- US Consumer confidence data will provide a gauge of how consumers are feeling.

- Jobless claims are in focus after Fed Chair Powell's dovish speech.

- Investors will look to the core PCE index to confirm that inflation is falling.

"We will do everything we can to support a strong labor market" – it does not get clearer than that. Federal Reserve Chair Jerome Powell committed on Friday to buoy the economy. Is the world's largest economy faltering? The first key two figures to be released this week are focused on the fragility of the economy, and the last one is on the battle the Fed is winning: inflation. Here is a preview for the last week of August's key events.

1) US CB Consumer Confidence to take the pulse of the economy

Tuesday, 14:00 GMT. The University of Michigan's Consumer Sentiment Index is published earlier but is prone to political influences. Democrats have become more confident about the economy once President Joe Biden stepped aside from the presidential race, while Republicans have become more pessimistic.

The upcoming report about Consumer Confidence from the Conference Board will be released later, but it will be less exposed to politics. In the past three months, it surprised to the upside, hovering around 100, showing that consumers are doing better than the slower economic data suggests.

After hitting 100.3 in July, a similar figure is likely. A dip might scare markets, showing that the hole is bigger, while an upside surprise will keep them buoyed. Gold needs a soft data point while the US Dollar needs a robust number to advance.

2) US Jobless Claims gain even more importance

Thursday, 12:30 GMT. Revised Nonfarm Payrolls data for the past year was depressing – over 800,000 jobs were shed from the total. That painted a bleaker picture of hiring in the 12 months ending in March. What about the most recent period?

Weekly jobless claims come to help out, and even more so after Powell's speech. Unemployment claims hit 232,000 in the week ending on August 16, and a similar outcome is expected for the week ending August 23.Such figures are above the lows, but far from being worrying.

A drop below 230,000 would be encouraging, while an increase to 240,000 or higher would be worrying. The US Dollar and stocks need upbeat data, while Gold bulls need softer figures.

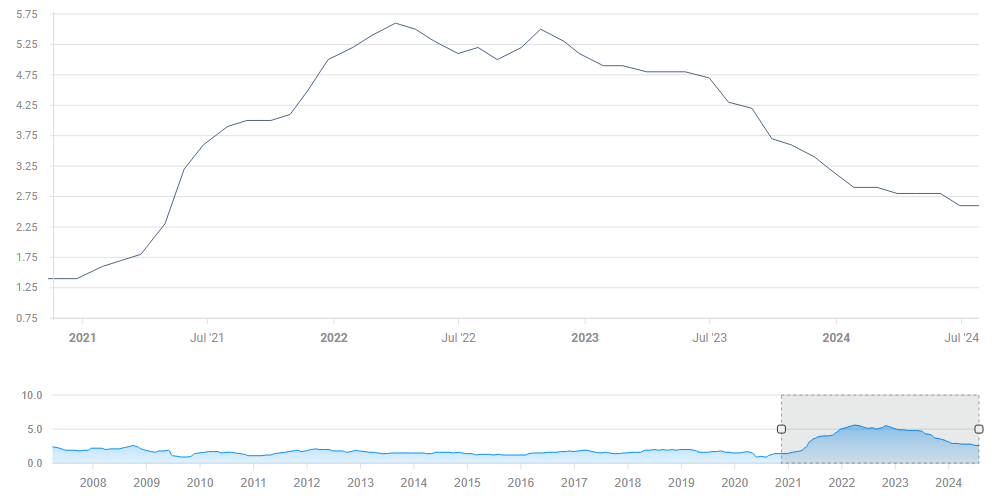

3) Core PCE – the Fed favorite still needs to continue falling

Friday, 12:30 GMT. The Fed targets on the core Personal Consumption Expenditure (PCE) Price Index as its preferred inflation gauge, so it matters to markets. While the focus has shifted to the labor market, underlying inflation still needs to fall toward the bank's 2% target.

Core PCE MoM rose by a moderate 0.2% rate in June, and the same outcome is expected for July. The YoY figure stood at 2.6%, a far cry from the inflationary days, but still not at 2%. Another slide is positive for stocks, a boost for Gold, and another blow to the US Dollar. Sticking at 2.6% or rising would do the opposite.

US Core PCE YoY. Source: FXStreet.

The data release also has the last word of the week and the month – and before a long weekend in the US. That implies price action will likely be stronger than usual in response.

Final thoughts

Investors cheered Powell's determined and clear dovish message, but markets have yet to stabilize. This week's data will provide more evidence about how the US economy is doing.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD consolidates gains near 0.6400; remains close to YTD top

AUD/USD holds gains near the 0.6400 mark early Friday and remains well within striking distance of the YTD peak touched earlier this week. A positive risk tone and a potential for a de-escalation in the US-China trade war act as a tailwind for the Aussie but fresh US Dollar byuing could check the pair's upside.

USD/JPY rises above 143.00 amid hot Tokyo CPI print

USD/JPY attracts some dip-buyers adn retakes 143.00 following Thursday's pullback from a two-week high as hopes for an eventual US-China trade deal tempers demand for the JPY. Data released this Friday showed that core inflation in Tokyo accelerated sharply in April, bolstering bets for more rate hikes by the BoJ.

Gold eyes US-China trade talks and third straight weekly gain

Gold price holds Thursday’s rebound, defending weekly gains near $3,350 early Friday. Gold buyers catch a breather, taking stock of the trade developments globally after US President Donald Trump’s tariffs whiplash.

TON Foundation appoints new CEO after $400M investment: Will Toncoin price reach $5 in 2025?

TON Foundation has appointed Maximilian Crown, co-founder of MoonPay, as its new CEO. Toncoin price remained muted, consolidating with a tight 2% range between $3.08 and $3.21 on Thursday.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.