Three fundamentals for the week: Middle East escalation, BoC decision and US Jobless Claims stand out

- An Israeli attack against Iran may stir markets ahead of the US elections.

- The Bank of Canada is set to slash rates, impacting Fed expectations.

- US Jobless Claims remain a bellwether for the wider economy.

Gold has reached new highs, but where is the market heading with two weeks to go until the US elections? The waiting period before Nonfarm Payrolls October data, the next decision by the Federal Reserve (Fed) and the vote mean investors are nervous.

Here is a preview of this week's big events.

1) Israeli retaliation against Iran seems imminent after attack on Netanyahu's house

Some three weeks have passed since Iran struck Israel with a barrage of missiles, and a counter-attack is still awaited. Israeli Prime Minister Benjamin Netanyahu had little time to celebrate the killing of the Hamas leader Yahya Sinwar when his private residence was attacked by a drone coming from Lebanon.

It is easy to become confused in the series of attacks and counter-attacks – but it is clear that an attack on Iran may risk global Oil supplies. Israel needs to take US considerations into account, especially ahead of the elections. Markets seem optimistic that any move would be limited due to American constraints, but hostilities have a dynamic of their own.

Headlines from the Middle East are set to continue rocking markets. A limited attack would likely trigger "buy the rumor, sell the fact" price action, which would weigh on Oil, Gold, and the US Dollar. Ongoing fire would support all these assets.

2) The BoC is set to accelerate rate cuts, comments on the US are eyed

Wednesday, decision at 13:45 GMT, press conference at 14:30 GMT. The Canadian economy is struggling under the weight of a sluggish property market, among many woes, despite robust US economic growth. Canada depends heavily on its southern neighbor.

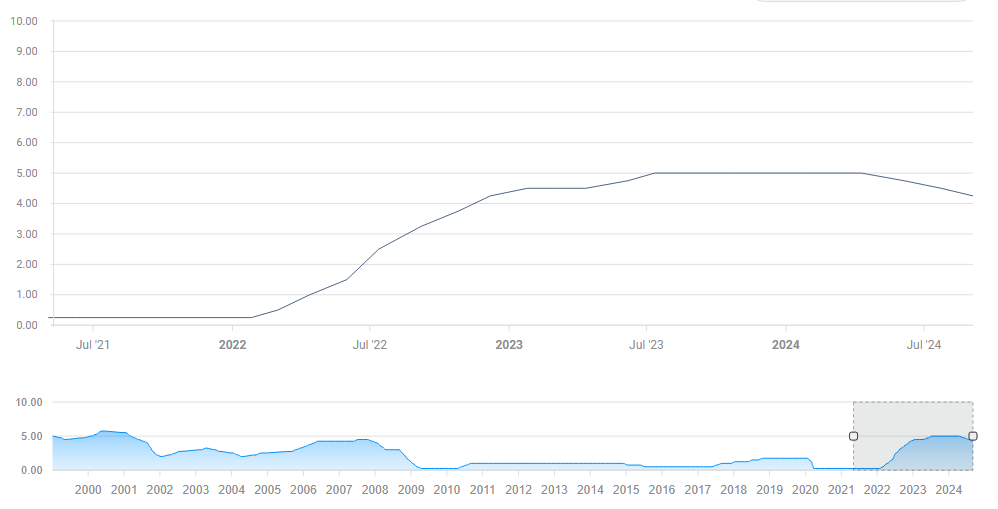

After cutting interest rates by 25 basis points (bps) three times in a row, economists expect the Bank of Canada (BoC) to announce a bigger 50 bps move – slashing borrowing costs from 4.25% to 3.75%.

Canadian interest rates. Source: FXStreet

While falling Canadian inflation is a good reason for such a move, worries about the economy would stir markets and weigh on the Loonie.

At this event, BoC Governor Tiff Macklem addresses the press, and talks about the broader economy. His outlook on the US economy may also have an impact on the US Dollar and the broader market mood.

3) US Jobless Claims closely eyed

Thursday, 12:30 GMT. With a dearth of top-tier indicators, this high-frequency indicator takes center stage. Weekly unemployment claims in the US leaped two weeks ago to 260K from the lows of 225K, and only dropped to 241K last week.

Fresh data from the week ending on October 18 may still be impacted by back-to-back hurricanes, and will be closely watched. The Fed is fully focused on the labor markets, after all but having declared victory on inflation.

Another retreat in Jobless Claims would boost stocks and the US Dollar while weighing on Gold. A worrying increase would support the precious metal while hurting the equities and the Greenback.

Final thoughts

While there is no decision from any major central bank nor any top data point – and even the elections are not close enough – markets are set to move.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.