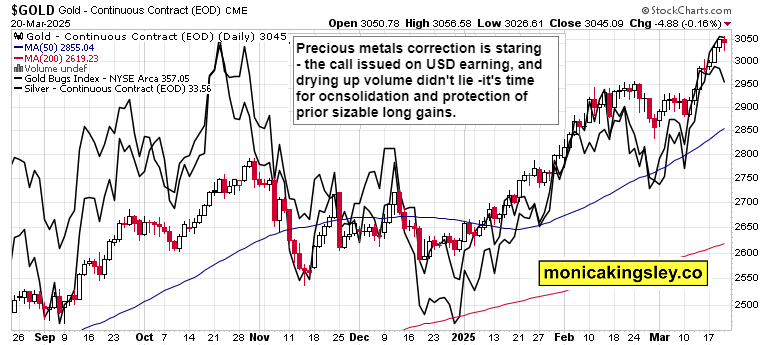

Check the remarks below, and put these into context of ES 5,688 weakness warning issued after today‘s packed video was finished (review it!). Get ready for a volatile session today, up and down, with little in terms of upside or downside breakouts succeeding. Remember also how relatively fast the oversold bounce reached almost overbought readings on some short-term breadth indicators, which has been one of the reasons of not giving luxurious room for S&P 500 to break above 5,760s yesterday. Accompanied by timely precious metals correction warning Trading Signals clients got already yeasterday premarket.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.