Three fundamentals for the week: UK inflation, Fed minutes and Flash PMIs stand out

- Fresh inflation figures from the UK will heavily influence a potential BoE rate cut.

- Minutes from the Federal Reserve's last meeting are set to provide clues to the next one.

- Economists fear forward-looking US PMIs may continue showing a slowdown.

Sell in May and go away? That market adage seems outdated in the face of new highs for stocks and Gold. Optimism depends on the easing from central banks – and some clues are due this week.

1) UK CPI set to show inflation nearing 2% target, hitting the Pound

Wednesday, 6:00 GMT. The Bank of England (BoE) is set to cut interest rates, but will it happen as early as June? The European Central Bank (ECB) policymakers will also be watching the UK inflation data for April.

The April and October UK inflation reports are heavily influenced by government-mandated energy prices, which change these months. A big decrease in Natural Gas prices is set to push the headline Consumer Price Index (CPI) to rise by 2.1% in April, a massive drop from a 3.2% rise a month earlier.

While the BoE targets topline prices, investors will also look at core CPI. The economic calendar points to core inflation dropping to 3.6% from 4.2%. The lower the outcome in core CPI, the deeper the fall in the Sterling, and the greater the impact on the Euro. A stubbornly high underlying inflation figure would boost the Pound.

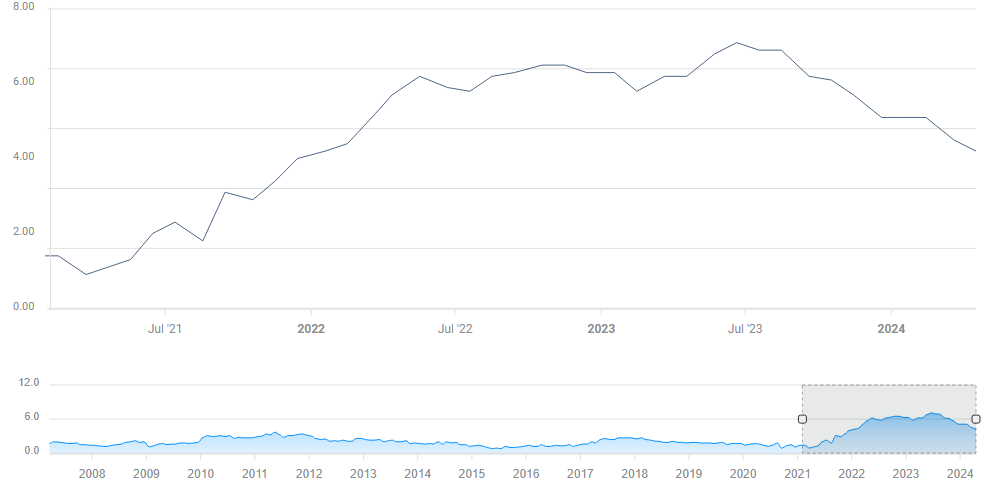

UK core CPI. Source: FXStreet

I expect inflation data to fall short of estimates, following a global trend. That would weigh on the Pound and reassure traders that the BoE would cut rates next month.

2) US FOMC Meeting Minutes eyed for the level of worry about unemployment

Wednesday, 18:00 GMT. The Federal Reserve (Fed) left rates unchanged in its May decision and also pushed back against imminent rate cuts. However, it still signaled that the next move in borrowing costs is down – and also put fresh emphasis on the labor market.

Since then, Nonfarm Payrolls missed estimates, with a smaller increase in hiring and higher unemployment. The release of the minutes from the early May meeting could shed more light on the level of worry about the labor market.

If the doves concerns about rising unemployment have a prominent voice in the minutes, the US Dollar (USD) will fall, and other assets will rise. Conversely, if inflation — which fell slower than expected in the first quarter — remains the top topic in the document, the Greenback will get a boost.

It is essential to note that Fed officials revise the document until the last moment and are fully aware of how markets view it. As the latest CPI report showed moderating inflation, I expect the FOMC Meeting Minutes to be more dovish, delighting markets.

Even if the tone is more hawkish, any market dip would likely be short-lived. The stock trend is up, and any hawkish comment would be seen as outdated – a mere bump in the road. Market reaction to Fed minutes tends to be short-lived.

3) S&P Global Flash PMIs feared for further weakness

Thursday, 13:45 GMT. Where next for the world's largest economy? S&P Global's preliminary Purchasing Managers' Indexes (PMIs) for May may provide some answers. These surveys have been on the fence in April, not growing nor squeezing.

US S&P Global Services PMI. Source: FXStreet

Any signs of moderate contraction would still be positive for markets, which desire lower interest rates, and weigh on the US Dollar. A big drop would already be worrying, scaring investors and sending them to the safety of the Greenback. A better-than-expected outcome would temporarily hurt stocks and support the Greenback, but it would probably keep hopes for a September rate cut intact.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.